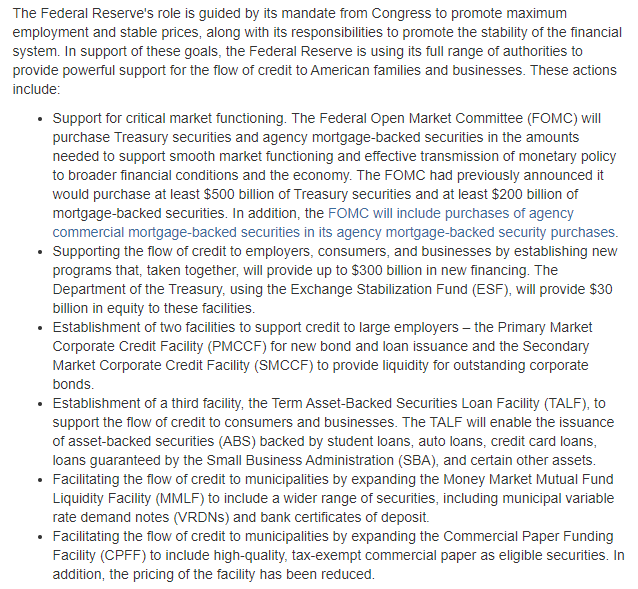

This morning the Federal Reserve announced a series of new programs to help the markets through the Coronapocalypse. Including an open-ended commitment to keep buying assets under its quantitative easing measures, purchase of corporate bonds directly and via ETFs, and programs aimed at business lending to keeping credit flowing for student loans, business loans, auto loans via a Term Asset-Backed Securities Loan Facility.

From the Fed’s announcement:

This morning the Dow reversed it’s course of action taking us green at open from last nights limit down of -5%. At the time of publishing, less than an hour after open, we are red again; it’s a volatile time.

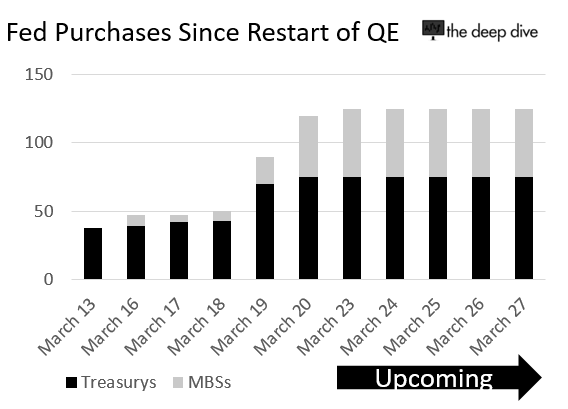

Previously, the Fed indicated their goal was to buy $500 billion worth of Treasurys and $200 billion in Mortgage Backed Securites as part of what has been labeled QE4. After getting half way there, they issued a statement this morning indicating the plan has changed, and now we are looking at open ended purchases with expanded new categories.

The moves comes on top of programs the central bank announced last week aimed at easing the flow of credit markets and the short-term financing that banks need to operate.

The coronavirus pandemic is causing tremendous hardship across the United States and around the world. Our nation’s first priority is to care for those afflicted and to limit the further spread of the virus…. While great uncertainty remains, it has become clear that our economy will face severe disruptions. Aggressive efforts must be taken across the public and private sectors to limit the losses to jobs and incomes and to promote a swift recovery once the disruptions abate.

Federal Reserve Bank

A quick visual of what the purchases have looked like since QE restarted on March 13th. And hat tip to ZeroHedge, for catching from the New York Fed, the plan is start purchasing $50B of MBSs and $75B of Treasurys everyday this week.

Also of note, the Fed unveiled a Primary Market Corporate Credit Facility (PMCCF) directly aimed at purchasing eligible corporate bonds from investment grade issuers in addition to a Secondary Market Corporate Credit Facility (SMCCF) to buy corporate bonds in the secondary market, including eligible investment grade corporate bond ETFs.

Lastly, the Fed is re-launching programs to support corporate and household debt. Introducing a Term Asset-Backed Securities Loan Facility, aimed at helping student loans, auto loans, credit card loans and loans backed by the Small Business Administration.

At the time of publishing the Dow is down 1.18% to $18,816.

Information for this briefing was found via the Federal Reserve Bank. Not a recommendation to buy or sell any securities. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.