FULL DISCLOSURE: This is sponsored content for Power Nickel.

The recent Canadian federal government budget introduced the Critical Minerals Strategy to promote exploration and development of critical mineral deposits in Canada. The Critical Mineral Exploration Tax Credit (CMETC) is a new incentive that provides a 30 per cent tax credit to investors in exploration companies seeking certain critical minerals.

Not to be outdone, the Quebec government introduced an enhanced tax incentive of up to 25% of eligible investments in regions that score lower on the economic vitality index that would reduce the costs to build and equip critical mineral mines.

Taken together, this creates a tremendous game-changing catalyst to accelerate investment in critical minerals projects in Quebec. These incentives should significantly reduce the capital risk to mining companies. And for projects that have a bankable feasibility study, companies should have the ability to almost fully finance a mine without incurring significant dilution.

The need for critical minerals

Global efforts to fight climate change by reducing carbon emissions from fossil fuel-based energy sources has resulted in policies to promote both renewable energy and a shift to electric vehicles. At the same time, governments have had to re-evaluate their dependence on the supply of strategically important products and commodities from China, Russia and other politically sensitive countries. As a result, they have begun to provide incentives for accelerating domestic supply sources and manufacturing.

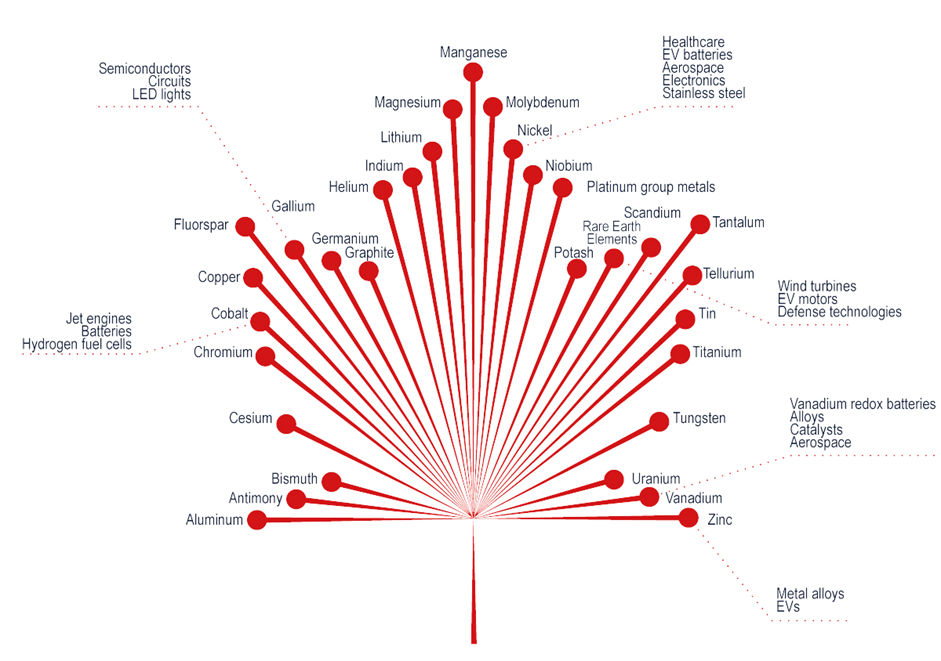

A host of battery metals are now being added to Critical Materials lists by nations, due to their strategically important role in the industrial supply chain, and particularly the manufacturing of EV’s. For instance, in March, the European Commission proposed a set of actions, referred to as “Critical Raw Materials: ensuring secure and sustainable supply chains for EU’s green and digital future,” which falls under the Commission’s Critical Raw Materials Act. Minerals included in the act include lithium, nickel, rare earth metals, and platinum use metals – and their inclusion directly relates to their use in batteries or renewable energy.

In Canada, the government in December unveiled its own Critical Minerals Strategy, which defines a mineral as critical if it,

- Is essential to Canada’s economic security and its supply is threatened,

- Is required for the transition to a low-carbon economy, or

- Is a sustainable source of highly strategic critical minerals for partners and allies.

A total of 31 critical minerals exist on the list in Canada, including lithium, nickel, cobalt, copper, potash, and rare earth elements. As a result, there is a significant effort by exploration companies to seek and develop mineral deposits closer to home.

Quebec as a mining hub

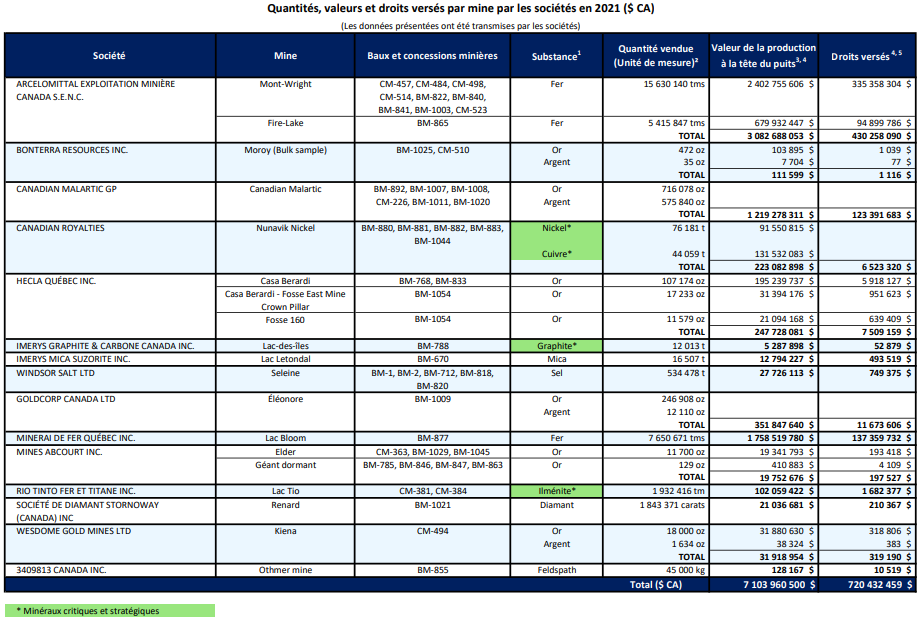

Quebec is actively promoting its goal of becoming a domestic hub for the electric vehicle industry. The province is a mining friendly jurisdiction, with a rich mining history as a host to many world-class mines, in a wide range of metals and minerals. In 2021, the province as a whole saw over $7.1 billion worth of minerals extracted from within its borders, generating fees of C$720.4 million and US$164.2 million for the province.

There is also an abundance of skilled mining professionals and labour, and well established infrastructure – with some of the world’s cleanest low-carbon, low-cost electrical power, extensive road and rail systems, and several deep sea ports and international airports. The most recently available data from the government of Quebec, published in 2016, suggests that the mining sector as a whole accounts for 12,364 direct jobs, with the sector bringing in $2.6 billion in investment to the province between exploration and mining activities.

Exploration in Quebec

There are many exploration companies currently seeking lithium, nickel, copper, and other minerals throughout province, with the exploration subsector bringing in over $295 million per year in investment as per the most recently available report. At its height in 2011 in fact, exploration brought over $830 million in investment to the region.

There are a number of advanced Quebec projects that could be close to production and would benefit greatly from the new tax incentives.

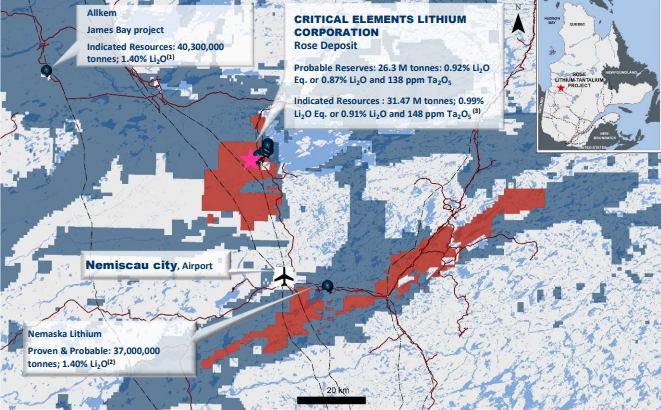

Critical Elements Lithium Corp. (TSXV: CRE) is advancing its high purity Rose lithium project in Quebec. The Rose Lithium-Tantalum Project is located in northern Québec’s administrative region, approximately 40 kilometres north of the Cree village of Nemaska and about 300 kilometres north-west of Chibougamau.

The Rose Project is CRE’s first lithium project to be advanced within its massive 700 square kilometre land position. The company’s 2022 feasibility study projects an average annual production of 173,317 tonnes of chemical grade 5.5% spodumene concentrate, 51,369 tonnes of technical grade 6.0% spodumene concentrate, and 441 tonnes of tantalum concentrate during an expected 17-year mine life.

Nouveau Monde Graphite Inc. (TSXV :NOU) is developing its Matawinie Graphite Mine Project, which is located in Saint-Michel-des-Saints, 150 kilometres north of Montréal. The company is also proposing to build its Bécancour battery-grade materials plant in an industrial park near the major shipping port in Bécancour, which is located on the Saint Lawrence River, approximately 150 kilometres northeast of Montréal.

Nouveau Monde plans to become a fully vertically-integrated mine-to-market operation. According to the company’s 2022 feasibility study, the mine has 61.7 tonnes of probable reserve at an average grade of 4.23% grade, with average annual graphite concentrate production of 103 kt over an expected mine life of 25 years.

Patriot Battery Metals Inc. (TSXV: PMET) meanwhile is developing its flagship 100% owned Corvette Property located in the James Bay Region of Québec. It is a massive, 214 square kilometre district-scale lithium property, with over 70 previously identified lithium bearing spodumene pegmatite outcrops over more than 20 kilometres of trend.

READ: Patriot Battery Metals Extends CV5 Pegmatite To 3.15 Kilometres Of Strike

Just 3-of-6 of the distinct lithium pegmatite clusters have been drill tested. The property is 15 kilometres from the all-weather Trans-Taiga Road, and 42 kilometres from the La Grande 4 hydroelectric generation plant. The company’s goal is to use the access to green power to potentially produce high-purity lithium with a low carbon emissions footprint. Patriot is developing the Corvette Property to enable initial production in 2028.

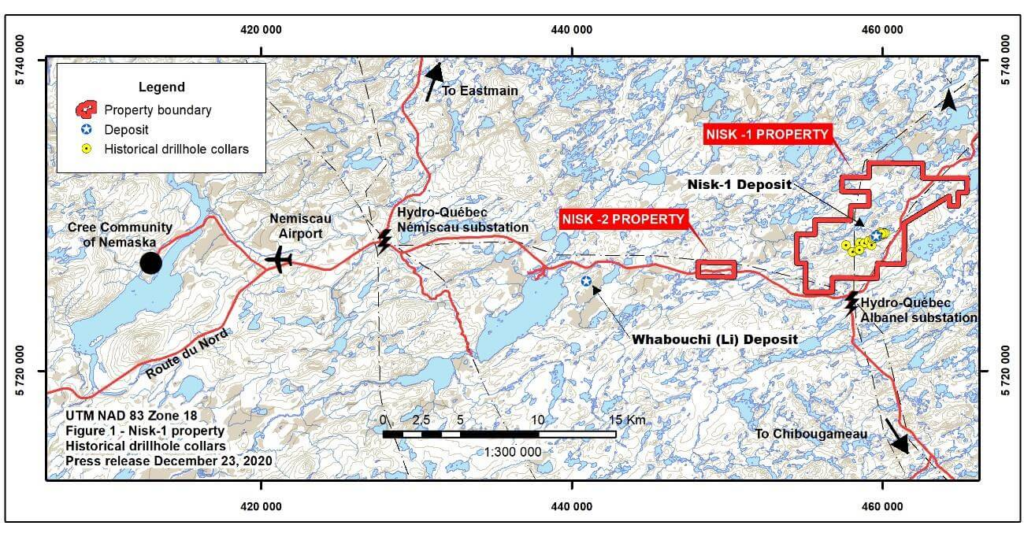

Power Nickel Inc. (TSXV: PNPN), is developing its flagship Nisk high-grade nickel project in the James Bay region of Quebec, near the town of Nemaska. The 20 kilometre long Nisk property consists of two blocks totaling 90 claims that cover a large land position of 45.9 square kilometres.

Nisk is considered to be a nickel sulfide deposit, and a significant characteristic of nickel sulfide deposits found around the world is that they occur as pods. This appears to be the case at the Nisk property, where there are a series of pods near the surface, which the company describes as a string of pearls – open along the strike length of the property, and at depth.

What makes Power Nickel particularly compelling is that historical exploration of the property has identified numerous high-grade intercepts of class-1 nickel, which is highly sought after and relatively rare. Due to the size of the property, Nisk has the potential to be one of the greenest sources of class-1 nickel in the world, while also containing other battery metals that include copper, cobalt, palladium, and platinum.

READ: Power Nickel Intersects 20.76 g/t Platinum Over 7.75 Metres At Newly Discovered Zone

With much of the mineralization found at the surface, Power Nickel is in a position to quickly advance the Nisk project into potentially becoming Canada’s next nickel mine and become a leading supplier of high-grade Class-1 nickel to North America’s EV battery manufacturers. When the new exploration tax credits are factored in, the economics of the Nisk project could potentially enable it to quickly proceed to a feasibility study, and enable the project to transition from exploration to production in a short period of time.

In Conclusion

The Critical Minerals Strategy will go a long way to strengthening national security, promote domestic manufacturing, strategically realigning supply chains, and become a catalyst for sustainable and stable economic growth. The shift to a green economy requires a strong and viable domestic mining sector capable of supplying the raw materials needed to sustain it.

For junior exploration investors, having an awareness of how the government exploration tax credit regime works can enhance the economic viability of any given potential producer, making it quite beneficial. For shareholders of companies such as Power Nickel, a rapid shift from exploration to production has the potential to significantly increase project valuations and enhance shareholder value in a relatively short period of time.

FULL DISCLOSURE: Power Nickel is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of Power Nickel. The author has been compensated to cover Power Nickel on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.