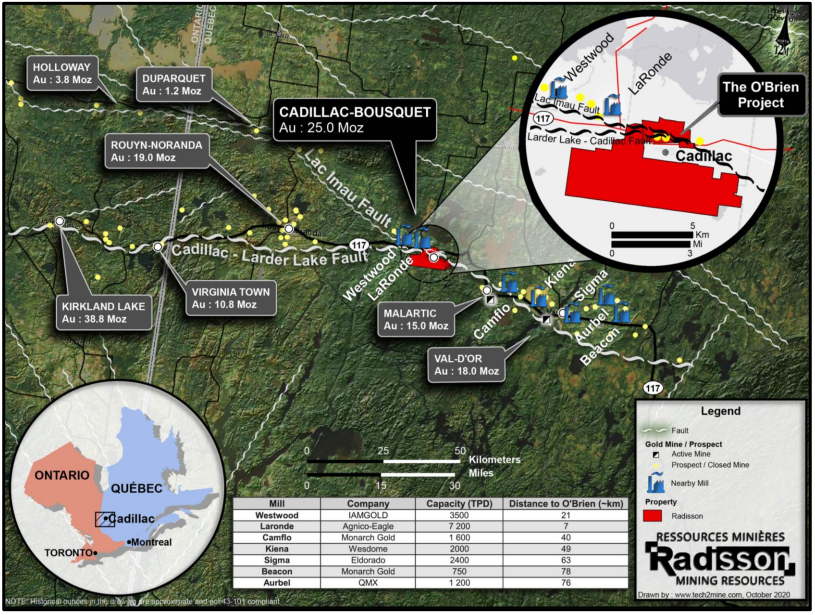

On October 7, Radisson Mining Resources Inc. (TSXV: RDS), a gold exploration company, announced bonanza-grade gold intercepts at its O’Brien gold project in Quebec. The latest results included 92.89 grams of gold per tonne over 2.6 meters and 47.1 grams of gold per tonne over 2.2-meters within the same hole.

These finds represent the third set of announcements of extremely high-grade gold discoveries since the company began a 60,000-meter drilling program at O’Brien in February 2020. Bonanza grade, the highest grade of gold in underground mining parlance, contains 34+ grams of gold per tonne of resource.

In early September, Radisson announced discrete gold discoveries of 45.86 grams per tonne (g/t) over 2.1 meters, 21.29 g/t over 2.0 meters, and 17.9 g/t over 2.15 meters; and in July, the company found gold with concentrations of 37.76 g/t over 2.0 meters and 18.15 g/t over a 4.4- meter span. To date, Radisson has completed 52,500 meters of its 60,000-meter drilling program, while the company has yet to analyze about 16,500 meters of drilling results.

Radisson’s balance sheet is in good shape.

For a pre-revenue, small cap exploration company, Radisson’s balance sheet is solid, and its cash flow deficits look manageable. As of June 30, 2020, the company had about $6.0 million of cash and no debt. In addition, Radisson’s 1H 2020 operating cash flow and 1H 2020 investing cash flow, which reflects the O’Brien exploration program, were negative $370,000 and negative $2.25 million, respectively, both fairly modest deficits, particularly in the midst of a major exploration program.

Radisson seems likely to be able to fund the 60,000-meter exploration program without taking on any debt.

Gold exploration programs are inherently risky, and the encouraging results that Radisson has released over the last few months could just represent unusual individual gold concentrations and not elements of a more important gold-bearing trend. Also, even if a substantial amount of gold resource were determined to be present, the costs to mine it could prove to be uneconomic. Under almost any scenario, the generation of any significant mining cash flow is still years away.

Bolstered by recent solid exploration results, Radisson looks like an interesting speculative gold miner. Its $62 million market cap seems reasonable for a company which has announced several discoveries with extremely high gold content. In addition, the company has a debt-free balance sheet and seems to control its spending well.

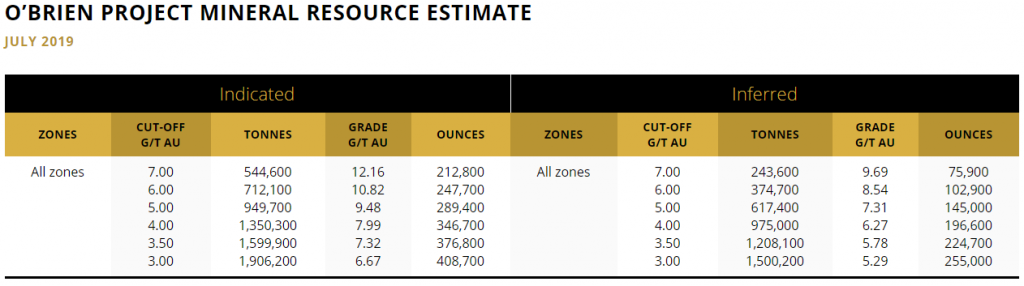

Furthermore, the company currently has a 43-101 resource estimate, wherein its estimated that the project contains indicated resources of 949,700 tonnes with a grade of 9.48 g/t gold, representing 289,400 ounces of gold at a cut-off of 5.00 g/t gold. Using the more common 3.00 g/t gold cut-off, indicated resources are as high as 408,700 ounces, while inferred sits at 255,000 ounces.

Radisson, like many other junior mining companies, is trading at near-historic discounts to the physical price of gold, which itself seems poised to continue to rally as worldwide governments implement easy money policies to combat the economic slowdown and job losses caused by the COVID-19 pandemic.

Radisson Mining Resources last traded at $0.33 on the TSX Venture Exchange.

Information for this briefing was found via Sedar and Radisson Mining Resources. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.