The world might be heading into a new world order as history points out, according to hedge fund manager Ray Dalio.

In a primer video promoting his book Principles for Dealing with the Changing World Order, the former CIO of the world’s largest hedge fund Bridgewater Associates shared how he views the global markets would react based on studying past events.

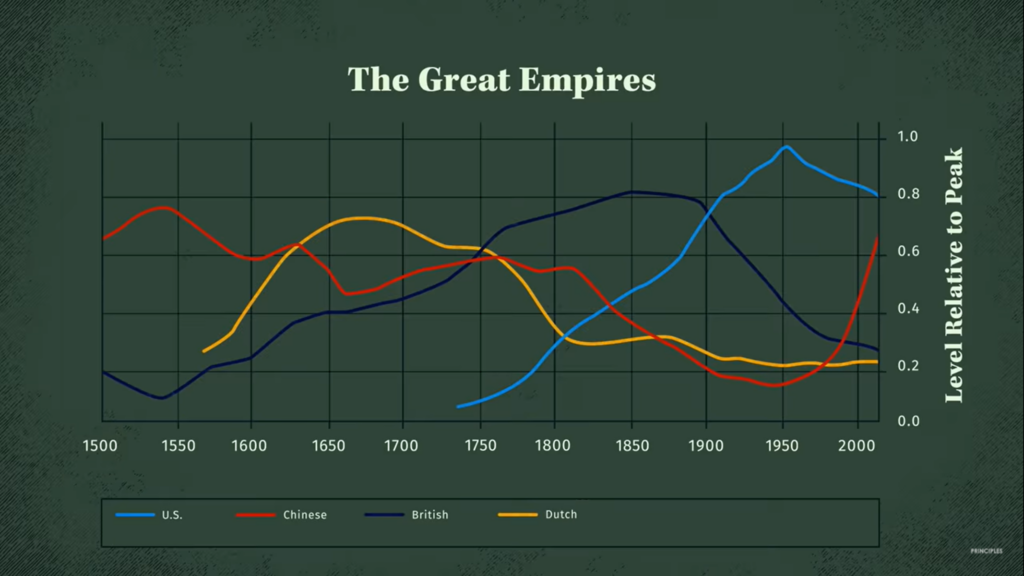

“Over my roughly 50 years of global macroeconomic investing, I’ve learned the hard way that the most important events that surprised me did so because they never happened in my lifetime,” said Dalio in the video. “These painful surprises led me to study the last 500 years of history for similar situations where I saw that they had indeed happened many times before… And every time they did, it was a sign of the changing world order.”

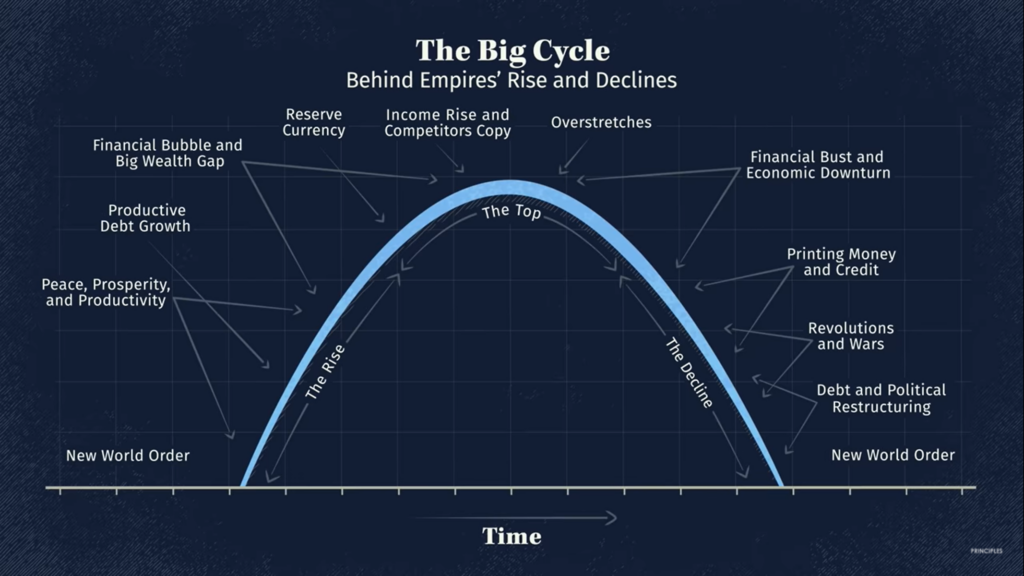

In what Dalio refers to as a “Big Cycle”, a new world order is usually established after the current order is replaced through a global conflict. The world order refers to the understanding in the international community of where the nations stand in the hierarchy–usually affirmed by treaties after wars and the wide use of the nation’s currency.

Based on his study, Dalio theorizes that three major events indicate a shift in world order: the current superpower overprinting currency to satisfy obligations, internal conflicts emerging out of the widening wealth gap, and external conflict between the leading great power and the rising power, “as is now happening with China and the United States.”

“Having the world’s reserve currency inevitably leads to borrowing excessively and contributes to the country building up large debts with foreign lenders,” Dalio said further. He added that while borrowing and spending are strong for the country to maintain the “empire,” its finances are being “weakened.” This leads to maintaining the current world order as unprofitable.

He added that in this cycle, “the richer countries eventually get deeper into debt by borrowing from poor countries that save more.” It is what he points to as an early sign of a wealth and power shift.

Citing history, Dalio explained that this was evident in the 1980s when US had a per capita income 40 times that of China’s and started borrowing from the latter. China, on the other hand, was looking to save dollar reserves as it is the prevailing currency. Now, China holds the biggest reserve of foreign currency in the world.

“If the empire begins to run out of new lenders, those holding their currency begin to look to sell and get out… and the strength of the empire begins to decline,” Dalio added.

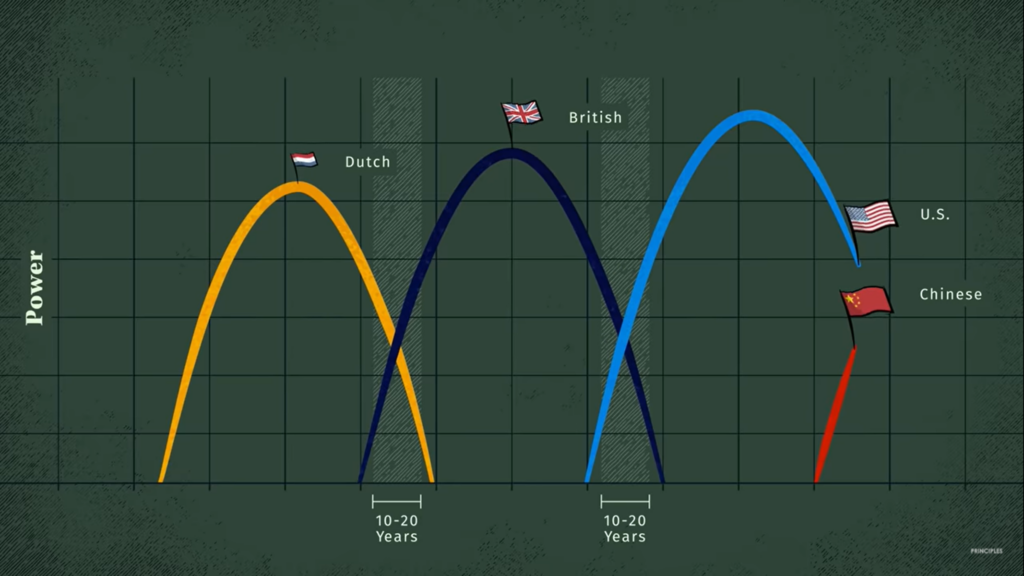

While this happened for the Dutch and British empires, Dalio thinks this hasn’t happened yet for the US because “the big sell-off in dollars and dollar debt hasn’t yet begun,” and the current internal and external conflicts haven’t yet evolved to become wars.

On the future outlook, Dalio posits that while indicators point to a shift in the world order, its timing can be prolonged or shortened depending on the actions of the current empire in place.

“It comes down to just two things: earn more than we spend and treat each other well… My goal for sharing this video… is to help you recognize where we are and the challenges we face, and to make the wise decisions needed to navigate these times well,” Dalio ended.

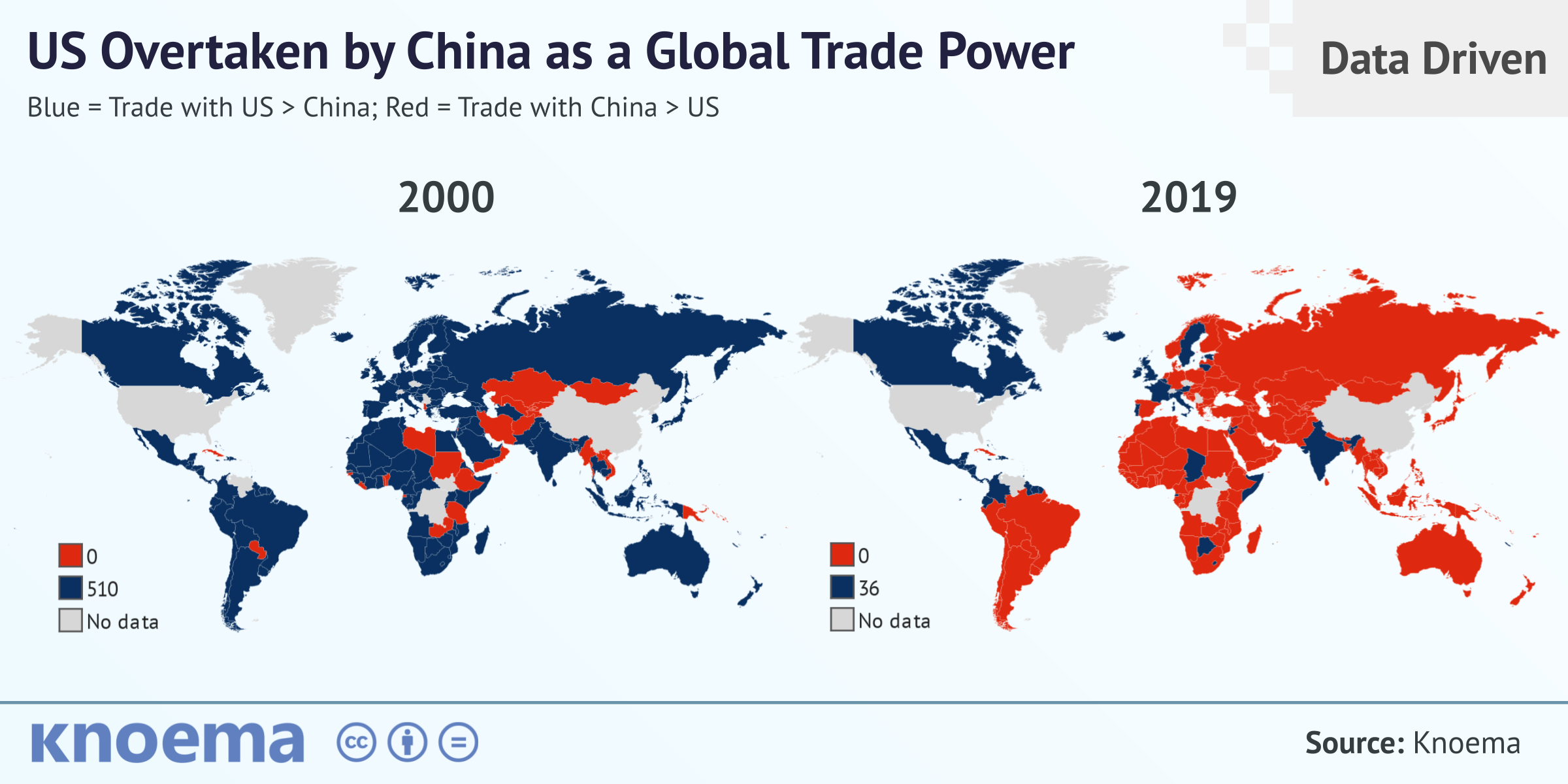

As of 2019, China has taken over the US as the chief global trade superpower.

Information for this briefing was found via Seeking Alpha. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

2 Responses

Curiously, did the Roman Empire, the Ottoman Empire and the Spanish Empire go through the same rise and fall as the UK and the US?

The current Russian conflicts in Ukraine could hasten the change starting with the weakening of US hegemony as alluded to by the author.

One of which could be the accelerated decline of the dollars as the de facto world currency.

Curiously, it is the rubbles and not euros or RMBs.