This week, PI Financial initiated coverage on Red White & Bloom (CSE: RWB) with a C$2.50 price target and a Buy recommendation. Within, Jason Zandberg refers to Red White & Bloom as a Michigan powerhouse.

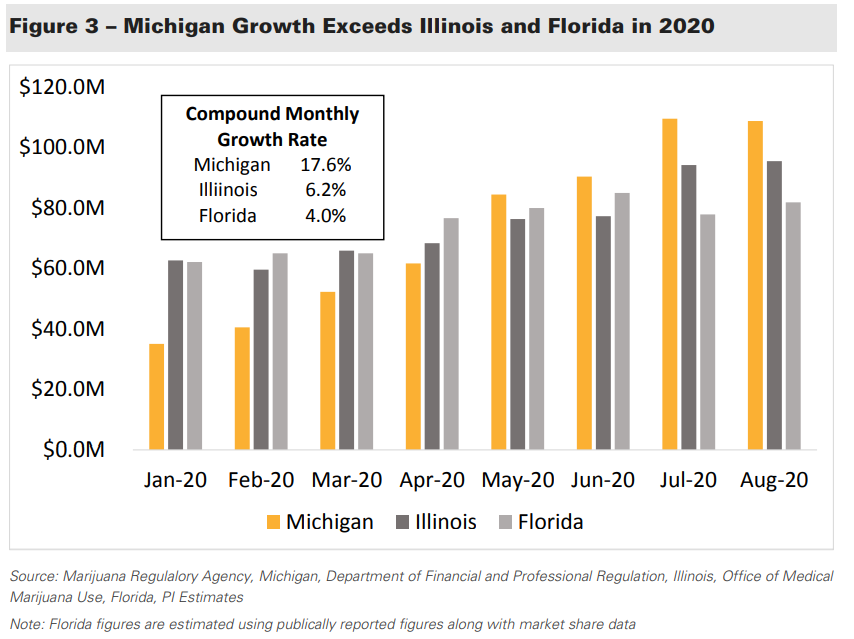

Zandberg says that Michigan has been the fastest-growing adult-use cannabis market since Michigan launched adult-use at the end of 2019. Michigan’s market has grown an annualized 566% in 2020, and the total market is currently larger than Illinois’ and Florida’s cannabis market, he says.

Red White & Bloom has massive exposure to the Michigan market because of its debenture investment into PharmaCo, among other acquisitions, which allows RWB to acquire 100% of the company. RWB has exercised this option but is still awaiting regulatory approval. PharmaCo operates ten dispensaries, three indoor and one outdoor cultivation facility with a fourth large cultivation facility to come online by January 2021. Zandberg estimates that the trailing twelve-month revenue from PharmaCo is U$70 million.

The next thing Zandberg highlights in his initiation note is the High Times licensing agreement. In June 2020, RWB acquired licensing rights to brand their dispensaries and products with the High Times label. RWB is expected to rebrand their dispensaries to High Times stores as a result. Zandberg says, “We believe the rebranding of RWB’s Michigan dispensaries will bring instant brand recognition.” and “The High Times brand is an iconic cannabis brand, and we expect it to resonate with consumers.”

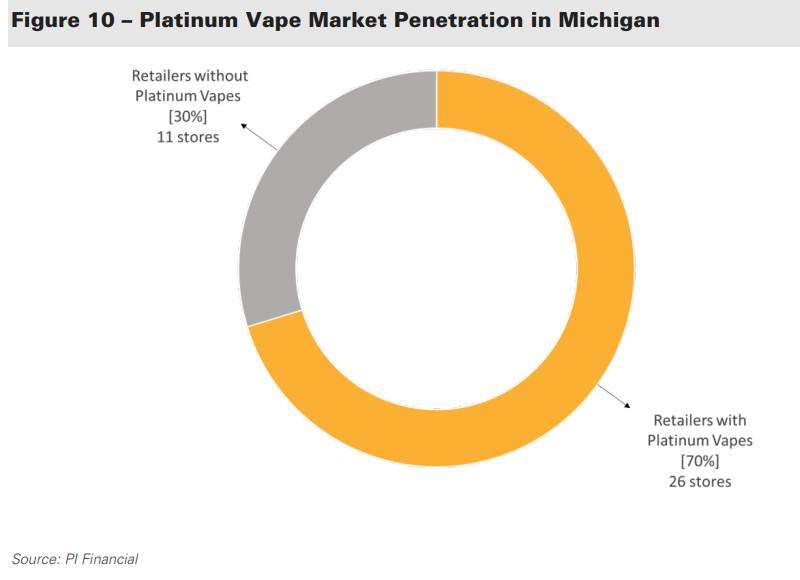

To round off the excellent acquisitions RWB has done to hopefully grab a foothold of the Michigan market, would be their acquisition of Platinum Vapes. Platinum Vape makes cannabis products sold in Michigan, California, and Oklahoma. They create the CCELL vapes cartridges, disposable vape pens, gummies, chocolates, and flowers sold in over 700 locations. Zandberg says Platinum Vapes has an annualized revenue of U$70-U$75 million, with EBITDA of 25%-30%.

The last thing Zandberg highlights is the merger between RWB Acquisition Sub, Inc. and Mid-American Growers, Inc. This acquisition makes RWB the largest premium Hemp greenhouse operator in the world through a 3.6 million square foot greenhouse.

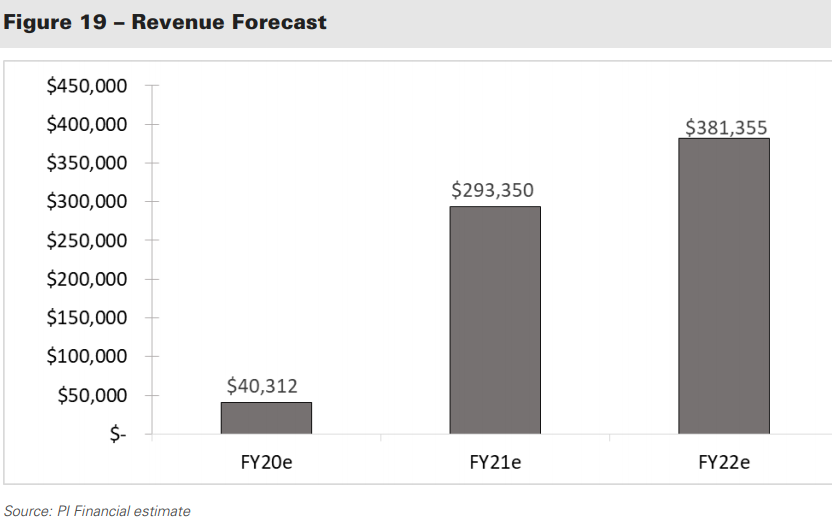

Currently, Zandberg is forecasting revenue of U$40.3 million for the fiscal year 2020, then ballooning to U$293.4 million in the fiscal year 2021 and growing to U$381.4 million in the fiscal year 2022. Zandberg adds that, “we believe RWB will hit peak EBITDA margins in FY22 at 32.9%.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

3 Responses

They are a sham. Michican had $1,512,050 revenue (in their only revenue producing quarter) when they starting counting on April 24th. That’s out of total Michigan sales in April of $33,817,309.23, in May of $45,153,117.50 and in June of $45,662,180.76. This is not a “company” but a money pit that is set up to dupe investors. RUN AWAY!!!

Very misleading comment. You don’t include any income derived in any of their Michigan dispensaries. They were not on the financials because regulators have not approved the transfer of ownership to RWB yet. I see a lot of these people telling half truths trying to cover positions. The company has had no problem raising funds from big name investors that do their homework. Name another company that has been around for less than a year that has verified income sources that add up to over 200M. Shame on you for trying to manipulate the retail investors.

They raised $60m credit facility at a 7% IR. That’s pretty much on par with the rates the tier 1 LP’s and MSO’s are paying and about 40% lower then what tier 3’s are playing. If they were a sham money pit I really doubt that someone would extend a credit facility of that magnitude at such a low rate. Also you should look at pro-forma / 2021 revenue. Which is what the price target is based on. 2022 Revenue estimates are $400m+ once the Mid American Growers wholesale operation is retrofitted from hemp to cannabis.

RWB has a EV right now of $200m. They’re trading at .5x forward revenue. Even at $2.5 they’re trading at 2x forward revenue which is about 1/2 of their competition. IMO the author is being conservative relative to market standards.