The latest data from Rentals.ca and Urbanation shows rental costs across Canada are rising at an alarming rate, with the average asking price for units hitting $2,193 per month in February. This represents a staggering 10.5% year-over-year increase, marking the fastest annual growth since September 2023.

The surge is being felt across housing types and regions. One-bedroom units now command an average of $1,920 per month, a 12.9% spike from last year. Two-bedrooms are listed at $2,293 on average, an 11.3% annual rise. Overall, asking rents have ballooned by 21% or $384 per month over just the past two years as interest rates climbed.

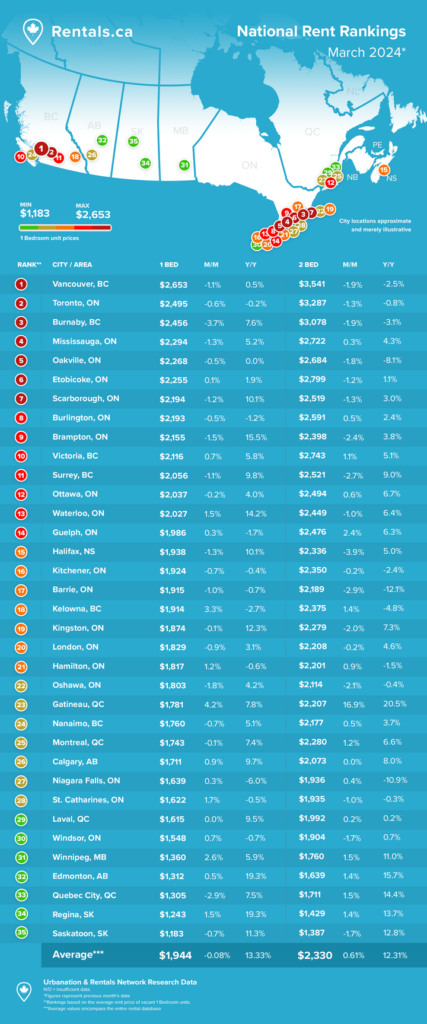

Alberta leads the country in rental inflation, with prices spiking 20% year-over-year to an average $1,708 per month provincially. In contrast, British Columbia and Ontario had the slowest annual increases at 1.3% and 1% respectively. However, they remain the priciest markets, averaging $2,481 in BC and $2,431 in Ontario.

The major cities in those two provinces are now exorbitantly expensive for renters. A one-bedroom in Vancouver averages $2,653, while Toronto clocks in at $2,495. These levels are mostly flat from 2023 but still tremendously burdensome.

Also read: BC Affordable-Housing Condo Units Allegedly Sold to People Who Already Owned Homes

Purpose-built rental apartments saw the sharpest 14.4% annual price hike in February, averaging $2,110 per month. Rental condos increased 5% to $2,372, while apartments in houses rose 5.3% to $2,347 on average.

Economist Mike Moffatt points out on X that the exodus of those priced out of Ontario has brought up rents across the country, effectively “exporting” Ontario’s housing crisis to the res to the country.

Thanks to the exodus out of Ontario, we're seeing rents starting to converge across the country. Ontario's housing crisis is being exported to the rest of the country. pic.twitter.com/IEvv4OdAqr

— Dr. Mike P. Moffatt 🇨🇦🏅🏅 (@MikePMoffatt) March 11, 2024

The pricey rental market is also driving a surge in demand for shared accommodations to save costs. Listings for roommates across the four largest provinces spiked 72% year-over-year in February, with average rents up 12% to $1,010 monthly.

Information for this story was found via Rentals.ca and Urbanation, and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Canada’s lawyers exempt from money-laundering laws

“In my view, reading down the act to exclude legal counsel and legal firms is appropriate, as this remedy respects both Parliament’s objectives of controlling money laundering and terrorist financing … and the charter rights of lawyers and their clients,” Gerow concluded.

https://www.cbc.ca/news/canada/british-columbia/canada-s-lawyers-exempt-from-money-laundering-laws-1.1078733

just google a real estate graph in Canada..and then go to Harbour 60 on a Friday night while gangsters drop $25,000 cash….