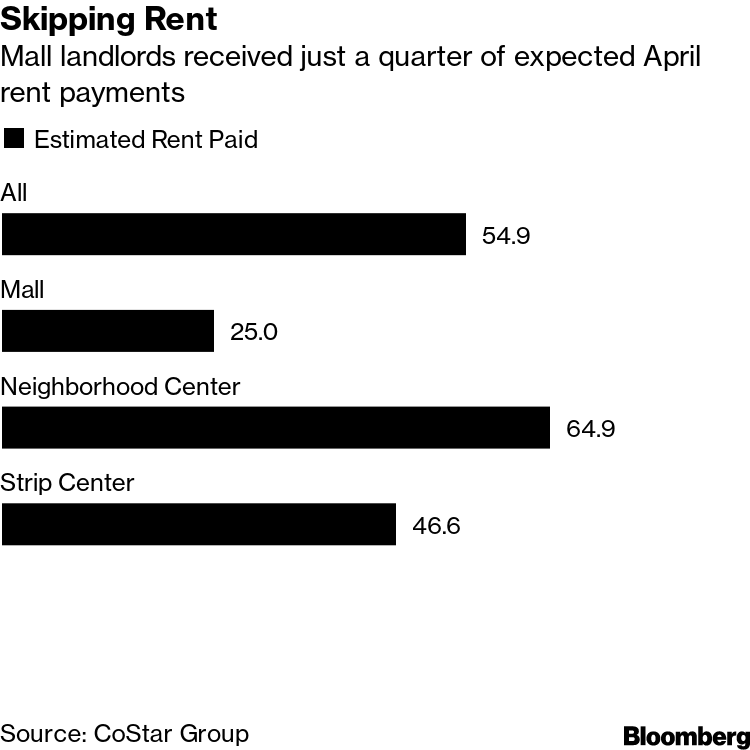

It appears the economic implication stemming from the coronavirus pandemic keep mounting. As retailers were forced to shut down as a means of slowing the spread of the virus, they amassed a significant loss in revenue, which in turn has put them in a situation where they were unable to pay rent. During the onset of the economic shutdowns, many retail landlords expressed some form of sympathy, and allowed their renters to defer payments.

But now forward to three months into the pandemic, and many retailers and business owners are even worse off than they were in March. Many are facing an existential crisis, and are resorting to bankruptcies. However, patience among retail landlords has run thin, and many are now issuing default notices to their tenants.

As of April, a staggering $7.4 billion in rent remains outstanding, and as a result, landlords are also forced to suffer financially. In a normal scenario, a landlord would issue a default notice after 10 days of no payment – but in the current situation, they have foregone months worth of unpaid rent.

Some landlords have sent threatening default notices, warning that they will lock out the building in question if no payment is made. Some landlords on the other hand, still continue to show a sliver of sympathy, and are only issuing default notices as a means of preserving their legal rights, while in the meantime they are in talks with the tenants regarding their financial situation.

Information for this briefing was found via Bloomberg and Zero Hedge. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.