Revival Gold (TSXV: RVG) has released a preliminary economic assessment for its Mercur Gold project in Utah. The study outlined a net present value of $294 million on an after-tax basis, alongside an internal rate of return of 27% using a gold price of $2,175 an ounce and a 5% discount rate.

The project, at $3,000 an ounce gold, is said to see its economics improve to an NPV of $752 million while the internal rate of return jumps to 57%. At this gold price, the payback period meanwhile is said to fall from 3.6 years to just 1.7 years.

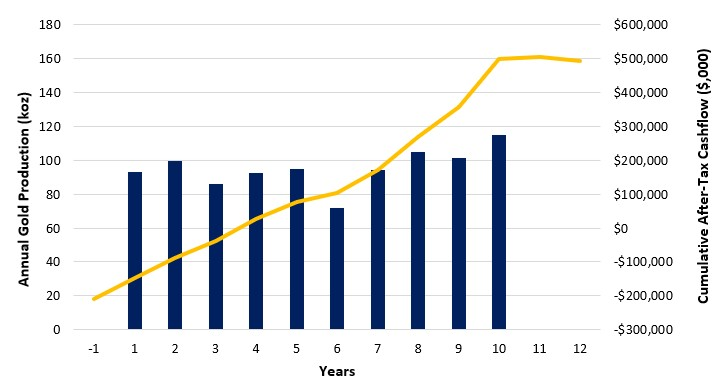

The PEA has outlined an open pit heap-leach operation that would produce on average 95,600 ounces of gold per year over an initial ten year mine life. Over the life of mine, production would amount to 951,000 ounces of gold at an average grade of 0.60 g/t. Recoveries are estimated at 75%.

Initial capital expenditures are pegged at $208 million, while life of mine sustaining capital is estimated at $110 million. Those gold ounces meanwhile are expected to be produced at cash costs of $1,205 per ounce, while all in sustaining costs are slightly higher at $1,363 an ounce.

The estimate was based on indicated mineral resources of 746,000 ounces of gold at 0.66 g/t, as well as inferred resources of 626,000 ounces of gold at 0.54 g/t gold, across both the Main and South Mercur deposits.

Revival Gold has indicated that it intends to focus on low risk resource conversion and expansion going forward, while it works on conducting additional engineering studies and the completion of permitting for the project to continue to be developed.

“As a brownfield site, Mercur offers significant historical exploration and operational data, excellent logistics including paved access, water supply system, electrical power line and substation, and close proximity to a large, skilled workforce, with the added benefit of exemplary historical environmental performance that should translate into a shorter permitting schedule and lower technical and execution risk,” commented VP of Engineering and Development John Meyer.

Revival Gold last traded at $0.365 on the TSX Venture.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.