Rio Tinto is targeting $5.0 billion to $10.0 billion of value creation from divestments and productivity growth as new CEO Simon Trott moves to simplify the group and narrow execution risk.

In his first major strategy briefing almost five months into the role, Trott said the company wants to become the world’s “most valued” miner and emerge “stronger, sharper and simpler.”

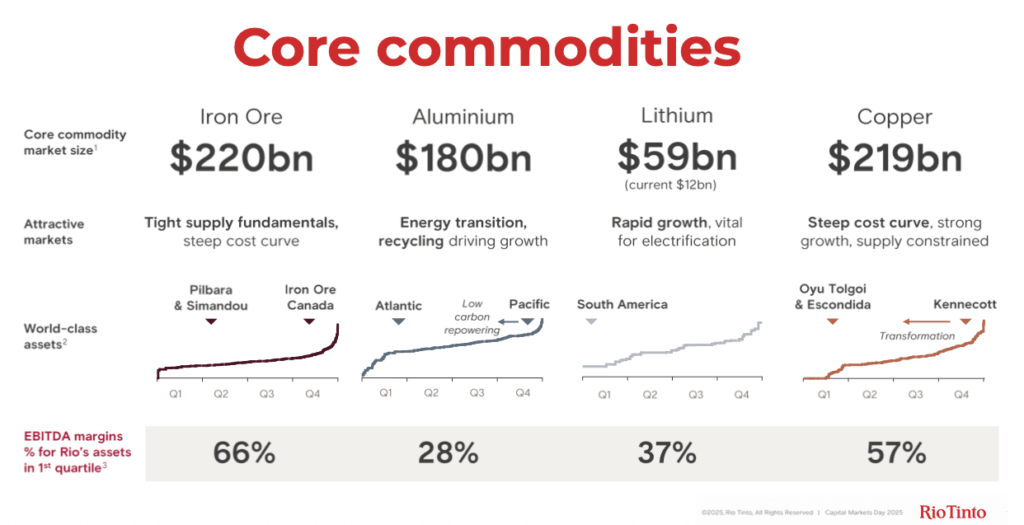

Rio Tinto is concentrating on iron ore, copper, aluminum, and lithium, and tightening capital discipline across the business.

The miner highlights the profitability positioning, asserting EBITDA margins for Rio’s assets in the first quartile at 66% (iron ore), 57% (copper), 28% (aluminium), and 37% (lithium), alongside “world-class assets” callouts including Pilbara and Simandou and Iron Ore Company of Canada for iron ore, Oyu Tolgoi and Escondida plus Kennecott for copper, and South America for lithium.

Trott’s divestment lens is broad and blunt: assets Rio “does not need to own” include titanium, borates, land, infrastructure and processing facilities, with non-core units such as titanium dioxide and borates specifically flagged. Beyond outright sales, Rio is exploring commercial, partnership, or ownership changes across land, infrastructure, mining, and processing assets, plus reviewing potential disposals of smaller product lines.

Rio expects capital expenditure to fall below $10.0 billion per year from 2028 as large projects wind down and the company scales back decarbonisation investments.

The decarbonisation envelope has been cut to $1.0 billion to $2.0 billion through 2030, down from an earlier $5.0 billion to $6.0 billion target.

Lithium growth is being gated harder too, with new lithium projects proceeding only “when supported by markets and returns.”

On costs, Rio is targeting a 4% unit cost reduction from 2024 to 2030, while also “releasing cash” from projects where third-party funding falls below Rio’s cost of capital. Trott has already trimmed leadership ranks and paused spend on BioIron and the Jadar lithium project in Serbia, actions framed as delivering about $650 million in annualised productivity gains.

Trott also said Rio is working with top shareholder Chinalco to resolve governance constraints that have limited share buybacks.

Operationally, copper is being pushed to the front. Rio raised its 2025 copper production forecast after stronger activity at Oyu Tolgoi and now expects 2025 copper output to be up to 3% higher than prior estimates, with 2025 copper at 860,000 to 875,000 tonnes versus a prior 780,000 to 850,000 tonnes, followed by 800,000 to 870,000 tonnes in 2026. Rio is targeting 1.0 million tonnes per year by 2030, while also saying Oyu Tolgoi copper output should rise more than 50% this year and about 15% in 2026.

Iron ore remains the volume engine, with Pilbara 2026 production guided at 323 million to 338 million tonnes. The new Simandou mine in Guinea shipped its first ore this week and is expected to produce 5 million to 10 million tonnes in 2026, while BMO flagged that this same 5 million to 10 million tonnes (100% basis) implied a slower ramp than its 19 million tonne estimate.

Information for this story was found via Mining.com and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.