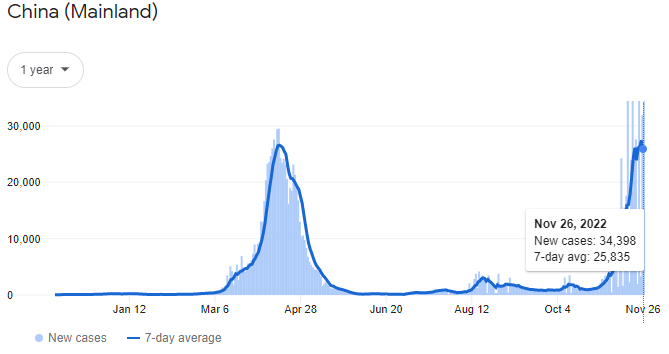

Daily COVID infections have reached all-time highs in China, surpassing the previous mid-April 2022 peak of about 29,000 per day in that country. On November 26, about 34,398 infections were reported in Mainland China.

While far below the daily peak infections rates seen in Western nations in late 2020 and early 2021, China’s oft-articulated zero-COVID policy has resulted in the imposition of local lockdowns, mass testing, and other curbs. These measures understandably have created discontent in the country, but, more importantly to investors, they impact economic activity in the world’s second largest economy.

For example, in Zhengzhou, the location of the world’s largest iPhone factory and the site where the new iPhone 14 is made, residents in eight districts cannot leave the area until November 29. Furthermore, rumors abound that Chinese authorities will impose a shutdown of the port city of Guangzhou, an important financial center which is just northwest of Hong Kong. Much of the recent COVID surge has taken place in and around Guangzhou.

Perhaps most significantly, this surge in COVID activity could diminish the probability that China will soon ease its zero-COVID policy. Investors have hoped that the governments’ recent decisions to implement more targeted measures, as opposed to the blanket measures put in place last spring, could mean the country will gradually move in the direction of more relaxed policies observed in almost all other countries.

Amidst the sharp rise in COVID infections, one positive is that about 90% of the new China cases in the last few days have reportedly been asymptomatic. In the spring, that ratio was much lower (i.e. much more symptomatic cases).

Investors should note that after COVID infections in China peaked in mid-April which prompted Chinese officials to impose strict lockdown policies to combat the outbreak, the S&P 500 Index proceeded to drop about 20% in just two months.

Clearly, other factors aside from China’s COVID situation played a role in that drop — for instance, Russia’s invasion of Ukraine initially caused many commodities, including oil, to spike and global central banks were just beginning their painful monetary tightening programs — but investors should closely monitor this situation. Investors could easily conclude that new, tough lockdown policies could be implemented to stem the outbreak. These steps could in turn slow the economy and perhaps prompt stock market participants to again back away from risky investments.

Information for this briefing was found via Bloomberg and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.