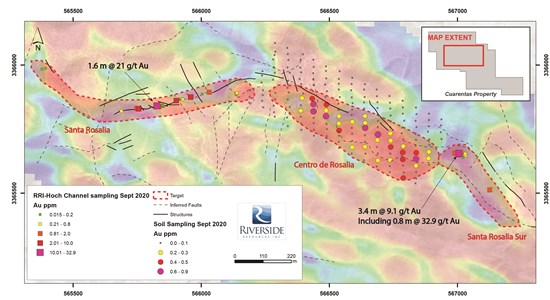

Riverside Resources (TSXV: RRI) this morning announced that it has received results from recent channel and soil sampling conducted at the Cuarentas project, located in Sonora, Mexico. The samples were taken along planned drill targets on the property, with the highlight value froming from a channel sample measuring 9.1 g/t gold over 3.4 metres.

A total of 55 channel samples and 181 soil samples were taken from the project as the firm works towards target definition on the project. Of the channel samples taken, 22% resulted in higher than 0.6 g/t gold values being reported, while 49% reported gold values higher than 0.2 g/t gold.

Soil sampling meanwhile returned results as high as 0.9 g/t gold. The program was conducted on a grid with 50 metre spaced lines, and 25 metres between samples. The program resulted in the definition of a continuous 550 metre long gold-in-soil anomaly being discovery. The discovery merges the Santa Rosalia and Santa Rosalia Sur zones of mineralization, with a zone referred to as Centro De Rosalia, with a total length of 1.7 kilometres of mineralization.

An induced polarity survey is now being conducted over the two primary targets, which may be extended to include the newly discovered Centro De Rosalia zone as well.

The Cuaretas project is operated by Riverside, with the firm having an earn-in partner, Hothschild Mining. Hothschild will fund the next $8.0 million of expenditures on the property as a means of earning a 51% interest in the project. The project is located 20 kilometres west of the Premier Gold Mercedes Mine, and 30 kilometres south of the Agnice Eagle Santa Gertrudis operation.

Riverside Resources last traded at $0.25 on the TSX Venture.

FULL DISCLOSURE: Riverside Resources is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Riverside Resources on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.