FULL DISCLOSURE: Canacom Group is long the equity of Riverside Resources.

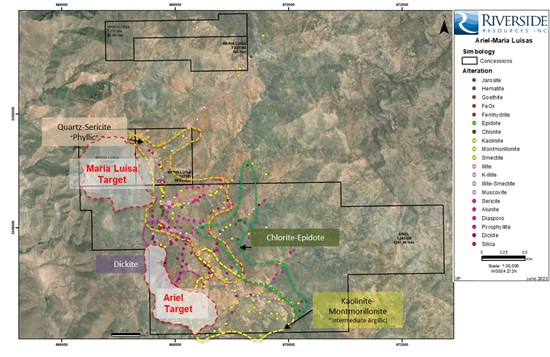

Riverside Resources (TSXV: RRI) has expanded its Ariel Copper Project in Mexico following the acquisition of the Maria Luisa Copper Property, which is located immediately adjacent to the project.

For Riverside, the acquisition results in the company fully consolidating the Laramide age porphyry copper, gold, molybdenum district, with the property now amounting to an area of 16 square kilometres. The company says Ariel amounts to a “turnkey, undrilled, high quality drill target” that is found just 18 kilometres east of the La Caridad Copper Mining Complex, the second largest copper mine in the country.

The Maria Luisa property amounted to four claims totaling 398.75 hectares in size, which the company paid a total of US$200,000 for, which included settling prior outstanding tax issues on the claims. The property notably contains no royalties or retained interest, with Riverside now owning the claims outright.

On a consolidated basis, the Ariel property is said to have two major targets that Riverside will focus its efforts on, with the project fully permitted for drilling. The first target is the Ariel target, which features Dickite-alunite angular breccias that are interpreted to be directly linked to a concealed porphyry target. The second is the Maria Luisa Target, a quartz-sericite breccia that is said to contain strong evidence of porphyry-copper system activity.

WATCH: Project Generators: DD On The Go, Ep. 1

“We are delighted to consolidate Maria Luisa into the larger Ariel project as this has been a goal for several years and was able to be completed on highly favorable terms for Riverside. This now provides the opportunity to move forward with drilling at both Ariel and Maria Luisa. Riverside will look to partner this large, fully titled, easily accessible and proximal to La Caridad copper mine location,” commented Riverside CEO John-Mark Staude.

Riverside Resources last traded at $0.145 on the TSX Venture.

FULL DISCLOSURE: Canacom Group, the parent company of The Deep Dive is long the equity of Riverside Resources. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.