Drilling has begun for Riverside Resources (TSXV: RRI) at the Cuarentas Gold Project located in Sonora, Mexico. The program is being conducted with exploration partner Hochshild Mining, whom will fund the exploration o the property as part of their minimum exploration commitment required in year one.

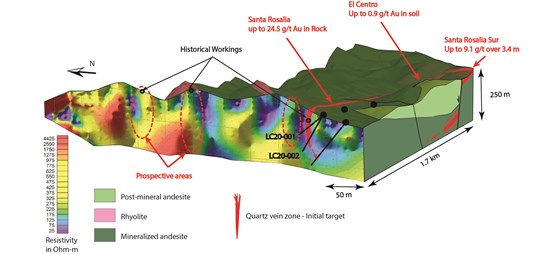

The drill program, at an estimated initla 2,000 metres in size, will consist of ten holes that will be drilled over the historical Santa Rosalia Mine and Santa Rosalia Sur gold vein target areas. The property is believed to have never been drilled previously. The current targets are roughly one kilometre apart, and form part of a large epithermal vein system.

Drilling will focus on testing the strike and depth continuity of the gold bearing veins known to be on the property. The veins currently extend from historical mine workings that are located on site. Recent exploration work conducted on the property defined Santa Rosalia as being part of a bigger system that has a total of five geophysical anomalies.

“We are excited to begin drilling and pleased with the strong IP indicators from the new work which builds upon the channel sampling and trenching we have already completed. Our team has enjoyed the collaboration and joint technical expertise working with Hochschild Mining as a mining partner, and we look forward to testing these initial discovery targets together.”

John-Mark Staude, Riverside CEO & President

Riverside Resources last traded at $0.24 on the TSX Venture.

FULL DISCLOSURE: Riverside Resources is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Riverside Resources on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.