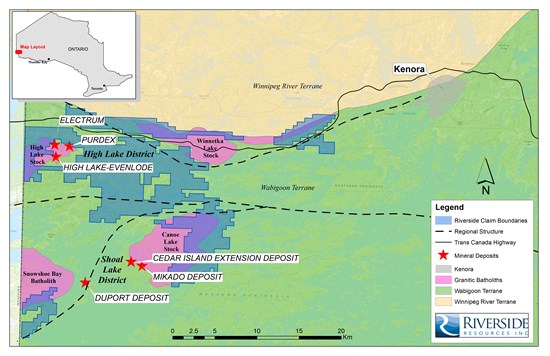

Hot off the heels of a successful spin-out from a gold-silver project in Mexico, Riverside Resources (TSXV: RRI) appears to be wasting no time to move on to its next project. The company announced this morning that it has staked a new gold project roughly 230 square kilometres in size west of Kenora, Ontario, in what is known as the High Lake Greenstone Belt, with the project containing sixteen mineral deposit inventory locations.

The project itself is located west of Kenora, Ontario, extending to the Manitoba border. With the claims block roughly 20 kilometres long, the property is immediately south and runs parallel to the Trans Canada Highway, providing excellent access to the site.

The greenstone belt is said to be underexplored, despite the area being subject to exploration since the 1800’s. Most historic work has been conducted on shear-hosted gold, however the company is focused on volcanogenic massive sulfide mineralization that is typical in other well endowed greenstone belts and for which the High Lake Belt has several known showings. Mineralization is said to be contained within vein systems within the belt.

“We continue our Company’s generative approach acquiring district scale projects whereby major mining companies can work systematically with Riverside and without serious third-party ownership interference. This Greenstone belt has been largely ignored since the last gold cycle. With recent discoveries in Red Lake and Rainy River explorers have focused on those areas and we believe the potential for new discoveries in this belt is excellent with the application of modern exploration approaches.”

John-Mark Staude, CEO

The company is in the process of assembling an immediate summer exploration program for the new project, which is to combine surface geochemistry with surface mapping to expand upon structural geology work previously completed on the region. The initial focus will be placed on the High Lake and Canoe Lake stock areas as Riverside works towards determining the primary structural controls on the property.

Full details on the property can be found here.

Riverside Resources last traded at $0.45 on the TSX Venture.

FULL DISCLOSURE: Riverside Resources is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Riverside Resources on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.