After the market closed on November 7, Rivian Automotive, Inc. (NASDAQ: RIVN) reported solid 3Q 2023 results and moderately boosted its full-year 2023 guidance for both vehicle production and adjusted EBITDA. This marked the second successive quarter that Rivian increased its 2023 estimates for these key measures.

More specifically, the company now expects to manufacture 54,000 vehicles and record a US$4.0 billion adjusted EBITDA loss this year, up from its early August projections of 52,000 units and negative US$4.2 billion, respectively. Over the twelve months ended September 30, 2023, Rivian produced 49,711 electric vehicles and recorded an adjusted EBITDA loss of US$4.34 billion.

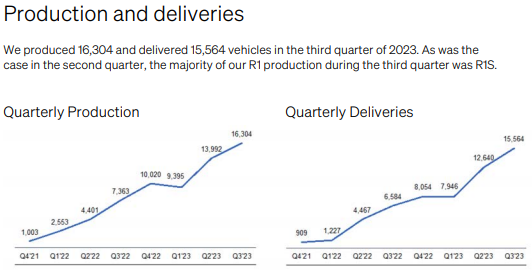

The company produced 16,304 electric pickup trucks and SUVs in 3Q 2023, up 16.5% from 2Q 2023 levels. Rivian’s 3Q 2023 deliveries increased at a much faster 23.1% sequential pace, reaching 15,564 units versus 12,640 in 2Q 2023.

Rivian continues to lose money on every vehicle it delivers, but those losses are narrowing. The company’s gross profit per vehicle delivered was negative US$30,648 in the just-completed quarter, a modest improvement from a US$32,595 loss in 2Q 2023, and markedly better than the US$67,329 loss per unit delivered in 1Q 2023. By comparison, fellow start-up electric vehicle maker Lucid Group, Inc. (NASDAQ: LCID) realized a gross loss per vehicle delivered of about US$228,000 in 3Q 2023.

RIVIAN AUTOMOTIVE, INC. — Selected Financial Statistics

| (in millions of US dollars, except vehicles produced and delivered and revenue and gross profit per vehicle delivered) | Full-Year 2023 Guidance | Twelve Months Ended 9-30-23 | 3Q 2023 | 2Q 2023 | 1Q 2023 |

| Number of Vehicles Produced | 54,000 | 49,711 | 16,304 | 13,992 | 9,395 |

| Number of Vehicles Delivered | 44,204 | 15,564 | 12,640 | 7,946 | |

| Ratio of Vehicles Delivered to Produced | 88.9% | 95.5% | 90.3% | 84.6% | |

| Revenue (A) | $3,782 | $1,337 | $1,121 | $661 | |

| Revenue Per Vehicle Delivered | $85,558 | $85,903 | $88,687 | $83,187 | |

| Gross Profit | ($2,424) | ($477) | ($412) | ($535) | |

| Gross Profit Per Vehicle Delivered | ($54,837) | ($30,648) | ($32,595) | ($67,329) | |

| Operating Income | ($5,953) | ($1,440) | ($1,285) | ($1,433) | |

| Operating Cash Flow | ($5,205) | ($877) | ($1,361) | ($1,521) | |

| Adjusted EBITDA | ($4,000) | ($4,344) | ($940) | ($881) | ($1,062) |

| Capital Expenditures | ($1,100) | ($1,022) | ($190) | ($255) | ($283) |

| Total Stock-Based Compensation | $741 | $242 | $181 | $183 | |

| Cash and Short-Term Investments | $9,133 | $9,133 | $10,202 | $11,244 | |

| Debt and Convertible Preferred | $3,413 | $3,413 | $3,347 | $3,308 | |

| Shares Outstanding (millions) – Period End | 956 | 956 | 946 | 939 |

Rivian disclosed that it no longer is selling its electric delivery vans (EDVs) exclusively to Amazon.com, Inc. (NASDAQ: AMZN) and that it is in talks with other potential customers. In March, The Wall Street Journal had reported that Rivian began to negotiate an end to the exclusive accord after the giant online retailer’s 2023 van order came in at the low end of previously set expectations. Amazon, which has a 17% ownership stake in Rivian, operates more than 10,000 Rivian-made EDVs.

READ: Rivian Reports Positive Production and Delivery Figures In Third Quarter

As of September 30, 2023, Rivian had cash and short-term investments of US$9.13 billion, down from US$10.2 billion on June 30, 2023. This US$9.13 billion total does not include proceeds from the sale of US$1.725 billion of convertible unsecured notes Rivian issued in October 2023. The notes carry an interest rate of 3.625% and mature in October 2030.

Rivian has been one of the poorest performing stocks in 4Q 2023; it is down about 31% just since September 29, 2023 (the last trading day of 3Q 2023). The stock’s valuation looks markedly different based on its revenue multiple versus a cash flow analysis. Factoring in its net cash position, Rivian’s enterprise value (EV) is approximately US$10.4 billion. Its revenue over the twelve months ended September 30 was just under US$3.8 billion; so, the stock trades at a reasonable 2.75x EV-to-revenue multiple. However, Rivian’s US$10.4 billion valuation is much tougher to reconcile with a projected US$4.0 billion adjusted EBITDA shortfall this year.

Rivian Automotive, Inc. last traded at US$15.40 on the NASDAQ.

Information for this story was found via Edgar and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.