Rivian Automotive, Inc. (NASDAQ: RIVN) has become perhaps the most talked-about stock in North America over the last week.

On November 9, the company issued 176 million shares in an IPO at US$78 per share, assuming that underwriters exercise their option to purchase additional shares. Including this issuance, total shares outstanding are 891.3 million, and, factoring in its current share price of US$129.95, Rivian’s stock market capitalization and enterprise value are about US$116 billion and US$96 billion, respectively.

As has been widely discussed, these represent remarkable valuation levels for a company which is just this quarter recording its first dollar of revenue. To assess Rivian’s valuation on potential future results, consider the following points regarding the company’s operations and management’s projection of future capabilities.

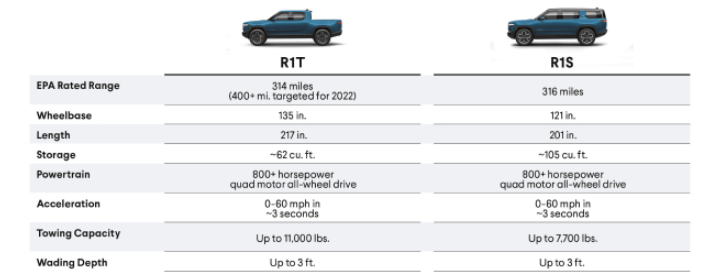

As of October 31, 2021, Rivian had 55,400 aggregate pre-orders in the U.S. and Canada for its R1T electric pickup truck and R1S electric SUV. These reservations require a deposit of US$1,000, which is fully cancelable and fully refundable. The company believes it can fill these orders by year end 2023.

Rivian has the capacity to produce 150,000 electric vehicles per year at its manufacturing plant in Normal, Illinois. More specifically, the company could potentially produce 65,000 R1Ts and R1Ss per year (about 1,310 per week assuming 49.6 working weeks per year), and 85,000 electric delivery vans, or EDVs, annually, principally for Amazon (1,710 per week).

The company is currently not producing anywhere near these levels. It produced 168 R1Ts in the month of October and delivered 145 of them. Production levels did increase late in the month as Rivian manufactured 104 R1Ts in the last week of October.

R1S production is supposed to begin in December. Rivian expects to produce 25 and deliver 15 SUVs by the end of 2021. In addition, the company expects to produce and deliver ten EDVs to Amazon by December 31, 2021.

If, as the company projects, Rivian can reach weekly production levels of 1,310 R1T/R1S vehicles and 1,710 EDVs in approximately two years — which would be no small feat given the current very modest manufacturing levels — the company’s annualized revenue at that time would be around US$10.5 billion. This rough sales estimate assumes about US$70,000 in revenue per vehicle.

So, if Rivian has sufficient demand for R1Ts and R1S’s and can achieve the dramatic increase in manufacturing it projects, which, as Tesla can attest, is quite difficult, Rivian trades at an enterprise value-to-late 2023 annualized revenue run rate of more than 9x, a high figure for any growth company. If Rivian cannot reach a 150,000-unit annual production rate in two years, the ratio would be even higher. Note that based on its late October data, the company’s present annual production rate is perhaps 5,000 vehicles per year.

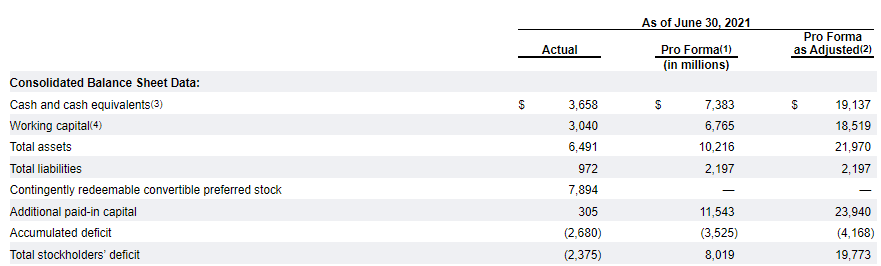

Rivian has a number of positive attributes. First, the U.S. government is aggressively encouraging and incentivizing the adoption of electric vehicles over conventional gasoline-powered vehicles. Second, Rivian’s balance sheet is a fortress — a cash balance in the vicinity of US$20 billion after the IPO — and third, its vehicles have received strong reviews and have impressive battery ranges.

The driving ranges of the R1T and R1S are 314 and 316 miles, respectively, and the range of an EDV with 700 cubic feet of storage is just over 200 miles. However, many of these characteristics and much of Rivian’s potential upside already seem to be reflected in Rivian’s share price.

Rivian Automotive, Inc. last traded at US$128.60 on the NASDAQ.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.