On December 11, Rivian Automotive, Inc. (NASDAQ: RIVN) declared it was pausing its agreement with Mercedes-Benz AG to work together to produce electric vans in Europe. The companies had announced a memorandum of understanding on this initiative in September. Rivian and Mercedes had planned to build one van based on Mercedes’ engineering technology and another predicated on Rivian’s engineering know-how.

The odd element about the announcement is the real reason for the shelving of the partnership remains unclear. Neither company alluded to a lack of demand for vans, nor did the auto makers cite higher than expected capital costs. Indeed, Rivian has a cash-rich balance sheet (see below).

Each company’s leader provided essentially non-answers. Rivian CEO RJ Scaringe said he wanted to focus on the consumer business, saying that represented “the most attractive near-term opportunities to maximize value for Rivian.” Mathias Geisen, head of Mercedes-Benz Vans, said that “exploring strategic opportunities with the team at Rivian remains an option.”

The fear for Rivian investors is that one possible reason to rein in its expansion ambitions and to focus on its consumer business (the R1T electric truck and the R1S electric SUV) is that production rates have not yet reached acceptable levels. As background, when Rivian reported 3Q 2022 earnings in early November, the company reaffirmed its 25,000-unit production forecast for 2022 which implies a notable step-up in manufacturing pace for the fourth quarter. Specifically, Rivian must produce 10,683 vehicles in 4Q 2022 to meet its full-year 2022 goal. That represents a production rate of 813 units per week, up a hefty 45% from the 3Q 2022 weekly rate of 560 vehicles. We note that Rivian’s 3Q 2022 manufacturing rate was 40% higher than the 399 per-week pace from May 10 through June 30.

Demand in Rivian’s commercial business does not seem to be in question. Reservations for Rivian’s pickup trucks and SUVs have increased since mid-year 2022, reaching about 114,000 as of November 7, 2022. Preorders totaled around 98,000 on June 30, 2022.

How in the world does a company with practically $0 in revenue, $4.5bn in losses, and down 74% so far this year… get included in the #Nasdaq100 ?! It will now get passive fund flows from everyday investors. $RIVN

— Brian Tycangco 鄭彥渊 (@BrianTycangco) December 10, 2022

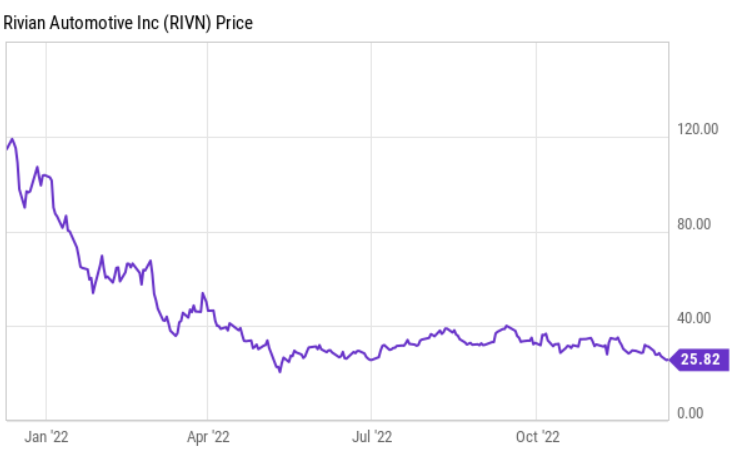

Rivian has a robust balance sheet. As of September 30, 2022, its cash balance was US$13.3 billion, offset only partially by US$1.8 billion of debt. Nevertheless, the company has burned about US$1.6 billion of cash per quarter this year as it struggles to reach economic production levels. Rivian’s cash totaled US$18.1 billion on December 31, 2021.

| RIVIAN AUTOMOTIVE, INC. — Selected Financial Statistics | |||||

| (in millions of U.S. dollars) | |||||

| 4Q 2022 Implied Guidance | 3Q 2022 | 2Q 2022 | 1Q 2022 | 4Q 2021 | |

| Revenue | $536 | $364 | $95 | $54 | |

| Operating Income | ($1,724) | ($1,708) | ($1,579) | ($2,454) | |

| Operating Cash Flow | ($1,368) | ($1,204) | ($1,034) | ($1,086) | |

| Adjusted EBITDA | ($1,694) | ($1,307) | ($1,305) | ($1,144) | ($1,108) |

| Capital Expenditures | ($675) | ($298) | ($359) | ($418) | ($455) |

| Cash – Period End | $13,272 | $14,923 | $16,432 | $18,133 | |

| Pro Forma Cash Reflecting IPO and Debt Issuance Proceeds | |||||

| Debt and Convertible Preferred – Period End | $1,761 | $1,655 | $1,609 | $1,533 | |

| Shares Outstanding (millions) – Period End | 921 | 916 | 901 | 901 | |

| Number of Vehicles Produced | 10,683 | 7,363 | 4,401 | 2,553 | 1,003 |

| Number of Vehicles Delivered | 6,584 | 4,467 | 1,227 | 909 |

Determining the appropriate valuation for Rivian has been a challenge since its IPO thirteen months ago. Factoring in its giant cash holdings, the company’s enterprise value is about US$11 billion. That is difficult to square with a projected US$5.45 billion negative adjusted EBITDA in 2022. On the other hand, the company has ~4.5 times the number of reservations for its popular R1 vehicles than the projected quantity it will manufacture this year. If/when production rates improve, Rivian’s cash flow could improve quite notably.

Rivian Automotive, Inc. last traded at US$25.61 on the NASDAQ.

Information for this briefing was found via Edgar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.