Robinhood Markets, Inc. (NASDAQ: HOOD) shares have lost roughly half their value since early August. For many stocks, such a correction could suggest a buying opportunity, but other considerations, including the ongoing and very real threat of data breaches and a still sky-high valuation, suggest that investors should continue to exercise caution.

The highly publicized November 3 hacking incident whereby criminals stole the email addresses of five million Robinhood users, the full names of two million others, and more complete data (name, DOB and zip code) from 310 users, is an embarrassing breach. Moreover, the hacker is apparently trying to sell the information on the dark web, according to various news services The computer thief alleges the information stolen was richer in quality than Robinhood admitted. (The hacker says the complete personal information for 310 people is not presently for sale.)

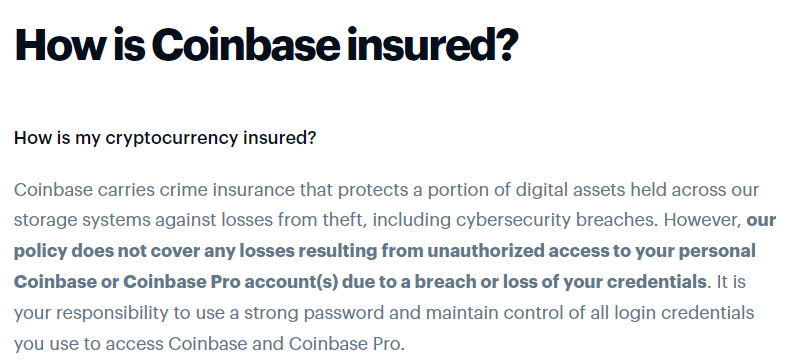

The breach highlights perhaps an even more concerning issue for Robinhood. Many cryptocurrency brokers, including Robinhood and Coinbase (NASDAQ: COIN) for that matter, cannot get full and complete insurance coverage for the crypto holdings of all their clients.

(As an aside, cash and securities, but not digital currencies, are insured by the Securities Investor Protection Corporation in a U.S. brokerage account in the U.S. for up to a total of US$500,000 per account in the event the broker becomes insolvent.)

Crypto trading fees represented about 25% of Robinhood’s total revenue over the first three quarters of 2021, and around 23% of its total assets under custody as of September 30, 2021. It is certainly possible that given the breach and a greater appreciation of the insurance situation, some owners of these crypto assets could decide to transfer their holdings to a different, perhaps more secure location.

As of October 27, 2021, Robinhood’s shares outstanding were 859.7 million. Factoring in its September 30 cash balance of US$6.2 billion, and its share price of US$27.98, the company’s enterprise value (EV) is around US$17.5 billion.

Robinhood’s adjusted EBITDA for the last twelve months is about US$200 million, meaning that the online brokerage firm trades at an EV-to-EBITDA ratio of more than 85x, an extraordinarily high figure — even after the share price has been cut in half over the last 3 ½ months. Based on management guidance, full year 2021 EBITDA seems likely to be even lower from US$200 million, as in the next calculation a negative figure in 4Q 2021 will replace positive US$79 million realized in 4Q 2020.

| (in thousands of US dollars, except otherwise noted) | 3Q 2021 | 2Q 2021 | 1Q 2021 | 4Q 2020 |

| Cumulative Funded Accounts (millions) | 22.4 | 22.5 | 18.0 | 12.5 |

| Sequential Growth | -0.4% | 25.0% | 44.0% | 9.6% |

| Monthly Active Users (millions) | 18.9 | 21.3 | 17.7 | 11.7 |

| Sequential Growth | -11.3% | 20.3% | 51.3% | 9.3% |

| Assets Under Custody (US$ billions): | ||||

| Equities | $69 | $73 | $65 | $53 |

| Options | $1 | $2 | $2 | $2 |

| Cryptocuttencies | $22 | $23 | $12 | $4 |

| Net Cash Held by Users | $3 | $4 | $2 | $4 |

| Assets Under Custody (US$ billions) | $95 | $102 | $81 | $63 |

| Sequential Growth | -6.9% | 25.9% | 28.6% | 43.2% |

| Average Account Balance (US$) | $4,241 | $4,533 | $4,500 | $5,040 |

| Sequential Growth | -6.4% | 0.7% | -10.7% | 30.6% |

| Average Revenue Per User (US$) | $65 | $112 | $137 | $106 |

| Sequential Growth | -42.0% | -18.2% | 29.2% | 3.9% |

| Options PFOF Revenue | $164,000 | $164,604 | $197,860 | |

| Cryptocurrency PFOF-Type Revenue | $51,000 | $233,103 | $87,587 | |

| Equities PFOF Revenue | $50,000 | $52,012 | $133,301 | |

| Other PFOF Revenue | $2,000 | $1,448 | $1,691 | |

| PFOF or PFOF-Type Revenue | $267,000 | $451,167 | $420,439 | $235,000 |

| All Other Revenue | $98,000 | $114,166 | $101,735 | $83,000 |

| Net Revenue | $365,000 | $565,333 | $522,174 | $318,000 |

| Sequential Growth | -35.4% | 8.3% | 64.2% | 17.8% |

| Adjusted EBITDA | ($83,999) | $90,173 | $114,771 | $79,000 |

| Cash | $6,166,705 | $5,077,752 | $1,402,629 | |

| Debt – Period End | $0 | $7,369,522 | $2,179,739 | |

| Shares Outstanding (millions) | 835.7 | 225.8 | 225.6 |

Robinhood’s valuation appears quite full simply based on the numbers shown just above. If one adds to this the recent sharp pullback in the prices — and quite possibly the trading volumes on Robinhood’s platform — of digital currencies and highly valued tech stocks, as well as the long-term effect of the November 3 computer hack, the company’s valuation looks even more problematic.

Robinhood Markets, Inc. last traded at US$27.98 on the NASDAQ.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.