A day after negotiating the company’s largest purchase ever to bolster the business, Royal Bank of Canada (TSX: RY) reported earnings that highlighted its domestic strength.

Rising loan balances and wider lending margins in Royal Bank’s Canadian retail division boosted total net interest income by 24% to $6.28 billion in the fiscal fourth quarter, while total revenue grew to $12.6 billion.

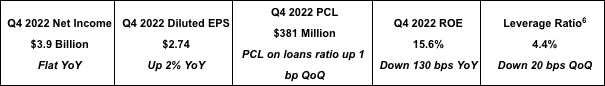

The Toronto-based firm said that net income fell 0.3% to $3.88 billion, or $2.74 per share for the fourth quarter. Profit after calibrating certain financial items was $2.74 per share, beating analysts’ estimate of $2.69 per share.

READ: The Royal Bank Has No Interest In Lower Housing Costs

However, consolidated results include total PCL of $484 million, compared to $(753) million last year, principally reflecting lower releases of provisions on performing loans in Personal & Commercial Banking and Capital Markets as a result of unfavorable developments in the current year’s macroeconomic outlook.

“While market conditions continue to be tough, our 2022 results reflect a resilient bank that is well-positioned to pursue strategic growth and deliver long-term shareholder value. Our premium businesses, strong balance sheet, prudent risk management and diversified business model mean we can deliver advice and services that help our clients navigate all cycles,” said CEO Dave McKay.

On Tuesday, Royal Bank revealed plans to acquire HSBC Canada for $13.5 billion, putting to use a substantial pool of capital amassed during the pandemic’s early stages. The acquisition, which is expected to close late next year, will provide Royal Bank with 130 branches and C$134 billion in assets, while also boosting its footprint in commercial banking and among high-net-worth individuals.

The bank has indicated that the purchase is expected to provide an internal rate of return of 14%, with the purchase price said to be 9.4x HSBC Canada’s estimated 2024 adjusted earnings of $1.4 billion.

Royal Bank of Canada last traded at $131.82 on the TSX.

Information for this briefing was found via Bloomberg, Sedar, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.