FULL DISCLOSURE: This is sponsored content for Rua Gold.

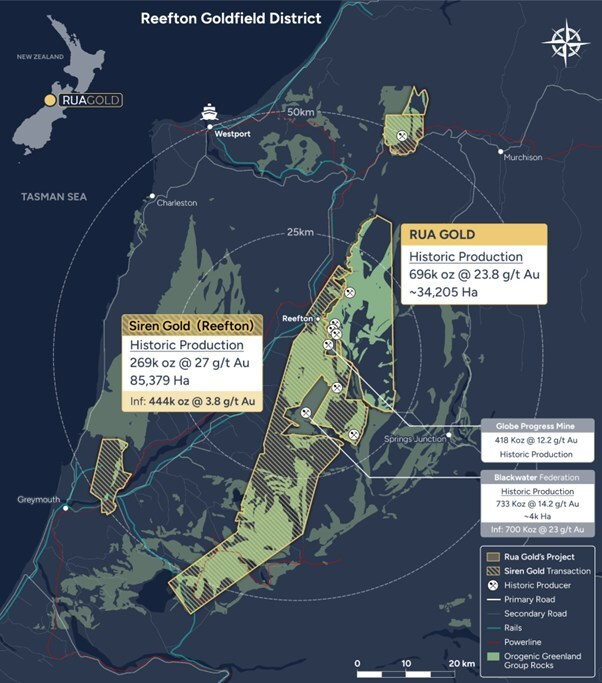

Rua Gold (CSE: RUA) is set to substantially expand its landholdings in the Reefton Goldfield of New Zealand. The firm as of this morning has entered into an arrangement to acquire Reefton Resources Pty, which is a subsidiary of Siren Gold (ASX: SNG).

Historically, the Reefton Goldfield has produced over two million ounces of gold, with production grades ranging from 9 g/t to as high as 50 g/t, despite minimal recent exploration work having been conducted in the region. The company, on a post-transaction basis, is set to become the largest landholder in the region with over 120,000 hectares of tenements on the South Island of New Zealand, with the tenements covering all known past production camps outside of the Globe Progress and Blackwater mines.

The Reefton properties include a JORC-compliant inferred resource estimate of 444,000 ounces of gold at 3.81 g/t. Past producing operations within the Reefton assets meanwhile saw the production of 269,000 ounces of gold at an average grade of 27 g/t.

The Reefton Goldfields region is also notably home to the Blackwater mine currently being placed into production by Federation Mining, which is expected to produce an estimated 70,000 ounces of gold at an all-in sustaining cost of US$738 per ounce. This transaction, as per Rua, is part of the “next chapter” in the firms efforts to become the next major gold producer in New Zealand, and will enable the company with a greater opportunity to work alongside the nations pro-mining government to assist in drafting the minerals strategy for New Zealand.

READ: RUA Gold: A Promising Player in New Zealand’s Gold Mining Renaissance

“This Transaction creates a significant opportunity in an under explored orogenic gold district. The Company has focused on the Reefton Goldfield and in four years combined rapid geochemical sampling, ultra-detailed geophysical surveying and mapping to highlight the potential of exploring old workings at depth as well as several new greenfield prospects,” commented Rua Gold COO Simon Henderson.

The transaction will see Reefton acquired for C$1.8 million in cash and C$16.6 million in shares of Rua, with 83.9 million shares to be issued to Siren under the arrangement. The transaction price amounts to US$25 per ounce based on the gold resource currently held by Reefton.

On a post-transaction basis, Siren will own a 30% stake in Rua, with shares issued under the transaction to be subjected to resale restrictions for up to 24 months from the closing date. As part of the arrangement, the two parties have entered into a shareholder rights agreement, which will enable Siren to nominate one member to the board of directors of Rua, and also requires the company to vote its shares in the same manner as the firms directors. Brian Rodan, Chairman of Siren and a Fellow of the Australian Institute of Mining and Metallurgy, has been selected by Siren as its first nominee.

“The decisions taken by the Boards of both Siren and Rua to take a major step to consolidate the 40km line of strike of the entire Reefton field is truly visionary and will realize significant long-term benefits to the Reefton district as a whole,” commented Rodan on the transaction.

The transaction is currently set to close in Q4 2024, subject to regulatory approvals.

Rua Gold last traded at $0.215 on the CSE.

FULL DISCLOSURE: Rua Gold is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Rua Gold on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.