In a surprising turn of events for global politics and finance, a recently surfaced internal Kremlin memo has revealed that Russia is considering a return to the U.S. dollar settlement system. This proposal is part of a broader pitch for an economic partnership with the Trump administration, signaling a potential shift in Russia’s long-standing effort to distance itself from American financial influence.

The internal document outlines seven key areas where the Kremlin believes Russian and U.S. interests could align following a potential peace deal regarding the war in Ukraine. For years, Russia has worked to “de-dollarize” its economy, moving toward the Chinese yuan to avoid the impact of U.S. sanctions. However, this new memo suggests a “stunning reversal” of that policy.

Beyond rejoining the dollar system, the proposal includes:

- Energy Cooperation: Joint ventures in oil and natural gas, focusing on fossil fuels over green energy.

- Industry Support: Long-term contracts to modernize Russia’s aviation fleet with U.S. involvement.

- Market Access: Giving U.S. companies special conditions to return to the Russian consumer market.

- Raw Materials: Working together on critical minerals like lithium, copper, and platinum.

This move appears to be a tactical play to appeal to the Trump administration’s economic goals. By offering to return to the dollar, Russia could provide the U.S. with a significant “win” by weakening the growing bond between Moscow and Beijing. Furthermore, the memo argues that rejoining the dollar system would stabilize Russia’s own economy and reduce currency volatility.

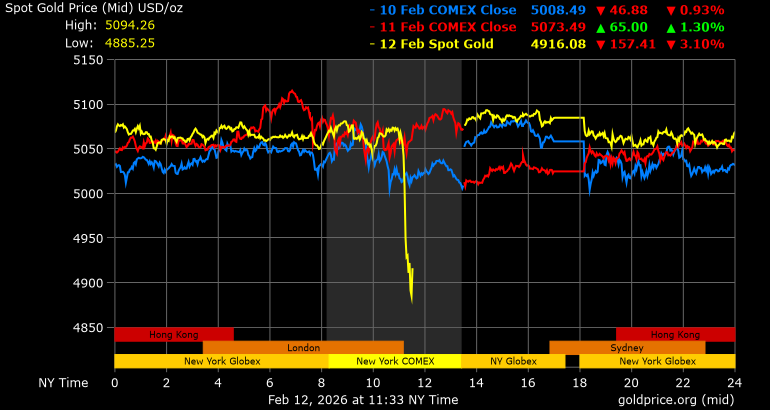

Market Reaction: Gold Prices Tumble

The financial world reacted almost immediately to the news. For a long time, gold has been seen as a “safe haven” for investors during times of geopolitical tension and as an alternative to the dollar.

As news of the potential Russia-U.S. economic thaw broke, the price of gold fell sharply, dropping roughly 4%. Investors appear to be pivoting back toward the dollar, betting that a reduction in global tensions and a return to a dollar-centric trade model between major powers makes the precious metal less necessary as a hedge.

Whether Vladimir Putin would truly risk his relationship with China to follow through on this plan, the memo highlights a significant change in the Kremlin’s strategy as they look toward a new era of negotiations.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.