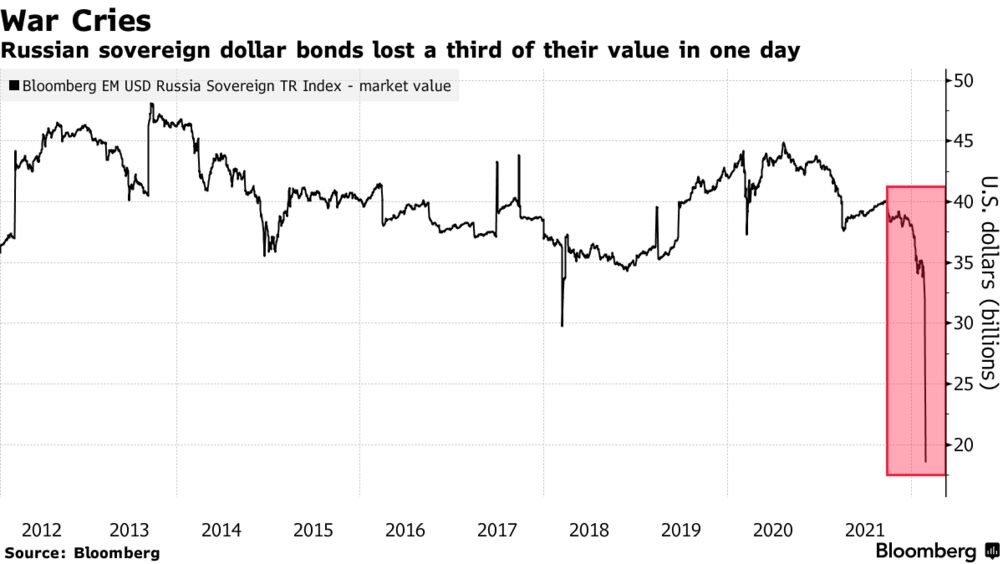

After the White House declared that Russia defaulted on its international bonds–for the first time in more than a century–the country is shunning the characterization of its lender status.

“Statements of a default are absolutely unjustified,” Kremlin spokesperson Dmitry Peskov said on Monday.

Instead, Moscow said investors blamed the Western financial agents who allegedly received payment from the state but the bondholders did not receive any cash.

“The fact that Euroclear withheld this money and did not bring it to the recipients is not our problem. There are absolutely no grounds to call such a situation a default,” he added.

This seconded the Russian finance ministry’s pronouncement “that “the non-receipt of money by investors did not occur because of lack of payment but due to the third-party actions.” As far as Moscow is concerned, it is “not directly spelled out as a default situation by issue documentation.””

Concerns about Russia’s ability to fulfill its debt obligations mounted as the country sustains numerous economic sanctions by the global community. Back in March, Russian President Vladimir Putin shifted to a ruble-only policy in servicing its debts, in an attempt to breathe life into the crashing currency.

Given the continuing revenues the country rakes in from its energy resource exports, Russia is believed to have the capacity to pay. But as sanctions and severed financial connections continue to freeze the country out of the global economy, it is facing troubles in fulfilling its bond obligations.

“It’s a very, very rare thing, where a government that otherwise has the means is forced by an external government into default,” said Hassan Malik, senior sovereign analyst at Loomis Sayles & Company. “It’s going to be one of the big watershed defaults in history.”

Putin last week announced that the country would consider the bonds paid once a ruble payment equal to the forex amount due was made. To get this, bondholders would have to create a Russian bank account and trade the ruble for their respective currencies.

The default was announced after the grace period for the snared interest payment of around US$100 million due May 27 expired.

Information for this briefing was found via Bloomberg and Reuters. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.