Oil prices could reach as high as US$380 per barrel should the sanctions war continue, which may lead to Russia cutting all of its energy exports to the West, JPMorgan Chase & Co. analysts warned.

The Group of 7 nations is finalizing a plan to form a cartel-like mechanism to cap the price of Russian oil to match the price of production.

“[The discussions are] extremely active. I think what we want to do is keep Russian oil flowing into the market… absolutely, the objective is to limit the revenue going to Russia,” US Treasury Secretary Janet Yellen said in the 2023 Treasury budget senate hearing when asked about the White House’s participation in the initiative.

But with Moscow raking in revenues from the oil price hikes, the country is believed to be in a better position to survive even if it cuts oil exports to the member states totally.

The analysts believe that Russia could afford to cut 5 million barrels daily from its exports. This, however, could lead to pushing the global oil prices to US$190 per barrel with a 3-million-barrels cut and to a “stratospheric” US$380 per barrel should there be a full 5 million barrels a day cut from production.

“The most obvious and likely risk with a price cap is that Russia might choose not to participate and instead retaliate by reducing exports,” JP Morgan Chase analysts wrote. “It is likely that the government could retaliate by cutting output as a way to inflict pain on the West. The tightness of the global oil market is on Russia’s side.”

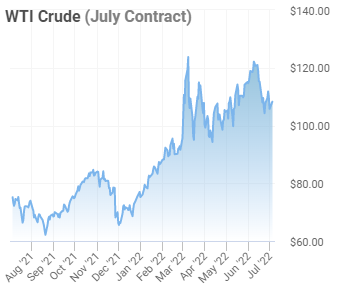

While global sanctions on Russia traverse the tricky balance between cutting Moscow’s revenues while also maintaining available supply for its oil customers, the rising price has more than offset the cut in demand. The country actually saw an increase in revenue from fossil fuels since the war broke.

Moscow earned around €93 billion from fossil fuel exports in the first 100 days of the war, 61% of which came from European Union clients. China overtook Germany to lead the list of importers at €12.6 billion.

While the exports saw a decline since March, records show the national revenue levels from fossil fuel are at record highs.

Information for this briefing was found via Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.