The year 2022 promises to be an extraordinarily active and divisive year in U.S. politics as the pivotal November Congressional mid-term elections could re-shape the political dynamics in America. Key to all this is the constant and polarizing presence of former President Donald Trump, who has injected himself into many races and transformed the coming primary and general elections into a referendum on his policies.

The almost-certain fervor and media attention attached to the mid-terms has been a central factor in the stock market’s assigning a multi-billion valuation to President Trump’s SPAC sponsor, Digital World Acquisition Corp. (NASDAQ: DWAC). President Trump’s Trump Media & Technology Group (TMTG), which has agreed to merge with DWAC, plans to launch a conservative social network called TRUTH Social in early 2022. TMTG has not yet begun operations, nor has it yet generated a dollar of revenue.

An alternate and cheaper way to play the almost certain increase in media and conservative social media attention to the 2022 election cycle may be through the shares of the Salem Media Group, Inc. (NASDAQ: SALM).

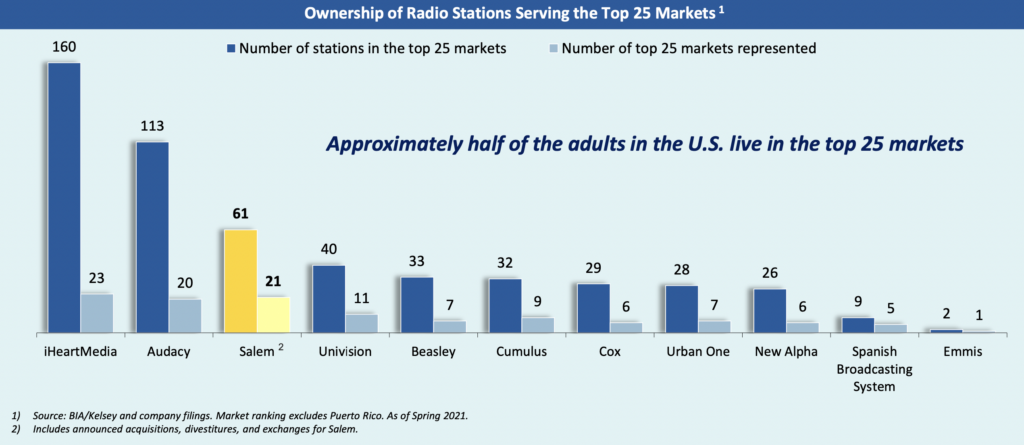

Salem is a sprawling media group that specializes in Christian and conservative content. It has 101 radio stations which feature some of the most popular conservative talk news hosts. Salem is the largest news talk radio broadcaster and the third largest overall radio broadcaster in the top 25 U.S. markets. In addition, Salem’s website and app platform receives 120 million visits per month.

Based on all this, it seems possible that many of the people who would visit President Trump’s social media platform may also listen to Salem’s radio broadcasts or visit its app platforms. However, the stock market valuation difference between Salem and DWAC is enormous: Salem’s enterprise value (EV) is around US$317 million, less than one-tenth that of DWAC.

Another major difference is that Salem generates significant revenue and is profitable. Over the twelve-month period ended September 30, 2021, the company recorded US$243 million of revenue, US$32 million of operating income, and US$37 million of adjusted EBITDA. Salem does carry a significant debt load, around US$252 million.

| (in thousands of U.S. dollars, except for shares outstanding) | 3Q 2021 | 2Q 2021 | 1Q 2021 | 4Q 2020 | 3Q 2020 |

| Revenue | $65,983 | $63,782 | $47,339 | $64,477 | $60,641 |

| Operating Income | $15,799 | $5,641 | $4,356 | $6,392 | $4,752 |

| Adjusted EBITDA | $10,832 | $8,748 | $7,922 | $9,917 | $9,625 |

| Operating Cash Flow | $4,549 | $1,000 | $9,197 | ($294) | $4,180 |

| Cash – Period End | $23,781 | $19,858 | $23,394 | $6,325 | $19,298 |

| Debt – Period End | $251,818 | $269,458 | $271,295 | $261,611 | $262,718 |

| Shares Outstanding (Millions) | 29.2 | 29.2 | 29.2 | 29.0 | 29.0 |

Salem’s valuation looks reasonable, not just versus DWAC, but versus other media stocks. The ratios of the company’s EV to its revenue over the last twelve months and its EV to its trailing twelve months EBITDA are 1.3x and 8.5x, respectively.

Being a small cap stock, Salem shares could be affected if the overall stock market were to perform poorly as the new year commences. For many years now, small cap stocks have fared substantially worse than their large cap counterparts in a pronounced market downturn.

Salem seems likely to benefit in 2022 from an almost certain jump in site visits to conservative websites and in attention paid to conservative talk radio. Equally important, it looks like a much less expensive and less risky way to play such a trend than DWAC.

An added possible side benefit: while Salem is not heavily shorted on an absolute basis (~618,000 shares shorted as of December 15, 2021), Yahoo Finance reports that shorts represent about 27% of its float. If Salem were to be targeted by Reddit users as a heavily shorted stock by hedge funds, the stock could benefit.

Salem Media Group, Inc. last traded at US$3.06 on the NASDAQ.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.