San Francisco, which is well-known for its astronomically high rent costs and lack of housing availability, has just been dealt a dose of reality. What was once the city of choice for those working in the tech industry, has been the subject of a mass exodus amid the pandemic. As a result, San Francisco’s extravagant rent prices that would make most jaws drop to the floor have collapsed by as much as 31% in September, signaling the shift towards a new era of working from home in leu of bustling downtown convenience.

As the pandemic continues to slip further and further out of control, many large tech companies in Silicon Valley and San Francisco have adapted remote work options for their employees. This has sparked a frenzy of workers moving out of high-cost rentals close to their place of employment into more spacious housing that is not only more affordable, but also carries less virus infection risk.

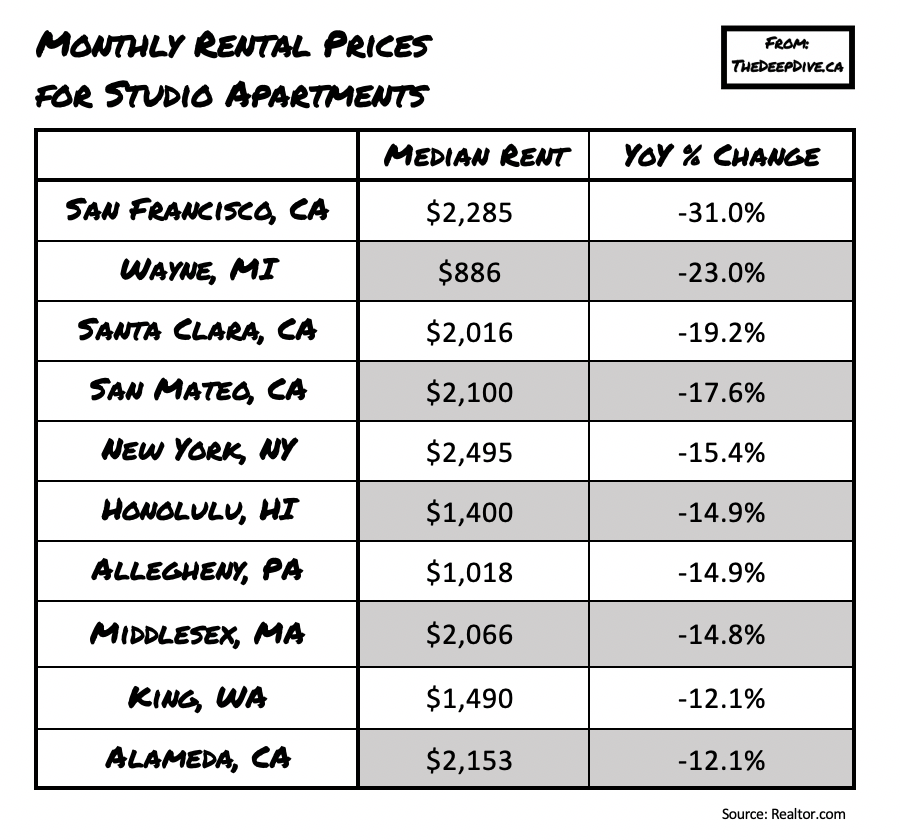

This has caused median studio apartment rent prices in San Francisco to fall to $2,285 – a staggering 31% drop compared to September 2019. In the meantime, one-bedroom apartments and two-bedroom apartments fell by 24.2% and 21.3%, respectively.

However, San Francisco is not the only city subject to a mass decimation of rent prices. Several other counties in California have also seen median rent prices drop significantly, with Santa Clara county and San Mateo county each seeing declines of 19.2% and 17.6% respectively. Rents for studio apartments in other once-popular urban regions across the US have also seen prices drop, as an increasing number of Americans have shifted the housing demand in favour of suburban and rural accommodations.

According to Realtor.com senior economist George Ratiu, the migration away form high-cost living does not come as a surprise amid a changing pandemic landscape. Prior to the pandemic, many Americans were comfortable paying a rent premium in order to have swift access to their place of employment in San Francisco and Silicon Valley. However, as infection rates began to climb across the US prompting the closure of businesses and congested work places, companies reverted to work-from home policies, which have been met with positivity among employees.

As more and more companies recognize the benefits of remote work, not only for the success of their business but also for the well-being of their employee’s wallets, the demand that was once soaring for urban downtown regions will likely continue to evaporate and with it drag along astronomical rent prices. After all, what goes up, must eventually come down.

Information for this briefing was found via Realtor.com. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.