The Canadian cannabis landscape, in a word, is saturated. Despite the best intentions of sector cheerleaders to state otherwise, production capacity far outstrips demand. With Friday’s licensing of Aphria Inc’s (TSX: APHA) (NYSE: APHA) Aphria Diamond facility, the situation has only worsened.

The problem, at its core, is that there is far too much mid grade cannabis supply currently available for Canadian consumers at inflated price points. While the illicit market continues to consume a large portion of total demand in the country, it does so on the basis of price and quality competition. Two areas that arguably, many licensed producers fail to compete with on any level.

While public producers are quick to highlight their cost basis per gram to investors, this costing appears to be forgotten by the time product gets to the retailer. While black market prices have continued to fall, medical and recreational prices have increased since legalization in October 2018, despite decreasing production costs at producers.

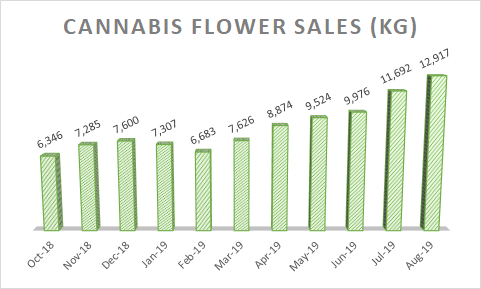

To be fair, legal monthly sales since legalization continue to grow on a month over month basis. The month of August, which is the latest data available, saw 12,917 kilograms of dried cannabis product sold – compared to November 2018 which saw sales of only 7,285 kilograms. Both figures include both medical and recreational use product. The problem with this, is the simple fact that multiple licensed producers currently have more licensed growing capacity than Canadians have consumed all year.

Total cannabis consumed in the eleven months of legalization amounted to 95,830 kilograms of dried flower. This doesn’t include cannabis oil product, due to oil product often utilizing trim from cannabis plants, while producers only tend to report capacities in terms of dried flower, not total cannabis mass – making things a bit murky for cross comparisons.

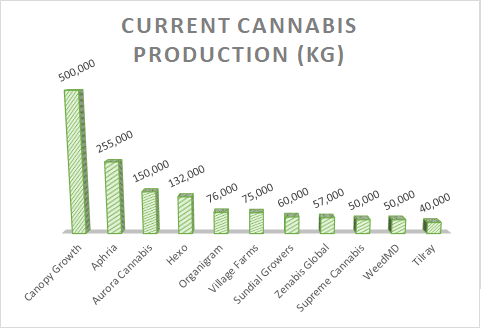

Yet, despite the current demand the top ten largest producers right now now have a total 1,405,000 kilograms of annual production capacity. It’s a figure that can be daunting for the remaining two hundred plus producers that have to fit in to the market yet. Friday’s licensing of Aphria Diamond added an additional 140,000 kilograms of capacity to this figure. Meanwhile, other producers such as Aurora Cannabis (TSX: ACB) (NYSE: ACB), currently have additional capacity still under construction. In Aurora’s case, once its latest projects are completed an additional 475,000 kilograms of product will flood the market each year. That’s enough additional annual production to last Canada approximately 4.5 years alone at the current run rate.

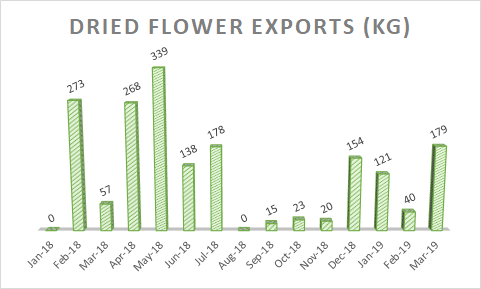

But wait. What about exports to foreign markets, such as Germany and the European Union? Turns out that the latest data provided via Stats Canada isn’t particularly bullish in that regard either. From the time that the data began being published to the latest updates – essentially, January 2018 to March 2019 – total exports of cannabis have amount to 1,806 kilograms of dried flower. Not exactly the promise land that investors were sold by industry leaders.

Yet, despite all this capacity, product shortages exist in the cannabis market. While certain large scale producers can have their product purchased at any retailer across the country at any given moment, this is not what consumers are primarily after. Consumers are largely after a premium, fairly priced product. This notion is evident by the struggle faced by consumers to acquire recreational product grown by cultivators such as The Supreme Cannabis Co (TSX: FIRE) and WeedMD Inc (TSXV: WMD), whom struggle to keep their quality product on store shelves across the country, despite their mid-sized footprints.

This premium niche is what many new players are after. Craft cannabis is aiming to become the next big thing in the Canadian landscape, and numerous smaller producers are betting the bank on it. Firms such as GTEC Holdings (TSXV: GTEC) and Rubicon Organics (TSXV: ROMJ) are betting that the typical consumer will be willing to pay a bit more for a high quality product. Whats more, is that they are unphased by massive facilities such as Aphria Diamond coming online. The struggle for these players however, will be whether the economies of scale will allow them to run profitable operations.

While mass facilities are effective at producing mass quantities of product, this product is most frequently viewed as being mid-grade at best. Thus, the question needs to be asked. Does the Canadian market really need another million square foot greenhouse cultivating mid grade product?

Information for this briefing was found via Sedar, and Health Canada. The author has no affiliations related to the organizations discussed, with the exception of WeedMD whom is a client of Canacom Group, the parent company of The Deep Dive. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

Galaxy Brain: Aurora Charting a Course through the Cannabis Supply Glut

For this weekend’s special piece, Deep Dive author Matthew Cox breaks down the Health Canada...