Sayona Mining (ASX: SYA) is reporting that its Moblan Lithium Project, found in the James Bay Region of Quebec, has a net present value (8%) of C$2.2 billion on a post-tax basis based on a recently conducted feasibility study.

The Moblan Mine is said to be the centerpiece of Sayona’s mining hub in the James Bay region. The proposed mine, a greenfield project, holds lithium pegmatite across four zones, which are to be mined under an open pit model that will see two pits used at the project.

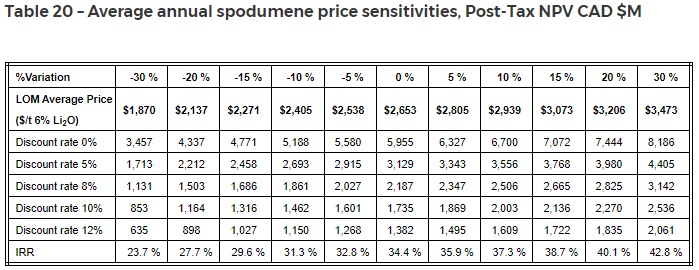

The NPV is based on proposed annual production of 1.8 million tonnes per year, with the project featuring probable mineral reserves of 34.5 million tonnes at 1.36% Li2O. Life of mine is estimated at 21.1 years, with life of mine cash flows estimated at $6.0 billion on a post-tax basis, resulting in a payback period of 2.3 years.

The mine meanwhile is expected to produce a spodumene concentrate grading 6.0% Li2O, with average annual production of 300,000 tonnes per year of concentrate.

Costing meanwhile is expecting the operating unit cost to come in at $555 per tonne, while all in sustaining costs are estimated at $748 per tonne. CAPEX is estimated at $962 million, while OPEX is estimated at $3.2 billion.

READ: Sayona, Piedmont Lithium Restart Spodumene Production At North American Lithium

The Moblan Project is expected to take approximately two years to complete construction, following the receipt of regulatory approvals and the delivery of a financing package, which is expected to be based on securing potential offtake and project partners.

“The challenging market conditions of recent months highlight the importance of developing Tier 1 lithium projects that are strategically located near existing transport corridors and end markets and that have the potential to deliver high grade lithium concentrate at industry-low and competitive operating costs. Moblan is an exceptional project that meets these criteria and we look forward to applying Sayona’s extensive operational expertise to minimise costs and develop the Project as efficiently as possible,” commented interim CEO James Brown on the study.

The Moblan project is 60% owned by Sayona, while the remaining 40% is owned by Investissement Quebec.

Sayona Mining last traded at $0.059 on the ASX.

Information for this briefing was found via Sedar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Any mining projects in Canada that are open pit will not go through, not with a known and convicted extremist terrorist as an environment minister. Just look at his road, oil and gas policies along with tripling the carbon tax on April 1