On April 12, Scottie Resources Corp. (TSXV: SCOT) agreed to acquire AUX Resources Corporation (TSXV: AUX) in an essentially no-premium share-for-share exchange. Each share of AUX will be exchanged for one share of Scottie. Both Scottie Resources and AUX Resources are exploration-stage junior miners in the Stewart Mining Camp in British Columbia’s Golden Triangle, one of the world’s most prolific mineralized districts.

The transaction is expected to close in June 2021, shortly after an AUX shareholder vote. AUX shareholders will own approximately 31% of the combined entity.

The combination of the two companies looks to be strategic for both sides for four chief reasons. First and most simply, it broadens the pathways to success for the shareholders of both companies. From AUX Resources’ perspective, its shareholders will benefit if either of Scottie’s key projects, the Scottie Gold Mine or Cambria, prove to be economic discoveries. By the same token, Scottie Resources’ shareholders would similarly reap rewards if AUX Resources’ flagship Georgia Project proves successful.

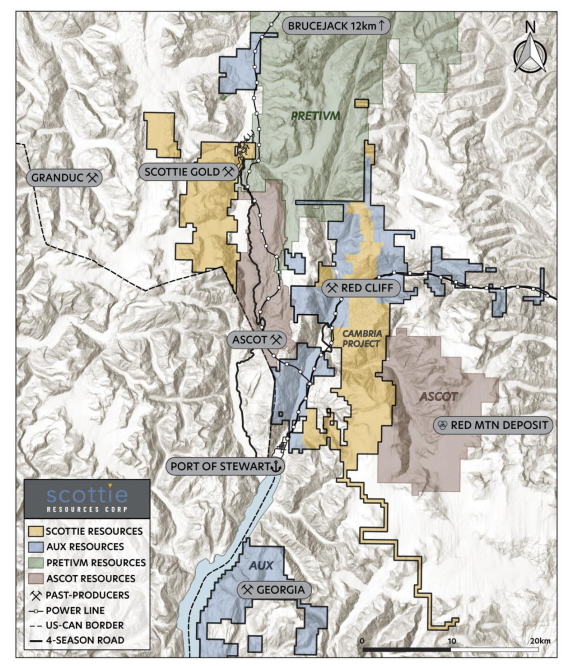

The 8,534-hectare Scottie Gold Mine Project is 20 kilometers north of Ascot Resources’ Premier Gold Mine and 27 kilometers south of the Brucejack Mine, which is owned by Pretium Resources. Brucejack has produced around one million ounces of gold since it began commercial operation in July 2017 and has estimated total mineral reserves of 4.2 million ounces of gold. The Premier Gold Project has total estimated mineral resources (indicated plus inferred) of 2.3 million ounces of gold equivalent.

Scottie Resources’ Scottie Gold Mine Project includes the past-producing Scottie Gold mine which produced more than 95,000 ounces of gold from 1981 through 1985 at an average grade of 16.2 grams per tonne of resources. As part of a 12,500-meter, three-rig drilling program, Scottie Resources has announced constructive assay results this year from drilling programs conducted on four regions of the Scottie Gold Mine Project – Blueberry Zone, Scottie Gold Mine, Domino Zone, and the O-Zone target.

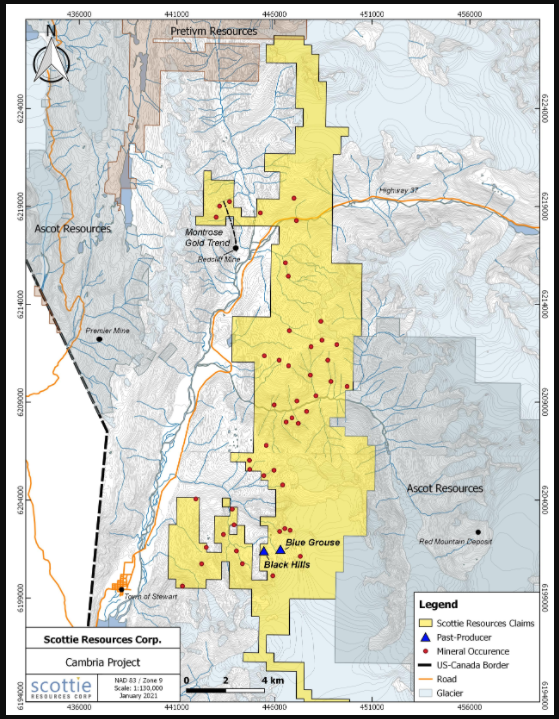

The 15,000-hectare Cambria Project consists of 71 mineral claims and borders Ascot Resources’ Red Mountain Project and Pretium Resources. Ascot acquired Red Mountain from IDM Mining for $45 million in early 2019. The project is expected to see its footprint expand substantially once AUX’s numerous contiguous properties in the region, as seen above, are vended in. Once consolidated, the project is expected to have a footprint of 27,465 hectares and include five historical mines within its borders.

At AUX Resources’ Georgia Project, a large hydrothermal system containing substantial gold may exist. To put the potential of the Georgia Project in perspective, a historic, non-compliant estimate of mineral resources remaining in a past-producing mine on the property is 276,400 tonnes at a gold grade of 27.6 g/t. The World Gold Council defines a high-quality underground mine as having gold density of 8-10 g/t.

Second, the Golden Triangle area is proving to be a region of significant interest for many miners. For example, in early March 2021, Newmont Corporation acquired GT Gold Corp., a copper-focused exploration company in this region, for an enterprise value of $414 million. In late March 2021, Cache Exploration reached an agreement with Granby Gold Corp, a private company, to acquire a 100% option on the Marmot Precious Metals Project in the Golden Triangle.

Third, Scottie Resources’ and AUX Resources’ management teams are quite familiar with each other; each side understands the potential of the projects described above. Indeed, Scottie Resources’ President and CEO Bradley Rourke is a Director at AUX and Thomas Mumford is both VP Exploration at Scottie Resources and Technical Advisor at AUX Resources.

Finally, the combined company will be well capitalized; it should have pro forma cash in excess of $6 million, representing 15% of the combined company’s stock market valuation.

Solid Financial Position

As of November 30, 2020, Scottie Resources (on a stand-alone basis) had cash of about $3.4 million and no debt. (AUX likewise is debt-free. Its last reported cash balance was $1.8 million as of September 30, 2020, with the company having since closed a $2.5 million financing lead by Eric Sprott.) Scottie has controlled its costs reasonably well; its operating cash flow shortfall has averaged about $375,000 per quarter over the last three reported quarters.

| (in thousands of Canadian $, except for shares outstanding) | 1Q FY21 | 4Q FY20 | 3Q FY20 | 2Q FY20 | 1Q FY20 |

| Operating Income | ($661) | ($715) | ($350) | ($195) | ($717) |

| Operating Cash Flow | ($220) | ($757) | ($148) | $57 | ($873) |

| Cash – Period End | $3,363 | $4,743 | $4,447 | $2,067 | $768 |

| Debt – Period End | $0 | $0 | $0 | $0 | $0 |

| Shares Outstanding (Millions) | 120.4 | 120.4 | 104.5 | 88.3 | 77.1 |

The combined Scottie Resources-AUX Resources could be negatively affected if future assay resources on the Scottie Gold Mine Project prove to be disappointing. Also, a sustained decline in precious metals prices could impact the stocks.

The combined Scottie Resources-AUX Resources entity could be a more attractive acquisition target for a larger miner than either was on a stand-alone basis. The combined company appears to have solid prospects which are located in a world-class mining region and will be well capitalized, with $6+ million in cash and no debt.

Scottie Resources and AUX Resources last traded at $0.235 and $0.23, respectively, on the TSX Venture Exchange.

FULL DISCLOSURE: AUX Resources Corporation is a client of Canacom Group, the parent company of The Deep Dive. The company has been compensated to cover AUX Resources Corporation on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.