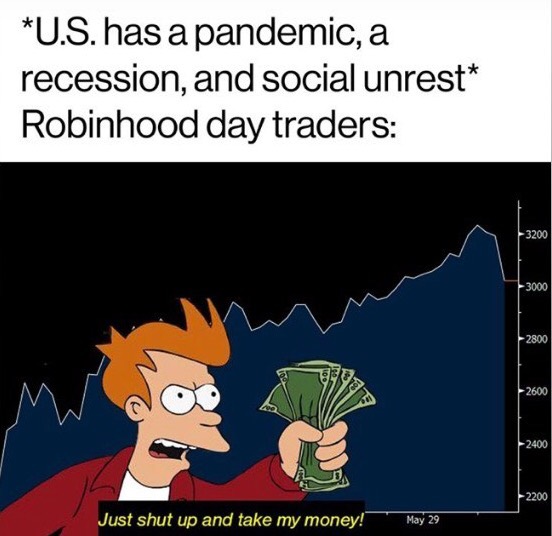

It appears that professional investors are taking offence to the erratically irrational behaviour of Robinhood day traders who are taking the basic fundamentals of investing and turning them on their head. As the feud continues to escalate, the spectrum of inexperienced and experienced investors are contemplating how to best capitalize on this bizarre occurrence.

Rich Ross, who is a macro research analyst at Wall Street’s Evercore ISI seems to have fanned the dust of speculation away and issued a statement to clientele. He is urging the senior investors to take advantage of the Robinhooder’s relative inexperience and eagerness to invest in essentially anything that has a ticker and turn it into a new opportunity. Such an opportunity has already been discovered by the infamous car rental company Hertz Global (NYSE: HTZ), who, along with Jefferies are seriously contemplating conducting an at-the-market equity offering– or should we say, initial bankruptcy offering.

Ross is also advising his clients to first and foremost take advantage of the dip. Inadvertently, that is exactly what these inexperienced retail investors have been doing with their $1,200 federal stimulus from the comfort of their couch. Nonetheless, it will certainly be interesting to see which group comes out on top of this entire fiasco. But one thing is for sure though: the experienced investors to the likes of Warren Buffet and Carl Icahn will be left fuming if their seasoned years are no match for couch-dwelling amateur day traders.

Information for this briefing was found via Evercore. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.