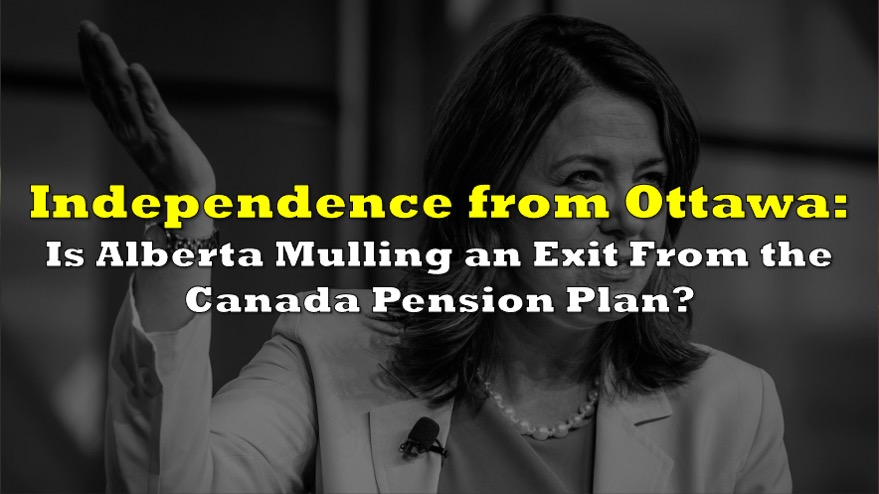

A recent study commissioned by the Alberta government suggests that residents of the province could collectively save over $5 billion in the first year alone if they opt to transfer their funds from the Canada Pension Plan (CPP) to a newly proposed provincial pension scheme. The report, conducted by consulting firm LifeWorks, was unveiled on Thursday, sparking a spirited debate between proponents and opponents of the idea.

According to the LifeWorks report, establishing a provincial pension plan in Alberta would result in more substantial retirement benefits for individuals while simultaneously reducing premiums for both individuals and businesses. However, it’s important to note that the findings have faced scrutiny and opposition from CPP.

The Canada Pension Plan, which serves a staggering 21 million contributors and beneficiaries, stands as one of the most significant pension systems in Canada. Any shift of funds away from CPP could have profound implications on its assets and income.

The study’s projections indicate that Alberta could potentially claim a staggering $334 billion asset transfer from CPP in 2027. This estimate is calculated based on Alberta’s contributions to the $575 billion CPP fund, minus the benefits received by its residents.

Premier Danielle Smith voiced her support for the idea of an Alberta pension plan during a news conference, stating, “I believe that an Alberta pension plan would be fairer. I believe it’s the right decision for our province.”

With an Alberta Pension Plan

— Jody Dahrouge (@JodyDahrouge) September 21, 2023

– $5 billion in savings in the year 1

– $5 to $10,000 bonus payment at retirement

– workers still on the job would save up to $1,425/yr in premiums

– businesses would save up to $1,425 per worker per year https://t.co/zXAQfZXNoG

Smith’s stance on provincial autonomy has been at odds with the federal government, particularly in her opposition to the proposed cap on oil and gas emissions, which she believes would harm Alberta’s economy.

In response to the report, Michel Leduc, Senior Managing Director & Global Head of Public Affairs and Communications at CPP Investments, issued a statement, saying, “The amount the report says could be extracted from the CPP is impossible and based on an invented formula.” Leduc emphasized caution and skepticism in interpreting the figures, given the unresolved issues between federal and provincial governments. He did, however, acknowledge the right of Albertans to consider withdrawing from the Canada Pension Plan.

Finance Minister Chrystia Freeland defended CPP, calling it one of the “crown jewels of Canada” and highlighting its role in ensuring secure and dignified retirements for Canadians across the nation.

In yet another study by University of Calgary economics professor, Trevor Tombe, he only finds “modest scope for material changes in benefit levels and contribution rates” relative to the current CPP plan should the province shift.

“Specifically, I estimate an [Alberta Pension Plan] minimum contribution rate (the rate that maintains predicted plan assets relative to plan expenses) is 8.2 percent, compared to the CPP’s 9.5 percent,” he said in his study.

Crucially, Tombe also noted that a separate pension plan carries a higher level of risk compared to the CPP, which effectively spreads and manages a wide range of risks on a national scale, including the challenges associated with interprovincial migration.

Moreover, the perceived wealth redistribution within the CPP primarily stems from Alberta’s demographic profile, where a youthful population contributes to the pension fund but receives benefits at a later stage. It’s essential to acknowledge that the entire disparity between contributions and expenditures within the CPP in Alberta can be attributed to factors such as age, income levels, and employment status.

Finally, the redistribution that many point to in the CPP are purely due to Alberta having a young population. Young people pay into pensions, then get benefits later. The entire gap between contributions and expenditures in the CPP within Alberta are due to age, earnings, emp.

— Trevor Tombe (@trevortombe) September 21, 2023

Albertans will have until the spring of 2024 to express their views on the proposed provincial pension plan through a dedicated panel, which will subsequently submit a report to the Alberta government. The government intends to introduce legislation before the end of the year, contingent on a majority of Albertans showing support in a referendum for the establishment of an Alberta-specific pension plan.

The discussion surrounding the creation of a provincial pension plan dates back to June 2020 when former Premier Jason Kenney announced a study to evaluate the possibility of replacing CPP with a provincial alternative. The panel’s recommendation emphasized the potential for Alberta, with its youthful population, to contribute a lower percentage while maintaining comparable benefits.

CPP’s most recent annual report, covering the fiscal year ending in March, identified the policy debates in Alberta concerning the potential exit from CPP as one of its associated risks. It’s worth noting that any province contemplating withdrawal from CPP must adhere to specific processes, including written notice, legislation enactment, and asset transfer negotiations. Currently, all Canadian provinces and territories, except Quebec, participate in the CPP Investment Board.

Information for this story was found via Reuters and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

2 Responses

Freeland is against Alberta’s exit from CPP because it is one of Canada’s “crown jewels.”

That is enough for me right there. EXIT. ASAP.

You mean the Alberta with the public sector pension fund that didn’t have enough risk mitigation to avoid a $2B bath on COVID? That Alberta?

https://edmontonjournal.com/news/local-news/aimco-risk-strategy-partly-to-blame-for-nearly-2b-drop-in-value-of-heritage-trust-fund-report-says

Are Albertans just cool with this obvious stab at making a gov’t backed slush fund for oilcos?