On Friday, Silvercorp Metals (TSX: SVM) reported their first quarter of fiscal 2021 with revenue of $46.7 million, up $1.1 million or 2% on a year-over-year basis. Net income came in at $15.5 million, while earnings per share was at $0.09, compared to $12.6 million and $0.07, respectively, a year prior.

Cash flow from operations amounted to $30.1 million for the quarter, with an all-in sustaining cost per ounce of silver of $5.61, down from $5.69 last year. Cash cost net of product credits was -$1.48, compared to -$2.17 in the prior period.

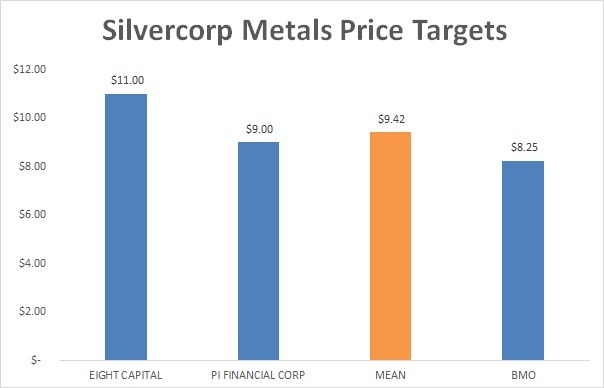

Currently, three analysts are covering Silvercorp Metals. One analyst has a strong buy rating, while the other two have hold ratings on the company. The combined mean 12-month price target is C$8.83 per share or a downside of 10.5%.

Eight Capital has the highest 12-month price target after they raised their target this morning from C$9.25 to C$11.00, while BMO still holds the lowest 12-month price target even after they raised their target from C$6.75 to C$8.25. The last analyst, Justin Stevens from PI Financial, reiterated their 12-month price target of C$9.00 along with their neutral rating.

In PI Financial’s note to investors, Justin Stevens starts by saying, “FQ1/21 Financials Beat, Well Positioned to Benefit from Rising Prices”. Stevens states that this quarter’s free cash flow was significant with both Silvercorp’s assets ramped back up to regular production, and that he expects Silvercorp will be in an excellent position to benefit from the recent metal surge.

Silvercorp beat PI Financial’s estimates, with cash flow per share coming in at $0.13, above estimates of $0.10, and adjusted earnings per share of $0.09 above PI Financial’s estimate of $0.05. PI reiterated their Hold rating and C$9.00 12-month price target on the stock.

Bank of Montreal’s Analyst Ryan Thompson starts their note to investors off by saying “Earnings Beat; Another Solid Quarter of Cash Generation,” meaning that their adjusted earnings per share of $0.09 tripled BMO’s estimates of $0.03 while revenue came in at $46.7 million versus estimates of $42.4 million.

As a result of the earnings beat and the rapid price change in Silver, BMO has upgraded its 12-month price target and 2021/22 revenue estimates. BMO raised its 12-month price target from C$6.75 to C$8.25 while reiterating its hold rating. The firm now forecasts 2021 and 2022 revenue coming in at $166 million and $163 million, respectively, compared to their previous estimates of $161 million and $162 million, while earnings per share are now estimated to be $0.16 and $0.11 for 2021 and 2022.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.