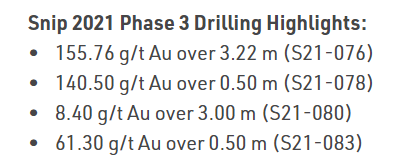

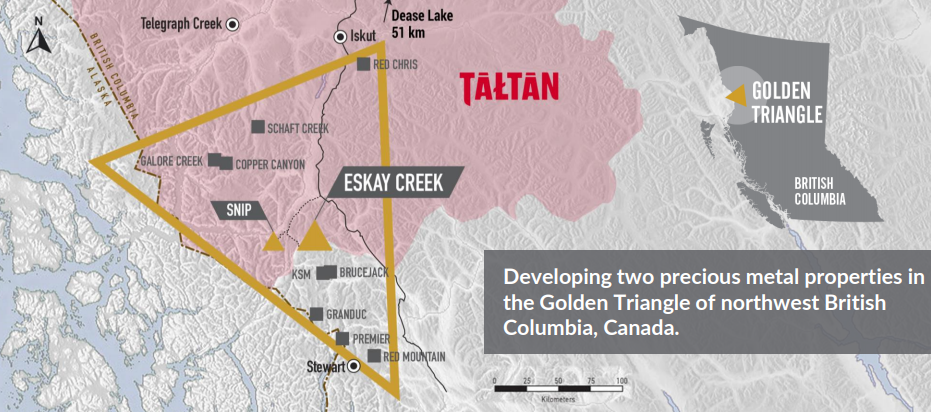

On May 20, Skeena Resources Limited (TSX: SKE) reported impressive assay results from its 2021 Phase 3 drilling program at its Snip gold project. One drill hole intersected 155.76 grams per tonne (g/t) of gold over a 3.22-meter span. The Snip gold mine is a past-producing mine located in the famous Golden Triangle region in northwest British Columbia.

Eskay Creek and Snip Properties

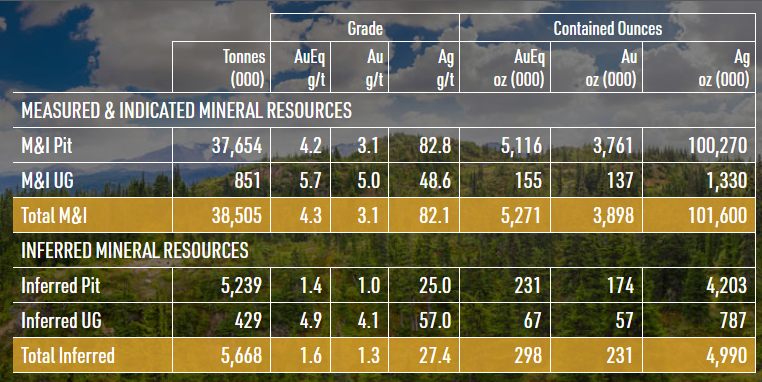

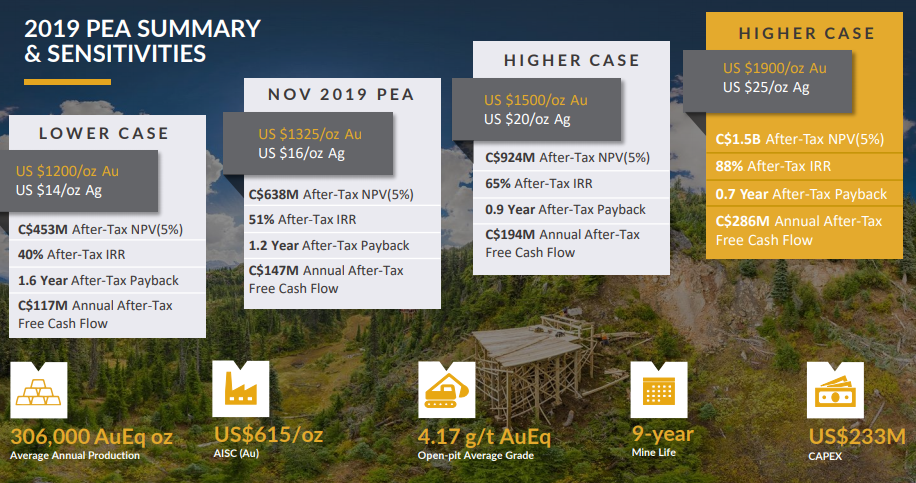

Skeena’s main focus is the development of the past-producing Eskay Creek mine, also located in the Golden Triangle. According to a mineral resource estimate prepared this year, Eskay Creek’s open pit resource contains 5.1 million gold-equivalent (AuEq) ounces at an AuEq grade of 4.2 g/t on a measured and indicated basis. Eskay Creek has a $638 million net present value (NPV) using a conservative gold price assumption of US$1,325 per ounce.

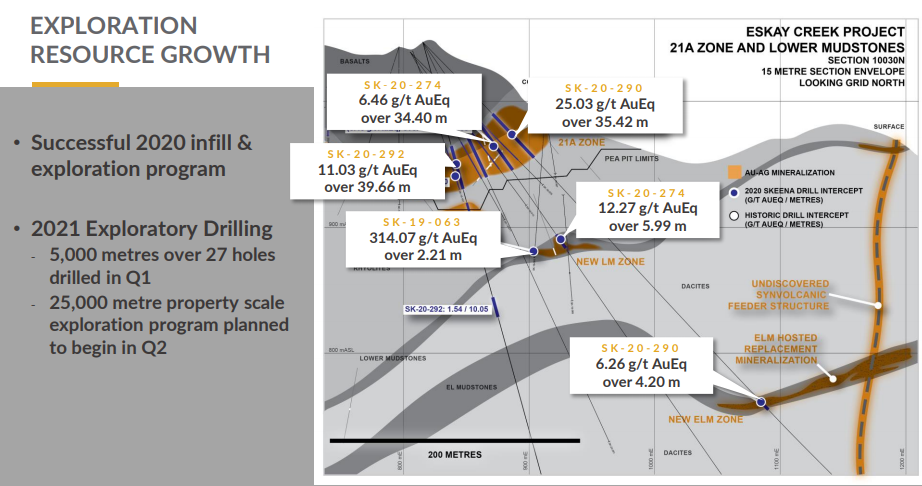

Skeena completed 83,000 meters of infill and exploration drilling programs in 2020. A further 25,000 meters of exploration drilling is planned this year. Skeena hope to complete a feasibility study on Eskay Creek in 1Q 2022.

From 1994 through 2008, Eskay Creek was one of the most impressive high-grade gold and silver mines in recorded history. Over that period, 3.3 million ounces of gold and 160 million ounces of silver were produced at average grades of 45 g/t of gold and 2,224 g/t of silver.

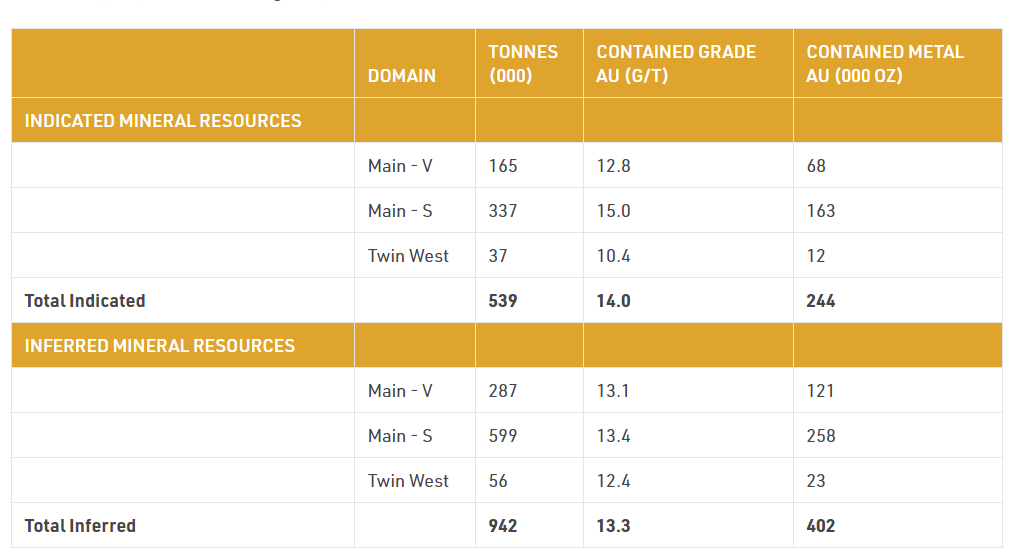

Skeena acquired the Snip mine from Barrick Gold in 2017. It produced about 1 million ounces of gold at an average grade of 27.5 g/t over the period of 1991 – 1999. According to a July 2020 underground constrained mineral resource estimate, Snip contains 244,000 ounces of gold at an average grade of 14 g/t on an indicated basis and a further 402,000 ounces at a 13.3 g/t grade on an inferred basis.

Skeena’s Exploration Spending Has Ramped Up Over the Last Three Quarters

The company’s quarterly operating cash flow deficit exceeded $30 million in both 4Q 2020 and 1Q 2021 as it markedly increased its exploration spending. Skeena’s March 31, 2021 cash balance was $27.6 million, which represents less than one quarter of its recent burn. The company bolstered its balance sheet on May 17 by selling 21 million new shares in a bought deal public offering totaling out at $57.5 million.

| (in thousands of Canadian dollars, except for shares outstanding) | 1Q 2021 | 4Q 2020 | 3Q 2020 | 2Q 2020 | 1Q 2020 |

| Operating Income | ($29,912) | ($36,231) | ($17,883) | ($5,237) | ($5,079) |

| Operating Cash Flow | ($31,928) | ($35,914) | ($16,940) | ($7,085) | ($6,441) |

| Cash | $27,648 | $37,821 | $24,396 | $44,726 | $22,421 |

| Debt – Period End | $2,280 | $2,634 | $2,710 | $1,593 | $1,485 |

| Shares Outstanding (Millions) | 221.3 | 216.7 | 171.7 | 171.4 | 149.2 |

Like many exploration and development stage miners, Skeena is dependent on the quality of its drilling results. If future assay results from its ongoing Eskay Mine drilling program were to be less constructive than they have been, the stock could suffer. In addition, any notable decline in the price of gold could have a similarly negative impact.

Skeena Resources owns two promising properties in the Golden Triangle, both of which were high-grade past-producing mines. Furthermore, the recently completed mineral resource estimates for both Eskay Creek and Snip suggest that substantial quantities of high-grade gold may be able to be mined in the future. As those properties move closer to production, Skeena’s stock may continue its upward trend over the last 18 months.

Skeena Resources Limited last traded at $3.35 on the TSX Exchange.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.