Late this past week, it was announced by Taiga Gold Corp (CSE: TGC) that the company had received notice from that of SSR Mining (TSX: SSRM) that it has met the conditions to acquire a 60% interest in the firms Fisher Gold project. Initially required to spend $4.0 million on the property in exploration, SSR spent nearly two and a half times that on the property during the earn-out period of the option arrangement.

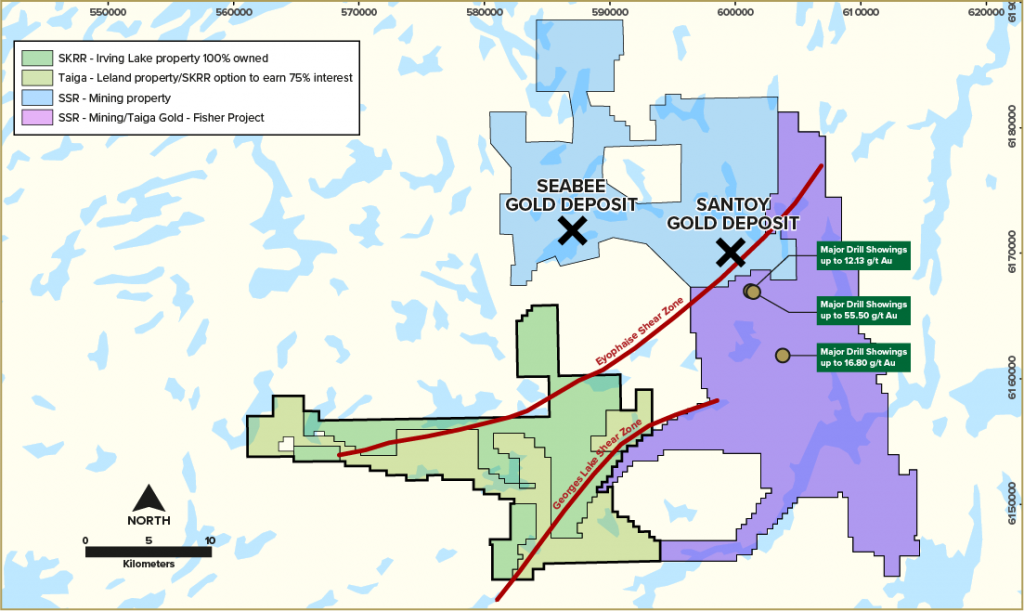

Now, SSR has to elect whether to make a $3.0 million cash payment over the next twelve months to secure a final 20% interest in the property, bringing the total allocation to 80%. The Fisher project is notably contiguous to that of SSR’s Seabee and Santoy mine operation, location in Northern Saskatchewan within the Trans Hudson Corridor.

This year alone, SSR Mining has conducted over 2,000 metres of drilling, under a current 3,800 metre program. Results from the program include discoveries of 13.74 g/t gold over 2.29 metres, 12.13 g/t gold over 1.5 metres, and 9.1 g/t gold over 1.92 metres, with further results remaining outstanding.

The development is notable for current SKRR Exploration (TSXV: SKRR) shareholders for several reasons. First and foremost, the Fisher property is contiguous to that of the firms Irving/Leland property in the region, with Fisher located directly to the east. SKRR currently has an option agreement in place with Taiga Gold, whereby it can earn up to a 75% interest in the Leland property, which borders Fisher. It also has an option agreement in place whereby it can acquire the Irving property, which is intertwined with that of Leland, as can be seen above.

Second, it demonstrates that SSR Mining is looking to expand its presence in the area, in addition to the simple fact that the expenditures demonstrate the firm is confident in the geology of the region. To date, the company has spent over $10 million in exploratory work on the Fisher property, despite being required to only spend $4.0 million to secure the option in the property, indicating that the company is prepared to spend big dollars to keep its operations going. The additional expenditure on the property signals that the firm will likely shell out an addition $3.0 million to secure the larger stake in the property, further reinforcing its interest in the region.

The Irving/Leland property covers a large area of the Pine Lake Greenstone Belt, the same belt that Seabee and Santoy both lay in. The property is said to have much the same attributes as the SSR property, including numerous mineralized showings, large scale structural shear zones, and localized flexures and faults, while lying on trend with the Seabee Gold operation. The Eyophaise Shear Zone, which runs alongside the Santoy deposit, sees itself carry through that of the Irving/Leland property as well.

A fieldwork program at the Leland portion of the property is believed to be currently ongoing, with the company announcing in September that exploration permits had been received for the property. Currently, the permits provide for a UTV trail to be constructed to enable easier access to the property, as well diamond drilling, although the commencement of drilling or details on the potential program have not yet been announced.

Furthermore, the company has indicated that the program will also include detailed prospecting and mapping, infill soil sampling, channel sampling of trenches, and ground truth of electromagnetic anomalies discovered in a 2019 drone survey. Results from this data will be used to push forward with identifying targets for the expected drill program. Previous work on the property has discovered mineralization grading as much as 5.4 g/t gold over 0.65 metres, while historic work has resulted in grab samples registering as high as 32.8 g/t gold.

Having recently completed a $2.4 million flow through private placement, it appears that SKRR is now cashed-up and ready to move on further exploration within the Trans Hudson Corridor, where its focus lies. At the time, funds were stated to be used for the expansion of the Olson drill program, as well as “strategic exploration work” at the Irving/Leland property. Given the recent developments from that of SSR Mining and Taiga Gold right next door, further development of the Irving/Leland property would not be outside the realm of possibilities.

FULL DISCLOSURE: SKRR Exploration is a client of Canacom Group, the parent company of The Deep Dive. The company has been compensated to cover SKRR Exploration on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.