SLANG Worldwide (CSE: SLNG) announced their second-quarter financials yesterday, with revenue coming in at $4.6 million, basically flat quarter over quarter, and their Pro-forma revenues were $10.1 million. Slang also had an adjusted EBITDA loss of $1.8 million, with gross margins of $2.8 million or 62%.

Only three analysts cover SLANG, and all three analysts have buy ratings on the stock. M Partners has the highest 12-month price target of C$0.5,0 or a 285% upside, while Clarus Securities has a C$0.45 price target, and Canaccord has the lowest of all three with a C$0.40 target. The mean price target equals out to being C$0.45, or a 246% upside on the stock.

In Canaccord’s note to investors this morning, Bobby Burleson commented, “cost-cutting paying off ahead of 2H ramp.” Burleson reiterated his C$0.40 price target and a speculative buy rating on SLANG. He also says that they expect the conditions to improve late into the second quarter and continue for the year. He states that Colorado and Oregon’s recent regulatory decisions, “clear some hurdles for SLNG in completing these acquisitions.” Burleson also says that while their core markets are growing, the decision to do asset-light partnerships in non-core markets complement each other very nicely.

Onto Canaccord’s estimates, SLANG’s revenue was in line with their $4 million estimate for the quarter. Still, the surprise came with a solid beat for adjusted EBITDA, which was estimated to be a loss of $3.1 million but was just a little over half of that. Management noted that in June alone, the demand in SLANG’s core markets was up 130% and 4x the April levels, which Burleson expects to improve further throughout the summer. Burleson also says that “cost-cutting initiatives put in place in late 2019 and early 2020 continued to bear fruit for the company in the quarter,” and expects quarter over quarter top-line growth to start happening in the second half of this year.

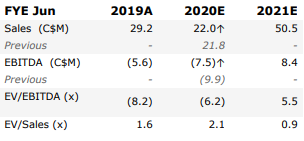

Although Canaccord did not raise their price target or rating they did slightly change their revenue and EBITDA estimates for the year. The firm now estimates that revenue and EBITDA will be $22 million and ($7.5) million, respectively, up slightly from their $21.8 million and (9.9) million estimates prior.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.