Snap Inc. (NYSE: SNAP) this morning reported its second quarter financial results. The company announced that revenues grew only 13% on a year-over-year basis to $1.11 billion, while all other underlying results deteriorated on a year-over-year basis.

The company reported an operating loss of $400.9 million, doubling the loss from last year, while net losses came in at $422 million, close to tripling the net loss it reported last year.

Adjusted EBITDA came in at $7.19 million, decreasing 94% on a year-over-year basis, and free cash flow dropped 27% to ($147.45) million.

The company also said its daily active users grew 18% year over year to 347 million users and increased in North America, Europe, and Rest of World.

Snap then announced that it would commence a $500 million stock repurchase program, saying that the goal of the program is to, “utilize the company’s strong balance sheet to offset a portion of the dilution related to the issuance of restricted stock units to employees as part of the overall compensation program designed to foster an ownership culture.”

Lastly, the company decided not to provide guidance for its third quarter financial results due to “uncertainties related to the operating environment.”

A number of analysts came out and slashed their 12-month price target on Snap, bringing the average price target down from $31 to $20 overnight. There are currently 44 analysts covering the stock; 8 have strong buy ratings, 14 have buys, 20 have hold ratings, and the last two analysts have sell ratings on the stock. The street high price target currently sits at $67.

In Canaccord Genuity Capital Markets’ note on the results, they reiterate their hold rating but slash their 12-month price target down to $16 from $20, saying that the macro environment and targeting headwinds fueled the missed results.

Canaccord notes that growth has decelerated throughout the quarter across both brand and direct response advertisers due to a number of headwinds such as privacy changes, weakening macro, and increased competition. They add that, “headwinds have worsened over recent weeks, and revenue has been flat y/y QTD.”

With the results and the management commentary, Canaccord believes that all expectations for the coming quarters have been reset.

On the results, which missed a number of Canaccord’s estimates, they say that revenue was the largest miss as it even missed even the lowered estimates. Though the company’s adjusted EBITDA of $7.2 million was above their estimate of $5.3 million.

The daily active user gains slightly beat Canaccord’s estimate by 1%, and in a pocket of hope, Snap’s short-form video saw its monthly active user base grow by 46% year over year while time spent watching grew 59% year over year.

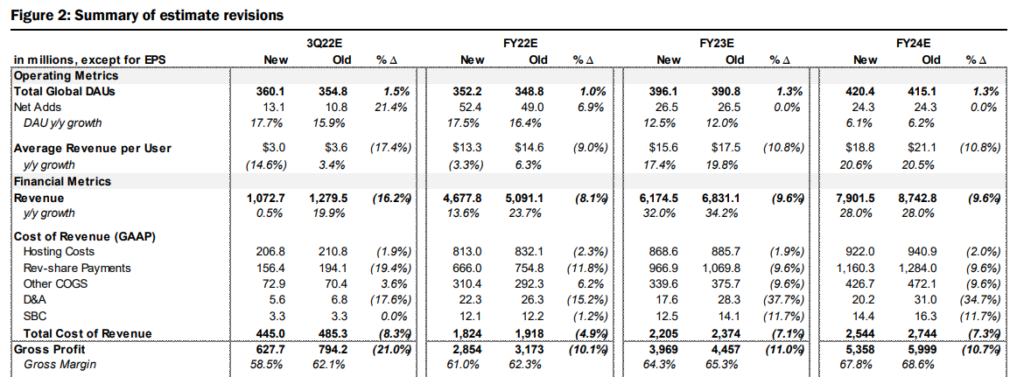

Below you can see Canaccord’s updated estimates.