On November 18, Manitoba-based Snow Lake Resources Ltd. (NASDAQ: LITM) issued 3.2 million shares in an IPO led by ThinkEquity at a price of US$7.50 per share. The company hopes to develop the first renewable energy-powered mine that can produce battery grade lithium.

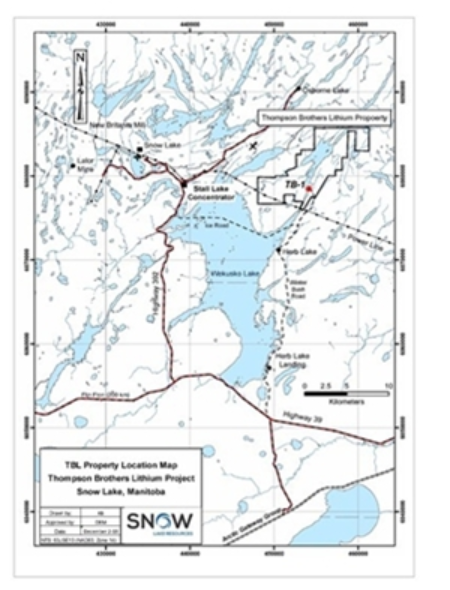

Snow Lake’s planned Thompson Brothers Lithium Project encompasses 13,828 acres about 20 kilometers east of Snow Lake, Manitoba, which is generally considered a mining-friendly jurisdiction.

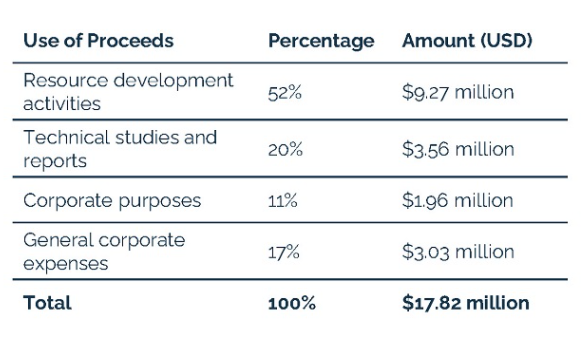

While Snow Lake’s business plan touches on some of the hottest buzzwords in the investing world today – battery grade lithium and renewable energy – and a gigantic volume of 24.6 million of its shares, or 125% of fully diluted shares outstanding, traded on November 19, we urge investors to exercise caution on Snow Lake stock. Admittedly, lithium stands to be in great demand in the battery cathodes of electric vehicles (EVs) for many years to come, and the cash proceeds from the IPO will allow the company to engage in necessary resource development activities and complete technical studies.

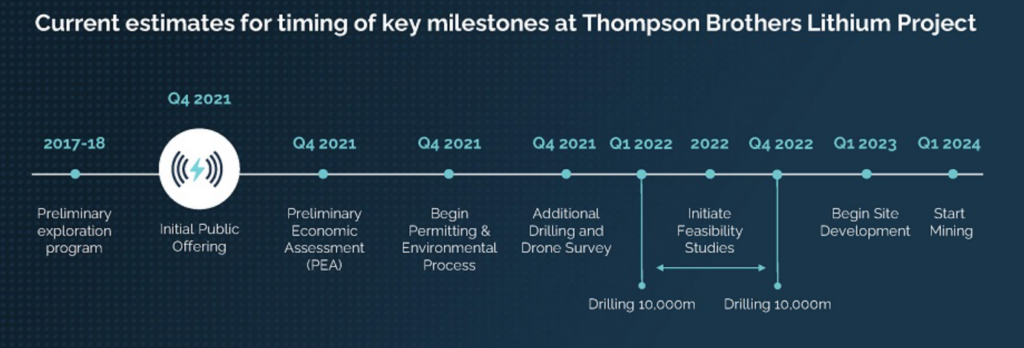

However, the company does not plan to begin mining activities until 1Q 2024, around 2 ½ years from now. Investors who are bullish on lithium’s prospects may want to focus on companies poised to begin production in the nearer term. Moreover, a substantial amount of work must be accomplished over the next 30 months in order for mining — and cash flow — to commence.

A Preliminary Economic Assessment is nearing completion, but permitting and environmental studies must also be finished, as well as at least 20,000 meters of drilling, during that time.

After factoring in the total 3.68 million shares sold in the offering, Snow Lake’s fully diluted shares outstanding are about 19.4 million. (On November 24, IPO underwriters exercised their full 480,000-share overallotment option.). At Snow Lake’s current share price of US$6.49, the company’s stock market capitalization is around US$126 million, and its enterprise value is roughly US$99 million. Snow Lake’s enterprise value reflects pro forma net cash of around US$27 million from the IPO.

An Australian-based company, Nova Minerals Limited (OTC: NVAAF), will own about a 60% stake in Snow Lake after the IPO share issuance, down from 74% pre-IPO. Snow Lake management owns around 8% of current fully diluted shares.

It is of course possible that Snow Lake’s Thompson Brothers project proves to be a huge find and that both the permitting and ultimately the mining processes proceed more smoothly and quickly than expected. In that case, the stock could perform well over the longer term.

Snowflake appears to check many boxes that have investors’ intense attention: anything related to electric vehicles (EV) and renewable energy. Nevertheless, no cash flow seems likely for at least 2 ½ years. It seems to us that investors’ current available capital might be better channeled to EV-related companies that could generate cash in the nearer term.

Snow Lake Resources Ltd. last traded at US$6.49 on the NASDAQ.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.