Spruce Ridge Resources (TSXV: SHL) as of late has been trading relatively flat, staying within a confined range of $0.07 to $0.09, with momentary spikes of volume occurring over the last few months. This pattern has been prevalent since the end of July, when the company had a spike in activity following a hard run-up that occurred in one of its investee companies.

That company, Canada Nickel Company (TSXV: CNC), went on a massive run as we previously reported thanks in part to a rumour related to certain potential production partners. The rumour had taken the firm from a low of $1.04, to the heights of a cool $3.00. While the excitement has somewhat dissipated from Canada Nickel, it was effective at essentially “re-rating” the value of the stock.

Currently sitting at $1.85 per share, Canada Nickel has managed to tack on roughly three quarters of a dollar to its valuation as a function of this rumour, which has managed to provide significant value for shareholders. Despite this change in valuation for the company however, it seems that Spruce Ridge has seen little benefit from the re-rate, despite the investment it holds in the company.

Presently, Spruce Ridge holds a position of 8,100,000 common shares in the company, following the sale of one of its assets to the firm back in February. Also included in the transaction was 10,000,000 common shares of Noble Mineral Exploration (TSXV: NOB), which also currently provides some value to the company, even if not as significantly.

The full chart of Spruce Ridge’s investment holdings can be seen below.

| Company | Holdings | Price Per Share (As of October 16) | Value (As of October 16) |

|---|---|---|---|

| Canada Nickel Company | 8,100,000 | $1.85 | $14,985,000 |

| Noble Mineral Exploration | 10,000,000 | $0.08 | $800,000 |

| Total | $15,785,000 |

The value of Spruce Ridge’s investment in other publicly traded firms is interesting, if solely for the fact that it is higher than the current market capitalization of Spruce Ridge, which currently sits at $12.09 million – representing a 24% discount to the value of the assets.

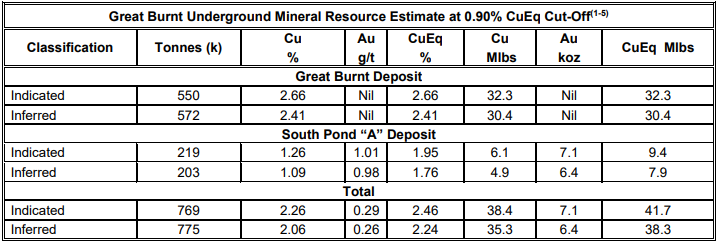

This discount also assumes that the property assets held by Spruce Ridge is effectively $0.00, which simply seems unrealistic given that the Great Burnt Copper-Gold Project currently has a 43-101 compliant resource estimate. The estimate, conducted in 2018, provides for total indicated resources of 38.4 million pounds of copper at 2.26% per tonne, as well as 7,100 ounces of gold at 0.29 g/t. Inferred resources for the project are pegged at 35.3 million pounds of copper at 2.06% per tonne, as well as 6,400 ounces of gold at 0.26 g/t.

Drilling is also currently ongoing at the property, with Spruce Ridge announcing that it had begun a 3,500 metre drill program on September 18. Highlight results from the previous campaign included 20.94 metres of 6.21% copper, including 6.98 metres of 10.71% copper. The current program is focused on increasing the mineral resource estimate, while the company looks to also upgrade inferred resources to that of indicated.

Further, Spruce Ridge has indicated its intent to carry out preliminary metallurgical testing on drill cores that have been archived to work towards completing a preliminary economic assessment (PEA), which will determine the viability of mining the deposit.

The result of this, is that the company at present appears that it might be currently valued lower than the sum of its parts. While not investment advice, (we hold no licenses) the exercise has proven interesting at the very least.

Spruce Ridge Resources last traded at $0.09 on the TSX Venture, with a market capitalization of $12.09 million.

FULL DISCLOSURE: Spruce Ridge Resources is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Spruce Ridge Resources on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.