On August 2, a Sunday, Square Inc (NYSE: SQ) announced that they would be acquiring Afterpay for A$39 billion or roughly $29 billion in an all-stock deal. Afterpay shareholders will receive 0.375 shares of Square per share of Afterpay and Square has the option to pay 1% of the total consideration in cash. The deal is expected to close in the first quarter of 2022. With this, Square will list its shares on the Australian Securities Exchange. Square ended the Monday session up almost 10%.

Afterpay is a “buy now, pay later” company that has 16.2 million active customers, of which 10.5 million customers are in North America, and 98,200 active merchants on their platform. The company did A$925 million, about $693 million, in revenue for the 2021 year, almost double from the $347 million recorded in 2019. Gross Merchant Volume (GMV) was $15.8 billion, up from $7.4 billion last year.

Analysts seem to generally like the deal, with many raising their 12-month price targets. The average now sits at $290, up from $277.65 last month. The street high sits at $380, while the lowest sits at $175 from BNP Paribas. Square has 49 analysts covering the stock, with 10 analysts having strong buy ratings, 22 have buy ratings, 14 have hold ratings and 3 analysts have sell ratings on the stock.

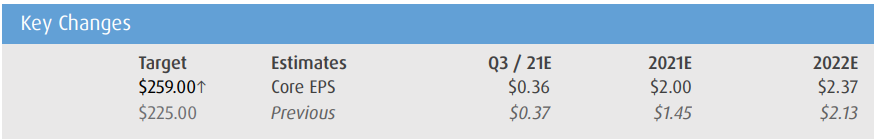

BMO Capital Markets was one of the investment banks to raise their 12-month price target to $259 from $225 and reiterated their Market Perform rating. They say that the acquisition, “accelerates SQ’s BNPL scale, provides cross-selling opportunities, and expands customer and geography footprints,” but at the same time comment that the price paid seems rich, as the deal values Afterpay at 200x 2 year forward P/E. They add, “we estimate investors are paying $60 per share (30% premium) for (unquantified) ecosystem synergies.”

BMO believes that the deal will become EPS accretive after one year as Square provides cross-selling opportunities and expands its footprint. But, Square did not quantify any of these synergies to help explain the benefits of the transaction.

BMO is raising its estimates due to faster than expected growth. They are raising their full year 2021 core-EPS by 38%, 2022 EPS by 11%, and 2023 EPS by 15% due to “higher than previously-modeled revenues offsetting even higher expected investments.” Below you can see the estimate changes.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.