On Tuesday, SSR Mining (TSX: SSRM) reported its first quarter financial results for 2022. The company reported revenues of $355.45 million, a decline of 3% year over year. While gross profits also dropped 5% year over year to $143.18 million.

The company did not escape inflation, seeing its selling, general and administrative costs grow 52% year over year and total expenses grew 10%. This dropped SSR Mining’s operating profit by around 12% to $107.92 million. The company also saw its net income drop from $129.18 million to $76.1 million, for earnings per share of $0.31.

On the production results, the company said it produced 157,010 ounces of gold this quarter and sold 157,179 ounces. The company also indicated it produced 1,303,000 ounces of silver, 7,303,000 pounds of lead, and 1,843,000 pounds of zinc. This puts the gold equivalent ounces produced at 173,675 ounces, compared to the 196,094 it said it produced last year. The company sold 179,692 gold equivalent ounces.

Gold was sold at an average price of $1,880 per ounce, while they sold silver at $23.85 per ounce. Cash cost per equivalent ounce was $775 while their all-in sustaining cost was $1,093, both costs were up from a year ago.

SSR Mining currently has 3 analysts covering the stock with an average 12-month price target of US$30, or an upside of 38%. All 3 analysts have buy ratings and the street high sits at US$32, or a 47% upside to the current stock price.

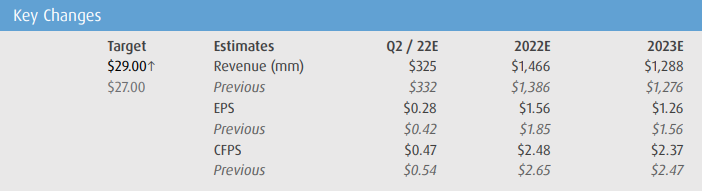

In BMO capital Markets’ note on the results, they reiterate their outperform rating and raise their 12-month price target to US$29 from US$27, saying that the better-than-expected results at Seabee offset the slow start at Marigold.

On the results, BMO says that the results generally came in line with their estimates outside Marigold, which had a weaker-than-expected quarter. Though they remain bullish as the company reiterated its full-year production guidance. The company reported an adjusted EPS of $0.31, which came in lower than BMO’s $0.37 EPS estimate. While cash flow from operations came in at $62 million, below their $91 million estimates.

On the production results, the company beat total gold and silver ounces produced, with BMO estimating that SSR Mining would produce 143,200 ounces of gold and 1,940,000 ounces of silver. Specifically, Çöpler and Seabee beat estimates while Marigold and Puna came in materially below estimates.

On the slow start at Marigold, BMO says that the production results coming below their estimate was due to mine scheduling and an increase in heap leach inventory.

Below you can see BMO’s updated estimates on SSR Mining.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.