St Augustine Gold and Copper (TSX: SAU) has updated the results of a preliminary feasibility study for their flagship Kingking copper-gold project in the Philippines. The update is said to allow the company to begin work on a definitive study and expedite the start of construction.

The revised PFS has identified that Kingking currently has an after-tax net present value of $4.18 billion alongside an internal rate of return of 34.2%. The estimate, conducted at $4.30 a pound copper and $2,150 gold, comes alongside an estimate payback period of just 1.9 years. The estimate is based on a 7% discount rate.

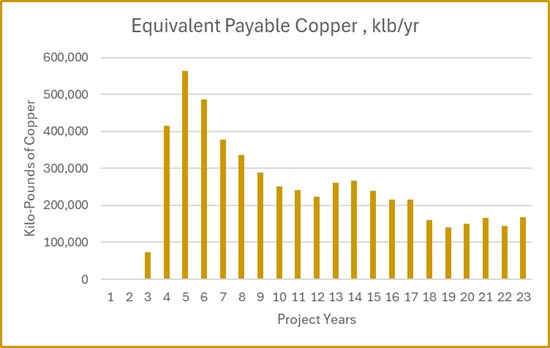

That net present value figure is based on a project life of mine of 38 years, with Kingking forecast to produce on average 185,828 ounces of gold a year and 54,265 tonnes of copper (119.6 million pounds), with all of that metal to come from an open pit. In terms of copper equivalent, the operation is expected to produce 96,411 tonnes of copper equivalent (212.5 million pounds) annually.

That production estimate is weighted heavily to the front side of production however, with the first five years of operation expected to average 129,000 tonnes of copper (284 million pounds) and 333,000 ounces of gold.

That estimate is based on an estimated 100,000 tonnes of ore being delivered annually, with 40,000 tonnes set to go to heap leach processing, while 60,000 tonnes will be sent to a mill. The current mine plan expects mining to occur for 31 years, followed by seven years of stockpiled ore being processed.

In terms of costing, initial capital is estimated at $2.37 billion, while sustaining capital is pegged at $798 million. Over the life of mine, C1 costs are estimated at $2.06 per pound of copper equivalent, while C1 costs net of by products are pegged at just $0.32 per pound.

As for permitting, Kingking is required to reobtain a mineral processing permit that had previously lapsed as a result of a ban on open pit mining that went into force in 2017 in the Philippines and was subsequently lifted in 2021. St Augustine is said to be actively working towards obtaining a renew on the permit.

St Augustine Gold and Copper last traded at $0.495 on the TSX.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.