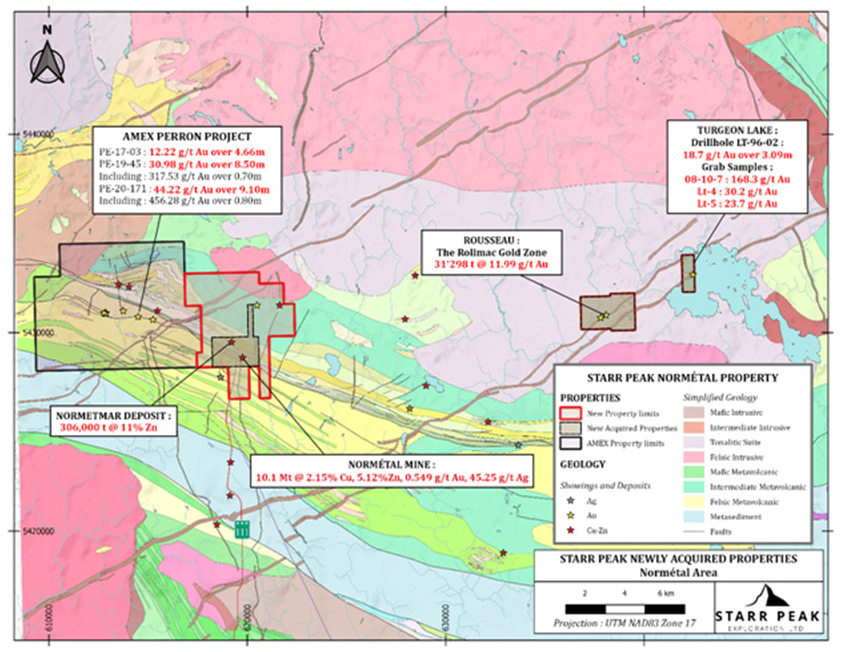

Starr Peak Exploration (TSXV:STE) caught our attention recently when on December 9, 2020, it announced gold assay results from grab samples gathered in September 2020 from their Rousseau and Turgeon Lake gold properties in the prolific Abitibi Greenstone Belt in Quebec, Canada. The Rousseau Property consists of 12 claims and covers 470.17 hectares, while Turgeon Lake consists of 2 claims covering 112.91 hectares. The Turgeon Lake results, which included grades of 157 g/t, 31.6 g/t, and 9.77 g/t gold, were similar to results from historical grab samples from the property.

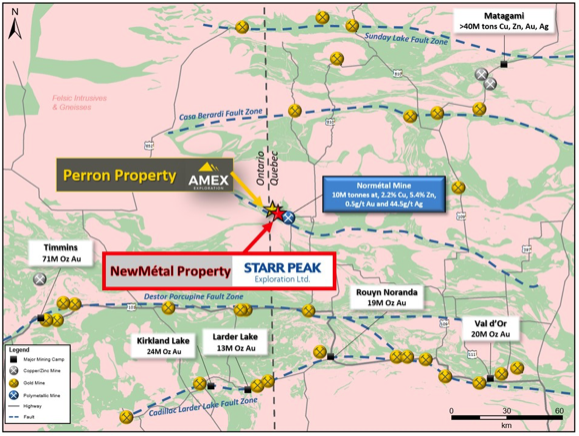

What makes Starr Peak compelling is that their NewMetal land package, consisting of 74 mineral claims covering 2279.53 hectares, is located 115 km north of the town of Rouyn-Noranda. It borders on the eastern side of Amex Exploration’s (TSXV: AMX) flagship Perron Project, a high-grade gold discovery that is on trend towards Starr Peak’s property. Like the Perron, the NewMetal property is fully accessible by road year-round and has abundant access to water and power.

Recent drilling by Amex has indicated that the gold grades have been improving as they have been drilling closer to the eastern edge of the Perron property and that the mineralized zone has also been widening, which portends well for the prospects of the NewMetal property, as it is expected that the mineralized zone extends well into it.

The Abitibi area is well known for its polymetallic VMS (volcanogenic massive sulfide) geology and also contains orogenic gold quartz vein systems. Until recent years, geologists had largely ignored the gold showings because of low gold prices when the area was being actively explored and focused primarily on copper, silver, zinc and other base metals common to the region.

Higher gold prices over the past 20 years however resulted in much more active gold exploration, which is considered to be relatively low risk due to the presence of gold bearing mineralization throughout the area. The past -producing Normetal mine is contained within the NewMetal property, supporting the old adage that the best place to look for a new mine is near an existing mine.

For gold exploration investors, Starr Peak bears watching. The company is well funded and will continue its exploration programs throughout the winter so there will likely be a steady flow of news from the project. Equally importantly, Amex is also continuing its winter exploration programs and their results could have a direct impact on the prospects for the NewMetal project because Starr Peak management expects that the Perron deposit trends well into NewMetal.

The Company has 33.38 million shares outstanding, 35% of which are owned by management and insiders, and a market capitalization of $61.08 million. Due to its location within the Abitibi Greenstone belt, Starr Peak appears to offer a reasonable risk exposure to the Abitibi region in general, but due to its bordering on the Perron property, the upside potential could be quite significant. A major discovery on the NewMetal property could signal that the Amex/Starr Peak properties could contain a potentially economic gold mine, making these projects attractive takeover targets for a large gold producer.

FULL DISCLOSURE: Starr Peak Exploration is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Starr Peak Exploration on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.