FULL DISCLOSURE: The Deep Dive is long the equity of Steadright Critical Minerals.

Steadright Critical Minerals (CSE: SCM) is pushing forward with exploration at the historic Goundafa Mine, a copper-lead-zinc-silver-gold mine which the company recently entered into an MOU to acquire.

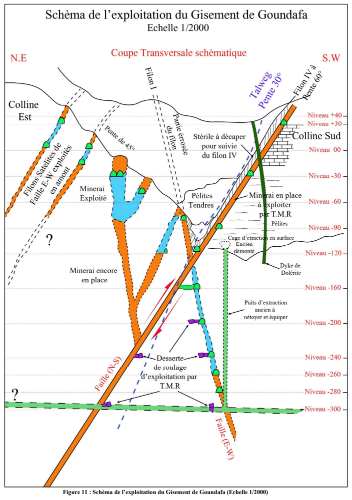

Exploration of the historic mine is set to commence in December and continue through early 2026, with Steadright indicating that they intend to undertake a phased targeted drilling campaign. Initial exploration under the program is set to consist of surface mapping and drilling as part of an effort to confirm potential resources within Vein I, which is adjacent to the historic mining areas.

Vein I of the Goundafa Mine was historically mined from 1926 to 1956, producing 320,000 tonnes of ore grading in excess of 400 g/t silver. The property itself meanwhile has conceptual resources of up to 6.62 million tons grading 2.1% zinc, 1.8% lead, 1.5% to 2.1% copper and up to 3.5 g/t gold in select zones.

Phase two of exploration meanwhile calls for geophysics to be conducted alongside further drilling and mapping, which will be utilized to delineate Vein 1, Vein II and Vein IV along interpreted extensions laterally and at depth.

The current development plan for the mine calls for a near-term resource to be established within proximity to the mine access points, which could be available for early production.

READ: Steadright Enters MOU To Acquire Historic Goundafa Polymetallic Mine In Morocco

“Steadright’s North Star is the thesis that we can best serve our shareholders by acquiring assets which have clearly achievable near-term production – and then moving to the revenue stage as quickly as possible. I am very pleased with our execution so far and think we are on target to hit our goals. We strongly commend our Moroccan team and all the levels of government helping make this possible,” commented Steadright CEO Matt Lewis.

Separately, Steadright confirmed this morning that it is still proceeding with a preliminary economic assessment at their TitanBeach Heavy Mineral Sands project, which is also found in Morocco. The PEA is expected to guide the company forward in terms of processing options, with refining schematics currently under review for sand processing.

The company is scheduled to meet with officials in November to establish plans for both mining and environmental license applications.

Steadright Critical Minerals last traded at $0.275 on the CSE.

FULL DISCLOSURE: Steadright Critical Minerals is a long investment of Canacom Group, the parent company of The Deep Dive. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.