FULL DISCLOSURE: Goliath Resources is a sponsor of theDeepDive.ca.

A “Surebet” lands Goliath Resources (TSXV: GOT) in Stifel’s initiated coverage of the miner with a Buy rating and a $5.00 target price, which implies about 89% upside to the October 31 close at $2.65.

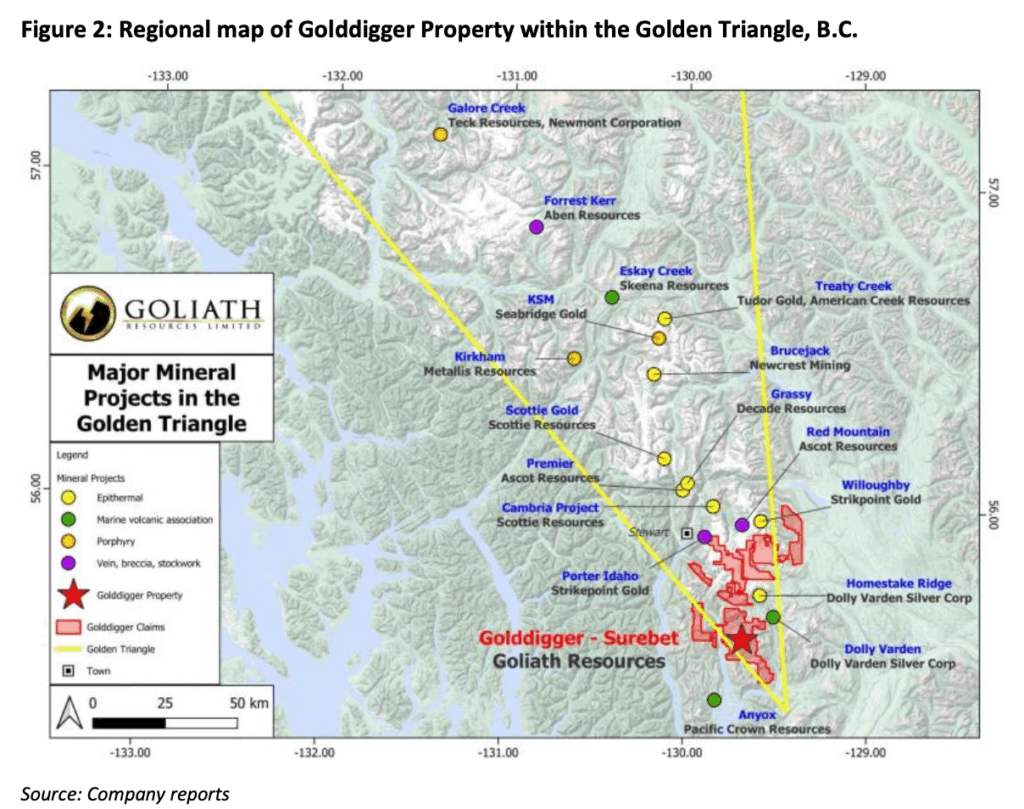

The firm applies a 0.55 times P/NAV multiple to its model and anchors the call on a potential multimillion-ounce, high-grade discovery at the Surebet deposit in British Columbia’s Golden Triangle.

Stifel frames Surebet as a rare early-stage outlier on drilling quality and consistency. Over five field seasons Goliath drilled more than 152 kilometres on the discovery with a 100% gold hit rate. Of the top 250 assay intervals reported by North American gold explorers since 2020, Surebet accounts for 18, including two of the top five by gram-metre. Stifel also notes Surebet’s first 150 holes are comparable on gram-metres to Great Bear’s Dixie before Kinross acquired it in 2022.

The investment bank highlights a practical advantage for any eventual development. Mineralization sits less than 10 km from tidewater at Hastings Arm and under 30 km from the purpose-built mining town of Kitsault, which retains power, seasonal road access, lodging for more than 1,000, and deep-water access potential.

On ounces and valuation, Stifel’s preliminary inventory analysis points to a 4.3 million ounce exploration target at 5.8 g/t gold, concentrated largely in the Surebet and Bonanza zones. Using that framework, the firm sees Goliath trading at about $68 per in-situ ounce, or 1.7% of in-situ value, and $12 per ounce on a grade-adjusted basis. That compares to transaction references of roughly 16.1% in-situ value for Kinross–Great Bear and 15.2% for Goldfields–Osisko Mining.

Stifel’s mine plan model envisions a 4 ktpd underground operation averaging 205,000 ounces of gold per year over an 11-year life with an AISC of US$1,258 per ounce. The firm assumes US$815 million in initial capital and, at a long-term US$3,000 per ounce gold price, calculates an after-tax NPV5 of US$1.47 billion at the asset level and average free cash flow of about US$320 million per year.

Goliath completed its 2025 program with more than 64,000 metres in 110 holes and a 100% hit rate, with assays pending for a large block of holes. Stifel emphasized the quality of reported intercepts: for instance, hole GD-24-260 in the Bonanza zone, which intersected 38.9 metres at 34.47 g/t gold. The firm argues that weighted average grades near 5.9 g/t and widths around 8.8 metres have stayed consistent as drilling stepped out, supporting potential mineable widths and dilution control.

Key trading and balance-sheet markers from Stifel’s summary support the call’s risk framing. As of October 31, 2025 the share price was $2.65 within a 52-week range of $0.95 to $4.00. Market capitalization was $461.1 million, enterprise value was $287.1 million, cash was $19 million, and there was no debt, for net cash of $19 million.

Stifel shows Price to NAV at 0.30 times, NAV per share at $6.27, and a target multiple of 0.55 times. Fiscal 2025 and 2026 production estimates are zero, with negative CFPS and EPS reflecting exploration status.

The firm’s narrative rests on catalysts into 2026. Stifel expects releases from the remaining 2025 assays and a fully funded 2026 program of about 40 km focused on infill and step-outs. The report suggests an initial resource is expected within 24 months, which would be a major de-risking event if grades and widths hold.

FULL DISCLOSURE: Goliath Resources Limited is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of Goliath Resources Limited. The author has been compensated to cover Goliath Resources Limited on The Deep Dive, with The Deep Dive having full editorial control. This is not a recommendation to buy or sell. We may buy or sell securities of the company at any time. Always do additional research and consult a professional before purchasing a security.