As detailed in our Sunday “Storycraft” post, The Deep Dive remains of the opinion that story stocks are at their best when the story is easy to tell and makes sense as a business. Since those two elements are difficult to find in the same place, we sometimes focus on the neat stories with holes in them, like Earthrenew (CSE:ERTH), whose plan is to literally sell bullshit.

The ERTH promotion appears to have begun in earnest this past June, but never really moved all that much paper. The stock has traded sideways for most of August on miserable volume as it’s cast about looking for true believers in their vision to develop a process that turns livestock waste into fertilizer.

We aren’t going to count the oxymoronic notion of industrialized permaculture out completely in a market-driven by the appeal of well-presented dreams, but we are going to laugh out loud at its prospects as a functional commercial business.

The development-stage company is working at a site in Strahtmore, AB to develop a process that treats cow turds to produce a pelletized fertilizer product that the company hopes will prove valuable to the fertilizer market.

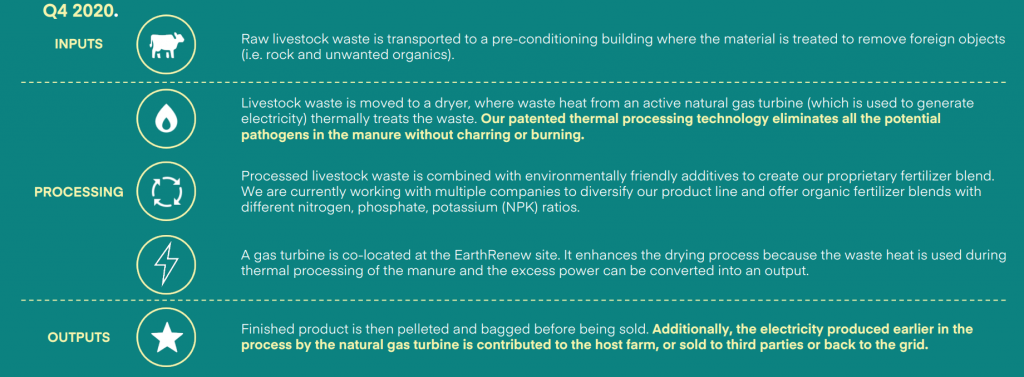

The investor deck lists the only input as “raw livestock waste” that has been treated to remove foreign objects, and continues to describe its processing in a natural gas-fired turbine that produces surplus electricity that could be sold back to the grid or used on site. ERTH shows $145,000 in income from electricity sales in Q1’20, for a gross profit of $80,000 that betrays what this company is at its core – a natural gas-fired power utility.

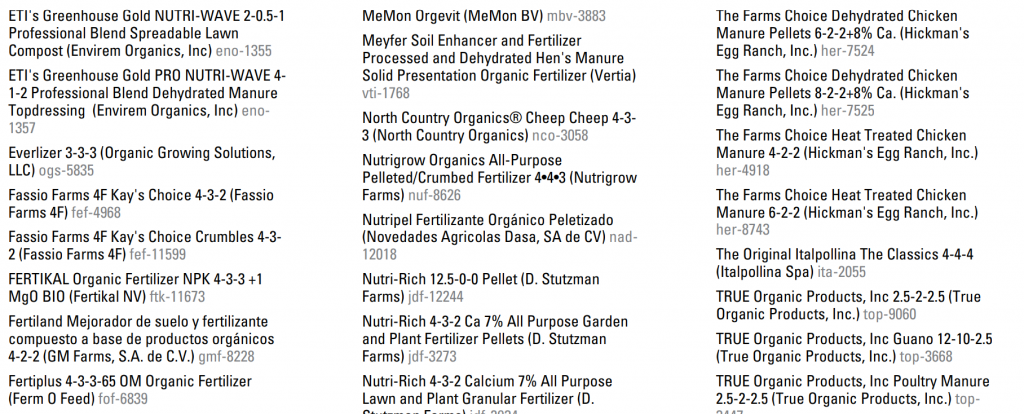

Pelletized animal manure itself isn’t an innovation. The processing of animal waste is necessary if it is to be used as a fertilizer blend at certified organic farms. Unprocessed manure blends can only be applied 90-120 days before harvest (depending on what’s being grown), or put on crops that aren’t meant for human consumption for their use to be consistent with organic growing standards.

The Organic Materials Review Institute (OMRI), official keeper of the list of organic agriculture products, presently lists several dozen available processed manure products, all of which are sold by what appear to be small, niche producers. Apart from Earthrenew, we couldn’t find any public companies among them. Many are side businesses attached to farming operations, who seem most interested in the backyard garden market.

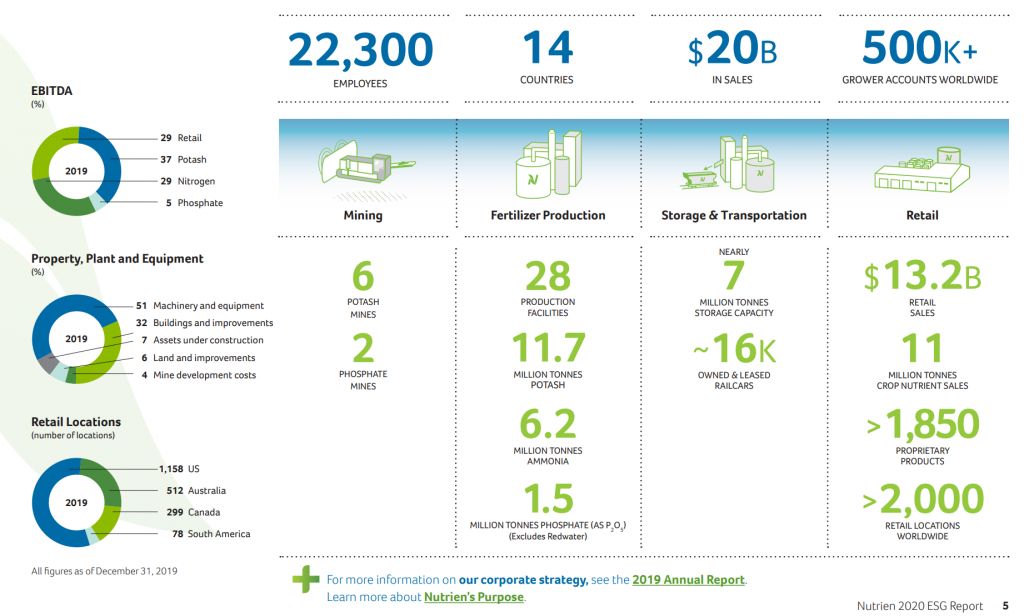

Those companies, most of whom are already shipping product to established pipelines, appear to be competing for the business of home gardens and whichever organic farms still use animal waste as fertilizer the way farmers did centuries ago. Any industrial operations enrich the dirt with fertilizer blends of nitrogen and potash that have been made in a lab by enormous international conglomerates like Nutrien LTD. (TSX:NTR), the product of a merger between Potash Corp and Agrium. Companies like Nutrien and Abermarle mine the raw materials required to fertilize plants, then provide them by the ton to industrial farming and to companies like ScottsMiracle-Gro (NYSE:SMG) for further processing and piecemeal distribution to consumers. Miracle-Gro products also appear on the OMRI list of acceptable organic fertilizers, because the use of commercial fertilizer is allowed by most commercial organic certifiers.

The notion that modern industrial fertilizer suppliers could ever be disrupted by the very medium they replaced seems far fetched, and competing in an ostensibly small pelletized manure market that’s already full of first movers seems difficult.

Ever the story stock, Earthrenew, is maximizing its exposure to stunts by co-locating with a cryptocurrency mining operation. Since the exposure to cyrpto is indirect, it’s fair to call this company a small-batch (4 Mw/h) power generation operation with a sensitivity to the price of natural gas, and a plan to revolutionize fertilizer.

The same investor deck that failed to recognize natural gas as an input lists ERTH as having 49 million shares, but the March 2020 financials show more than 133 million outstanding shares, having been printed before a 1:3 rollback undertaken this past June. Earthrenew was formerly Valencia Ventures, which has been moving sideways without volume or relevance since being released from a year-long halt in January of 2019. Prior to that same halt, the company plodded along with vague intentions of making an asset acquisition in the resource industry, various related stops and starts, and literally no tangible business.

The going rate pre-rollback, the last time this company was raising money in 2016 and 2017 was between $0.32 and $0.46 (adjusted for the rollback), so the sideways, anemic reaction tracks. It’s a base of shareholders who have been ignoring their positions and expecting very little out of them for for quite a while.

The rollback and financing gave ERTH a bit of a kick in the side and caused volume to pick up, but it’s still trading an average 110,000 shares per day on the CSE as the organic fertilizer/power/crypto pitch is met by this market with a resounding, “yeah, sure. whatever”

2 Responses

Thanks for reading, Matt.

Erosion, the hardening of soil, and the over-salting of fertilized and irrigated soil are indeed fertilizer-related problems faced by modern agriculture. The larger producers have seen more growth in sulphate of potash (SOP) than Muriate of potash (MOP) in recent years, partly as a result of farmers addressing ongoing soil issues. Everything is very crop specific and there are different blends available for different purposes from all fertilizer producers of all sizes in response to consumer demand. Farmers tend to be more careful with soil that’s hardening up, and prioritize yield in soil that’s good and loose… what I’m saying is: there are a lot of moving parts. Accordingly, the large fertilizer companies have teams to address those consumer needs, labs to create new, custom blends as required, and a sales infrastructure capable of getting those blends sold. Surely, there’s a place for organic fertilizer – companies are already selling it. But it would surprise me to learn that it could punch in the big leagues.

As far as offtake agreements go, there’s a Feb ’19 presser about negotiations for POWER offtake agreements, but I don’t see anything in the company literature about fertilizer offtakes.

https://www.earthrenew.ca/news-releases/02-01-2019-earthrenew-launches-program-to-restart-electricity-generation

B

Thanks for the commentary. I too have plenty of skepticism about this company, and therefore remain on the sidelines until they advance this project further and start proving out the concept. That may never happen.

However, one point that you didn’t address in the report that might be important are the problems associated with topsoil erosion due to decades of using industrial fertilizers. There is a growing problem with topsoil erosion around the world that may only be solvable by reintroducing manure and other such inputs. That is one of the reasons I remain intrigued by this story.

The other point you didn’t mention is that they apparently have an off-take agreement for all planned initial production with an organic fertilizer distributor from British Columbia. Can’t recall volumes or other specifics, but if that’s true it suggests there is demand for the product.

Would love your comments on these if/when you have the chance.