Substack, a newsletter company that apparently failed to raise funds last year due to a larger slowdown in the tech market, wants its next round of funding to come straight from its pool of writers.

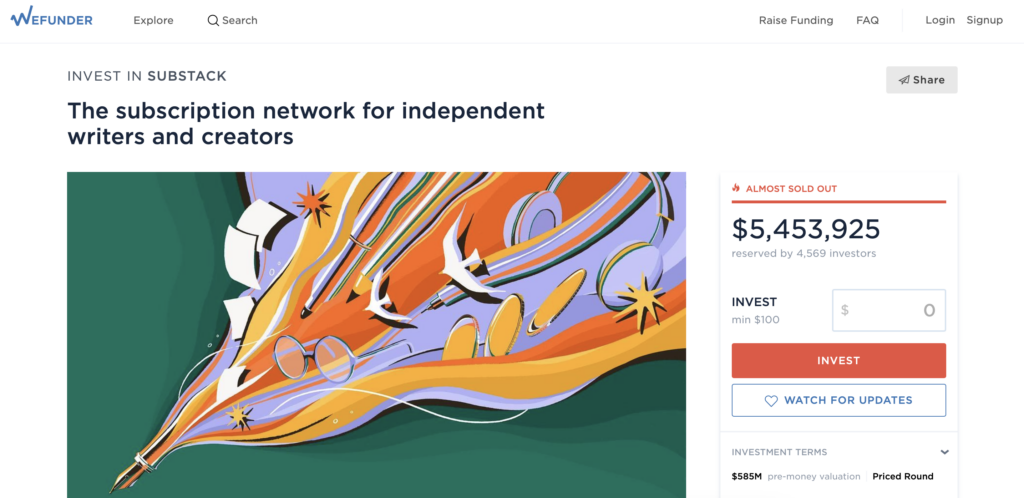

The firm most recently raised funds in a $65 million Series B round headed by venture capital company Andreessen Horowitz in 2021, at a valuation of roughly $600 million. It is now seeking $5 million directly from its writers, who publish free or paid newsletters through the platform, in order for them to participate in the action and get equity in the company on which they rely.

“We are serious about building Substack with writers, and this community round is a good way to concretize that ideal. We’re doing this because the dynamics of a platform like Substack change if the people who are building their businesses on it are owners of it, too,” the company said in its WeFunder page.

Today we’re starting a process that will let writers invest in Substack.

— Substack (@SubstackInc) March 28, 2023

You can find the full details of this community round, which will also be open to non-writers if there is room, and make an investment here: https://t.co/MRlXzBN9MR pic.twitter.com/HGm6qsDeYk

Substack is taking $100 or more investments, with a ceiling of at least $2,200 through Regulation Crowdfunding. People can invest more should they show proof of net income and net worth but Substack said the “investment may be lowered depending on the interest we receive in this round.”

Initially asking for $2 million in gross funds, the firm raised it to $5 million, the legally allowed limit. If they were able to raise that amount, the new post-money valuation will be $655 million from a pre-money valuation of $585 million. It is noteworthy that the pre-money valuation is lower than Substack’s valuation during the 2021 funding round led by Andreessen Horowitz.

At the time of this writing, the firm was able to raise nearly $5.5 million from more than 4,500 investors.

Substack claims that company intended to engage writers as part of its Series B financing, but that this proved problematic at the time. However, the US Securities and Exchange Commission’s regulation of crowdfunding altered in 2021, raising the ceiling on how much a company can raise without registering with it from $1.07 million to $5 million in a 12-month period.

But if the funding is oversubscribed, Substack said it “may not be able to accept all investments and may reduce individual investments.” In such case, Substack writers and paying subscribers will be prioritized.

VC dries; big ambitions

Following its 2021 investment round, Substack allegedly initiated negotiations with potential investors in 2022 about raising $75 million to $100 million to fuel the company’s expansion. This would have valued the company between $750 million and $1 billion.

The firm’s revenue in 2021 was approximately $9 million. Such a high valuation for a company with relatively low income was more prevalent in the latter months of 2021, when the stock market was soaring and venture capitalists were more optimistic about start-ups–but not in 2022. The newsletter platform soon reportedly dropped the plans to conduct another investment round.

"Own a piece of Substack"

— Travis Jamison (@Travis_Jamison) March 28, 2023

aka Substack can no longer raise money from VC's without a massive down-round, so they'll turn to the normies. pic.twitter.com/Uu7Q1224E0

These are your new partners, and if you spent any time in the last while griping about VC nonsense, then I’m not sure what to tell you pic.twitter.com/xjb0H6Zssr

— Shed Capital LLC (@ShedCapitalLLC) March 29, 2023

The crowdfunding move seems an opportune act to raise funds given the economic environment and the situation of its fundamentals. However, the firm can’t seem to build up confidence in terms of returns and has resorted to appealing to writers who use the platform.

“We’re not able to make lots of future projections, but we have big ambitions for the company. We are working on a new economic engine for culture,” Substack reasoned. “We think the best way to achieve that is to build a successful independent company, which could involve going public one day, but for now we are focused on building.”

Substack reiterated a caveat that “just because you can invest in Substack, it doesn’t mean you should,” adding that it is “still proving that there is a large market for subscription-based writing and culture.” But the firm appealed to those who share their belief “that Substack can grow its financial impact alongside its cultural impact.”

“We are at the dawn of the era of the subscription network. This work will be ambitious and exciting, and it will be meaningful. We’d love to have you by our side as we build this new economic engine for culture together,” the firm said.

So far, the only way Substack illustrated how retail investors can earn money from their investment is through “a successful exit in the future (like an IPO, merger, or acquisition) for more than” the pre-money valuation.

Information for this briefing was found via Quartz, Verge, The New York Times, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.