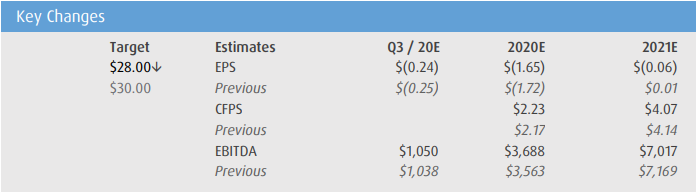

Friday morning, BMO Capital Markets put out a note on Suncor Energy (TSX: SU), upgrading their estimates and reiterating their outperform rating, but lowering their 12-month price target by C$2 to C$28.

Randy Ollenberger headlines the note with “under appreciated aalue.” Suncor has underperformed its peers and the broader crude oil market in 2020, following the 55% cut to its dividend. He says that the weak third-quarter results are priced into the shares, and “in our opinion, the shares offer compelling long-term value, and we recommend that investors increase exposure at current levels.”

The first note Ollenberger makes mention of is the recent opportunity they had to get an update with the CFO and VP of Investor Relations. He comments that the company’s operations are recovering well following the unexpected outage at their base plant.

Ollenberger adds that it was a “challenging quarter for oil sands.” The pressure on this quarter’s oil sand business is because of the unexpected outage that happened and accelerated maintenance. Although, the company’s base plant is expected to return to normal by mid-November. He says that “Firebag and Fort Hills volumes should increase above prior guidance following an early turnaround and resumption of an extraction train. This should translate to better results in 2021.”

Ollenberger believes that free cash flow is re-emerging as Suncor has slashed operating and capital costs in the second quarter following the rapid drop in oil prices. However, the company is spending above sustaining capital costs to complete several projects, making $1 billion in extra free cash flow. He adds, “we do not believe that the company is being given credit for the growth in free cash flow while it is being penalized for the higher capital spend.”

He believes that Suncor is undervalued because “Suncor shares are trading at a 2021 EV/EBITDA multiple of 5.0x based on consensus estimates, which represents a discount to its peer group median of 5.6x and historical mid-cycle multiple of 7.3x.”

Below you can see the key changes BMO’s analyst has made to his 2020 and 2021 fiscal year estimate.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.