Sundial Growers (NASDAQ: SNDL) is attempting to stop the endless bleed of their recently listed equity, announcing this morning that certain members of management have agreed to lock up their shares for several months. The news comes after the firm has had eight straight days of losses on the public markets as the cannabis sector gets hammered by negative sentiment.

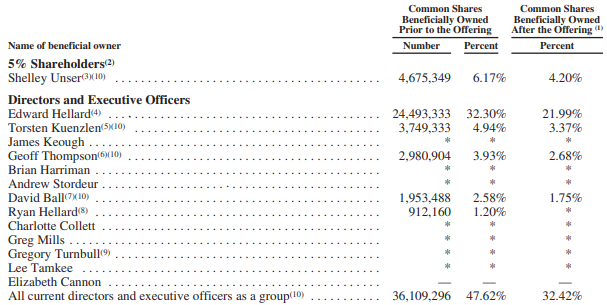

Of the total outstanding shares, the lock up covers approximately 25% of those currently trading, or 26 million, and 34 million, or 28%, on a fully diluted basis. The group of directors and executives participating includes the Chairman of the firm, as well as the CEO. It was unclear however who exactly agreed to the terms of the voluntary lock up.

Based on filings included within the final prospectus of Sundial on July 30, 2019, this implies that at least 2 million shares held by insiders did not subscribe to the agreement.

The terms of the agreement indicate that 15% of the locked shares will become free-trading again on February 25, 2020. The remaining 85% will become available on August 15, 2020, thereby creating a future date that investors need to be aware of as a significant portion of the float is set to hit the market.

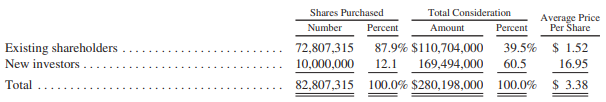

When examining the share structure of Sundial Growers, its quickly evident as to why the equity has continuously fallen from any rally in which it has managed to muster. Prior to the go-public transaction, the average price per share was a meager $1.52, which consists of 87.9% of the outstanding shares as of the date of the go-public transaction.

Sundial Growers is currently trading at $4.86 on the NASDAQ.

Information for this briefing was found via Sedar and Sundial Growers. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.