With the recent news that the Trump administration has vowed to respect state level cannabis laws in the US, and the flurry of politicians introducing various measures to ensure it, many investors who had been focusing on the upcoming Canadian recreational legalization have begun to also look at US cannabis assets.

Ever since US Attorney General Jeff Sessions rescinded the Cole Memo, most US based cannabis companies have seen their stock prices suffer significant losses, and struggle to recapture previous gains. Given the fact that California and Canada are the two largest legal cannabis markets in the world, and the US may soon be getting some legal clarity, we thought it appropriate to take a look at a firm positioning to take advantage of both. Joins us as we take a Deep Dive into Sunniva Inc (CSE: SNN).

Sunniva: An Undercovered Bi-National Opportunity

Overview

Sunniva is a vertically-integrated producer and distributor of medical and recreational cannabis in the world’s two largest cannabis markets, California and Canada, operating through several wholly-owned subsidiaries. They are constructing a massive purpose-built cGMP greenhouse facility in Cathedral City, California through the CP Logistics subsidiary, that is expected to produce between 100,000 and 120,000 kg’s per year. Sunniva will also soon break ground on their Canadian facility in Oliver, BC under the Sunniva Medical subsidiary which is expected to produce a similar amount of cannabis annually.

The locations and designs for the facilities were chosen to take advantage of abundant sunlight in order to save on electricity and push production cost to below one dollar per gram. The facilities will also be highly automated and will collect significant data from all aspects of the business to drive efficiencies, furthering Sunniva’s pursuit of becoming a low cost leader. They will arguably be the most advanced purpose-built cannabis production facilities in the world. About one mile from their Cathedral City facility is their fully-owned subsidiary A1 Perez, LLC. In Q3 2017, Sunniva acquired A1 Perez for $1.26 million ($566k cash, $692k note). The A1 entity is an extraction facility that came with an oils and extracts manufacturing license. They are currently upgrading the facility with additional equipment with a portion of the funds they received from their most recent bought deal.

In addition to the two cannabis grow facilities and the extraction facility, Sunniva also owns Full Scale Distributors, LLC, which they also acquired in Q1 2017 for a total of $6.537 million ($1.96 mm cash, $4.58mm convertible note). FSD’s brand, Vapor Connoisseur, provides vaporizers, accessories, packaging and labeling to over 80 brands in North America, making it a clear leader in the space. Vapor Connoisseur designs custom vapor hardware for any consistency of cannabis oil or concentrate. Firms can bring their oil to VC and have it matched to the perfect hardware to ensure maximum functionality. With the addition of A1 Perez, they can also have the extraction and processing done, the cartridges filled, assembled, labeled, and packaged according to their company’s standards and branding and shipped to their final destinations.

The final piece of the Sunniva puzzle as it stands today is National Health Services Ltd., a network of medical cannabis clinics in Canada that connect patients with doctors who specialize in the endocannabinoid system. They acquired NHS for $22.5 million in Q1 2017 through the issuance of 5,584,371 shares, $1.5 million in cash and a $2.25 million note. Besides consultations and recommendations for medical cannabis, NHS also connects patients with licensed producers through their “SPARK” proprietary software system, allowing Sunniva to capture revenue from patient purchases. Once their facilities are operational, Sunniva will begin selling their own cannabis directly to patients through this system. NHS currently has over 90,000 patients, and have agreements in place with 27 licensed producers.

The Sunniva Model

All of these pieces fit together to form the foundation of the Sunniva business plan. The production facilities aim to produce over 200,000 kg’s annually, plus a significant amount of trim at the lowest cost possible. They also intend to have a focus on premium quality, avoiding pesticides and contaminants. They anticipate that many of the current producers in California will have trouble initially adhering to the state’s regulations and standards. Some labs have reported seeing as much as 90+% of tested samples coming back positive for pesticides [Source: The Cannabist]. There is also a high prevalence of mold and other contaminants. Sunniva believes it can gain an edge in the market place by consistently producing a pharmaceutical grade product that they will distribute through multiple sales channels.

The Canadian operations will attempt to sell 75% of all products through long term wholesale supply agreements. To this end, they have already made significant progress. In February, Sunniva and Canopy Growth announced they had entered in to the largest supply contract in cannabis history. Canopy will purchase up to 45,000 kg’s annually from Sunniva’s Canadian operations. The full financial details of the contract have not been released, but the revenue Sunniva receives will be dependent upon the strain and quality and also on the sales channel through which it is sold.

If Sunniva can achieve its goal of costs below $1/gram, then even selling it to Canopy at $3/gram would give them a gross margin of 66%, and provide $135,000,000 in revenue. However, it is important to point out that the agreement is to purchase up to 45,000 kg’s/year. Canopy may not end up purchasing the full amount if demand disappoints.

The remaining 25% of Sunniva’s Canadian production will be reserved for the 90,000+ medical cannabis patients of National Health Services. By selling direct to the consumer, they should be able to capture excellent margins, especially if they control costs as they intend to. In addition to the 100,000+ kg’s of annual flower output, they expect 25,000 kg’s of trim to be processed into higher margin derivative products and concentrates like oils and edibles, as they become legal.

The California campus will also attempt to de-risk operations by negotiating wholesale supply agreements to move a majority of the product. However, Sunniva intends to also operate at least one dispensary of their own at the Cathedral City site. It is currently unclear whether they intend to carry products from other producers or reserve shelf space exclusively for Sunniva cannabis and derivatives. The California operation will also offer white label services to other cannabis companies in California by providing premium cannabis and concentrates to be packaged and branded according to the purchasers’ wishes. Construction of phase one is expected to be complete in Q3 of this year, and will likely produce between 10-15,000 kg’s by year end.

As with the Canadian outpost, Sunniva will be generating 25-30,000 kg’s of trim to be used in extraction. Unlike the Canadian operations, they will also be using 30-50% of all flower production to be extracted and converted to higher margin edibles, oil, and concentrates. The A1 Perez extraction facility located nearby the main campus in Cathedral City is expected to be able to process up to 500 lbs/day of raw material. It is currently producing oils for existing customers, in conjunction with Vapor Connoisseur.

Currently, all California operations have received the temporary licenses and permits necessary to proceed with both phases of construction, production, and sales. The Canadian operation is a late stage applicant under the ACMPR, and is under review. While neither facility or entity is guaranteed to be granted the final licenses required to permanently operate, at this point it seems unlikely that they would be denied.

Sunniva’s Management

Sunniva’s management is as strong as any in the business. CEO Dr. Anthony Holler was previously CEO and founder of ID Biomedical, a biotech company that produced vaccines on a large scale. In 2015 it was sold to Glaxo Smith Cline for $1.7 billion. He was also Chairman of Corriente Resources Inc., a mining company that was sold for $700 million. The similarities between the Sunniva business model and ID Biomedical are striking, leaving him well prepared to grow Sunniva to scale. Prior to launching Sunniva, he toured cannabis operations in the US and found that consistency, quality, and scale were badly missing, and concluded that this presented a massive opportunity for someone of his background.

The rest of the management team and Board of Directors also come with a wide breadth of business experience, including; investment banking, biotech, real estate, clothing, food, law, private equity, and commercial construction.

Financing and Capital Structure of Sunniva

After the firms most recent capital raise via a bought deal financing in March, there are a total of 30,644,151 shares currently outstanding and 40,392,732 fully diluted. This stands in contrast to the hundreds of millions and sometimes more than a billion shares outstanding for many firms in the sector. There are a number of firms in the sector who operate businesses we like, but have capital structures that tell a story of recklessly diluting away the upside for shareholders. Though there is no doubt that equity will be diluted at least somewhat in the process of further expansion, the fact that they have been intelligent with financing so far leads us to believe it is unlikely they will be reckless with equity going forward.

Largely, the reason Sunniva hasn’t had to significantly dilute ownership is that they have not been forced to make massive capital expenditures for their facilities. The California campus is being financed and built by Sunniva’s strategic partner Barker Pacific Group. BPG founder Michael Barker sits on Sunniva’s Board of Directors. Sunniva sold the land where the facility is being built to BPG, who agreed to bear all costs for the development of the campus—estimated at $54mm—and then lease it back to Sunniva for an initial term of 15 years with 3 extensions, each for a period of 5 years. The lease will cost Sunniva approximately $8.7mm per year during the initial term.

Given the fact that Canadian cannabis companies enjoy greater access to capital than their US counterparts, Sunniva intends to finance the Canadian campus via debt. CEO Anthony Holler is confident in the company’s ability to obtain financing from a Canadian bank.

Not having to issue equity to cover these two large capital expenditures has helped keep the number of shares outstanding from ballooning into an undesirable figure. Although they will be taking on debt, it does not appear to be at a level that will be difficult to service.

It is unclear exactly how much cash they have on hand as of today, but as mentioned above, they recently closed a bought deal that issued 2,850,900 units and 50,000 warrants. Each unit consisted of one common share and one half purchase warrant. The units were priced at $9.75, and the warrants at $0.02, with an exercise price of $12.50, about $4 above the current stock price of $8.56 CDN at the time of this writing. The financing netted Sunniva $27,797,275, and they intend to use the funds for beginning the development of the Canadian campus, additional equipment for the A1 Perez extraction facility, and further development of the NHS SPARK platform.

What We Like

There are several things about Sunniva that we like. The emphasis on pharmaceutical quality at an extremely low cost is attractive. If they can indeed produce a premium product at a cost of less than $1/gram, they should be able to maintain a strong operating margin even as prices come down across the industry over the next several years.

The decision to operate in the two largest legal cannabis markets in the world gives them a large addressable base of consumers, and being in Canada allows them to potentially sell their product internationally, should they choose to pursue those opportunities. Furthermore, their site selection and financing arrangements for these properties allows them to build massive scale while not significantly diluting ownership, and should allow them to keep the operating costs to a minimum.

They have strong management that has experience in building and operating similar businesses at a large scale. Having already built and sold a somewhat similar business for nearly $2 billion dollars to a major pharmaceutical company leads us to believe that Dr. Anthony Holler is well-equipped for the task at hand.

NHS, Vapor Connoisseur, and A1 Perez all seem to have been highly-complimentary acquisitions that will help them to grow the business, the brand, and maintain margins as they create solid vertical integration. Furthermore, they acquired them at reasonable prices. Being able to capture the derivative/value-add margin and retail margin on some of their production, along being a low-cost premium quality producer, adds some measure of safety, if not necessarily an insurmountable economic moat.

Combining the high-margin aspects of the business with de-risking through large wholesale supply contracts could potentially lead to a business that can consistently generate earnings in excess of the large majority of their competition. Furthermore, the market seems to be greatly under-appreciating the significance of their supply contract with Canopy. In addition to being the largest cannabis contract ever signed and potentially giving Sunniva an outlet for nearly half of all Canadian campus production, the fact that Canopy growth, the world’s leading cannabis company, would grant such a large contract to Sunniva before they have even finished their facilities is one of the greatest votes of confidence the cannabis sector has seen and speaks volumes to Sunniva’s leadership.

What Concerns Us

While there is a lot to like, there certainly still exist significant risks. Beyond the obvious fact that they are operating in the US where cannabis of all kinds is illegal at the federal level, there are in our opinion several areas of potential concern that investors should be aware of. As any introductory business class will teach you, threats and opportunities can be interchangeable. Or, in other words, their blessings could turn out to be curses.

California and Canada are the largest addressable markets of cannabis consumers in the world. The downside of choosing to operate in these two markets is that they have little-to-no barriers to entry, and the competition will be fierce. Assuming that other producers will have trouble complying with regulations and will continue to have quality control issues is a dangerous assumption. There are many well-capitalized groups in both Canada and California that are focused on dominating the market. While Sunniva has made the smart move of going straight for immense scale, they are somewhat late-comers to both markets, and therefore have no pre-existing brand loyalty or even recognition.

Speaking of brand loyalty, Sunniva intends to create Sunniva-branded lines of cannabis strains, oils, edibles, etc. However, they are also offering white label service to competing brands. Whether this proves to be a wise business move remains to be seen. From our perspective, the brand will be the single-most important factor in deciding the fate of would-be cannabis empires. If they are really able to produce genuine premium quality cannabis, letting other companies slap their names on it could come back to haunt them. While these other firms could turn into long term Sunniva customers, Sunniva runs the risk of helping to prop up their competition while those firms ramp up production.

If their cannabis is really of a superior quality than that of their competitors, they may be better off waging a campaign to become a popular premium brand, and if they are able to produce it at less than a dollar a gram, they could offer it to retail outlets (or even open more of their own) at a lower price than most competitors and use that advantage to consolidate market share.

Another concern is this assumption of superior quality. While the new purpose-built, GMP compliant cannabis greenhouses are state of the art, they had better be amazing if they intend to compete with California’s best indoor-grown craft cannabis. Frankly, although the new facilities are exciting, and should take greenhouse cannabis gardening to the next level, greenhouse cannabis has historically been of an inferior quality. It remains to be seen whether or not the cannabis that will be produced in these massive greenhouses that Sunniva and several others are building will be comparable to indoor cannabis.

The spectrum of light available from indoor cultivation lights tends to produce cannabinoid and terpene levels that far exceed those of sun-grown cannabis. This is a potential issue not only for Sunniva, but for all the firms who seem to be overly focused on capacity, possibly at the expense of quality. It all comes down to whether or not you want to be another commodity producer, or you want to be an exclusive premium brand. Trying to brand mediocre quality will be like putting lipstick on a pig. As previously noted, these are not your grandma’s greenhouses, and we remain optimistic, but cautiously so

Sunniva’s Valuation

While we have named many things that excite us about Sunniva, and a few things that keep us cautious, perhaps the most exciting aspect is the current valuation. Sunniva looks cheap, at least relative to many of its peers. Sunniva is currently trading at $6.65 US and $8.55 CAD, giving a fully diluted market cap of $268,611,668, and $345,357,859, respectively. Current P/S and P/E multiples across the sector are absurd. Firms are generally trading at 30-60x’s sales, and 100’s of times earnings, for the few firms that even have earnings. The valuations are not based on the firm’s current production or earnings, but of the expected numbers over the next several years as the industry expands.

If this is the case, Sunniva looks attractively priced, even though they have not yet sold any cannabis. They are reporting 2017 figures on Monday, and while we won’t see for certain for a few more days, they should have somewhere in the ball park of $15-25 million in revenue from NHS and VC. Even if we take the low end estimates of $15, and the low end of P/S for the industry of 30, that would give them a cap of $450mm.

Furthermore, they could realistically do $90-100+mm in revenue in 2018, putting them into the upper echelon of cannabis companies with revenue, before they even really get started. They should produce a minimum of 10-15,000 kg’s this year in their California facility, which is expected to be operational in Q3. If they produce just 10,000 kg’s and sell for an average of $7/gram, that alone would give them $70mm US in revenue, and that is not counting revenue from NHS and VC. What multiple gets attached to those figures is anyone’s guess, but if we get federal clarity from the US, as Trump has agreed to and other politicians are promising, and that multiple starts to look anything like the Canadian multiples, investors could do very well.

However, next year is where the numbers get exciting. Phase 1 in the US will be fully operational for the entirety of the calendar year, and the Canadian campus should be operational for at least half of the year. That should give them well over 100,000 kg’s of production. Even if they only earn $0.75 a gram, which would be extremely low for such a low-cost, vertically integrated producer, that would translate into earnings of $75,000,000. This does not even take Vapor Connoisseur, NHS, or the 30,000 kg’s of trim that will be converted into higher margin derivative products into consideration. Unless something goes terribly wrong, Sunniva should do an incredible amount of revenue in 2019.

If they were to produce 100,000 kg’s and 30,000 kilograms of trim, which would in turn yield 6,000 kg’s of oil, and we assume revenue of $5/gram for flower, and $20/gram for oil, that would produce $620,000,000 in revenue. Furthermore, of the 60,000 kg’s that will be produced by the California campus, 30-50% will be converted into higher margin products. Attach even an average multiple, let alone a growth multiple, and shareholders should enjoy excellent returns.

In reality, at least for the first couple of years, Sunniva should enjoy strong margins that translate either into great earnings, or rapid growth. Trying to build a model of their earnings over the next few years is a subjective and speculative endeavor. There are simply too many unknowns to forecast with any great confidence.

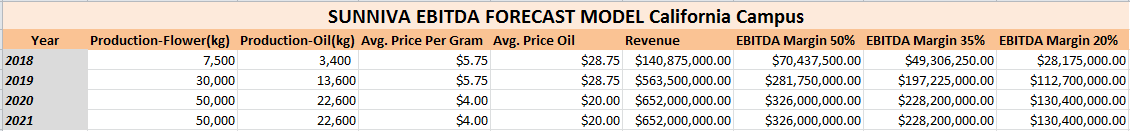

However, just to give an idea of the range of potential, here is an EBITDA model of just the California campus. The model assumes half of all production and all trim will be converted to oil. It also assumes a 3-1 conversion rate for flower, and a 5-1 conversion rate for trim. Lastly, it assumes an average selling price of $5.75 per gram for flower and $28.75 for oil over the first two years, and $4 and $20 per gram going forward. This is not intended to be a forecast, just a range of EBITDA and revenue possibilities.

Actual selling prices and margins could be significantly higher or lower. However, we should note that we believe these to be conservative numbers in regard to average selling price. It should also be noted that Cowen, the leader in the cannabis institutional research space, forecasts prices dropping by 8% annually within Canada. However, it is possible that prices in California could drop at an accelerated pace.

Conclusion

In conclusion, Sunniva is a well-managed company that is positioning itself to be a dominant player on the West Coasts of both the US and Canada. They are building facilities that are second to none, focusing on driving efficiencies, de-risking their business model through supply contracts, and will be one of the largest producers of cannabis in the world within 6 months.

Sunniva faces many of the same risks that the entire sector faces, but appears to be better prepared than most of their peers. We think the market has under appreciated the supply deal negotiated with Canopy, and has failed to appreciate that by positioning themselves as a low-cost leader and a premium brand in both the US and Canada, they could generate earnings in line with any of Canada’s largest LP’s. Furthermore, upon news of increased legal clarity in the US, CEO Dr. Anthony Holler has stated that they plan to expand and seek new acquisitions, so by year end there could be several more pieces to the Sunniva puzzle.

That being said, they have not produced any cannabis yet, so this is a speculative play. But frankly, so is every cannabis company in existence at this time. Although there is an added element of risk due to their US operations, there is also significantly more opportunity. And given that the US appears to be on the verge of legal protection for cannabis operators, strongly positioned US cannabis assets could do very well over the coming years. Considering all of these factors, the pipeline of catalysts, and the current valuations of their Canadian peers, we think of Sunniva as very attractive at its current price level.

FULL DISCLOSURE: The author has a long position in Sunniva Inc and Canopy Growth Corp.

All material in this report comes from Sedar, CISION, Cowen, www.sunniva.com, interviews with the Sunniva CEO on the Midas Letter, and the author’s own analysis.