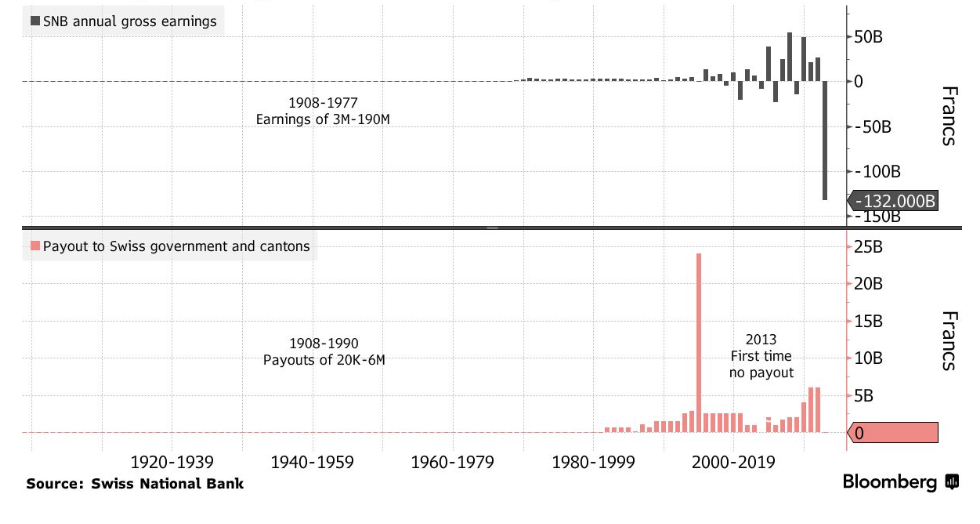

The Swiss National Bank is expecting to suffer the biggest annual loss in its history, thanks to the dramatic drop in valuations of its foreign currency holdings.

Switzerland’s government and other private shareholders won’t be receiving their annual payout from the Swiss National Bank, as preliminary results show the central bank underwent a loss equivalent to $143 billion in 2022— more than five times the last such record loss, and the biggest in its history dating back to 1908. For decades, the central bank embarked on a foreign currency shopping spree in an effort to devalue the Swiss franc.

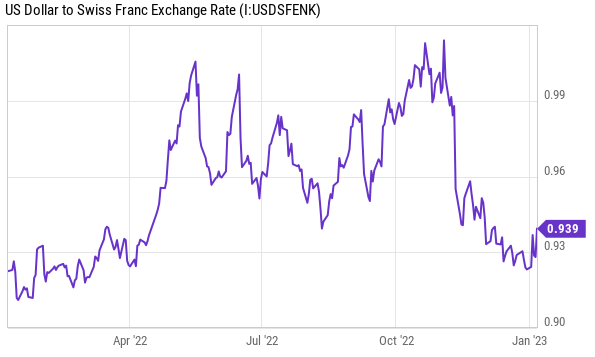

However, the valuations of its forex holdings dropped dramatically, falling 17% over the past year. Meanwhile, valuations of the central bank’s francs holdings dropped about 1 billion francs, substantially exceeding the 400 million francs the SNB received on its gold holdings. The Swiss central bank’s losses last year coincide with a broader dismal backdrop whereby rapidly rising interest rates are creating undue financial consequences for central banks around the world.

In the EU, central bank policy makers are being questioned for failing to make adequate payments to public finances from their banking activities. The UK’s central bank, for example, is facing such a dismal financial position thanks to losses from its bond-buying program, it’s unable to make contributions to the public purse and is instead getting money from the Treasury.

Information for this story was found via Swiss National Bank, Bloomberg, and the sources and companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.