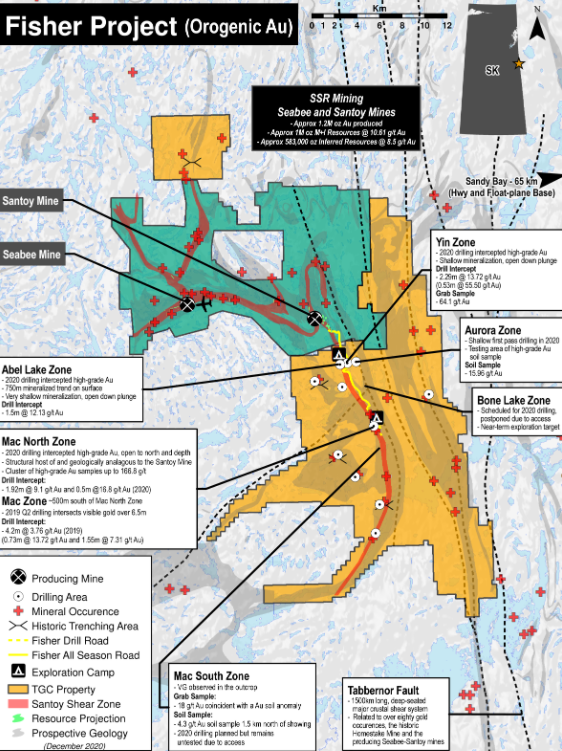

On January 5, SSR Mining Inc. (TSX: SSMR; market cap of $5.3 billion) announced that it exercised the second option earn-in on Taiga Gold Corp’s (CSE: TGC; market cap of $19 million) Fisher gold property. By doing so, SSR Mining increased its stake in the project to 80% from 60% and formed a Fisher Joint Venture (JV) with Taiga, with Taiga owning the remaining 20%. The financial implications for micro-cap Taiga are significant: SSR Mining paid Taiga $3 million in cash plus reimbursed it for $400,000 of initial exploration work. The announcement comes just weeks after SSR met the conditions to acquire a 60% stake in the property.

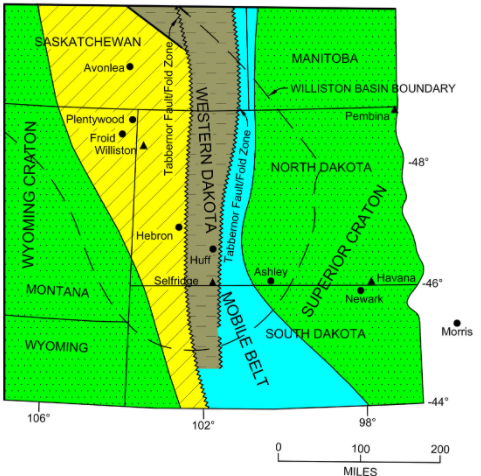

Taiga, an early-stage gold exploration company, primarily employs a strategy of reaching option agreements with other companies to develop its properties whereby the partnering company funds the required capital expenditures. In this way, Taiga limits its cash outlays, but still preserves substantial upside for shareholders. Taiga owns six gold projects in the Trans Hudson Corridor near SSR Mining’s Seabee Gold Operation (SGO) mine complex in Saskatchewan. Taiga’s projects are located along the Tabbernor Fault structure, a 1,500-kilometer (km) shear system associated with many significant gold discoveries, including the SGO mine complex.

Taiga retains a 2.5% net smelter royalty (NSR) on the Fisher property, although it must pay a third party a 1% NSR on certain of its Fisher claims per a separate agreement. The JV can at any time choose to reduce Taiga’s NSR royalty payment to 1.5% from 2.5% by paying Taiga $1 million.

Even if this royalty reduction step were to be exercised, the implications of a net 1.5% NSR are substantial. The owner of a 1.5% NSR is entitled to 1.5% of the net revenue from the sale of gold (proceeds from the sale of gold less transportation and refining costs). If Fisher ultimately were to produce 100,000 ounces of gold per year at a price of US$1,800 per ounce, and if we were to further assume the combined transportation and refining costs associated with this production level would total US$800 per ounce, Taiga’s potential annual NSR royalty stream could be 1.5% x 100,000 ounces x US$1,000 net revenue per ounce, or US$1.5 million (C$1.9 million) per year.

Leland Gold Project Option Agreement

In May 2020, Taiga reached an option agreement with SKRR Exploration (TSXV: SKRR) on Taiga’s Leland Gold Project that is structured similarly to the Fisher option accord. The 10,761-hectare property is located 23 km southwest of the SGO mine complex. SKRR Exploration can achieve a 51% ownership stake in Leland by meeting a three-year schedule of cash payments and SKRR share issuances to Taiga, and by incurring the required capitalized capital expenditures. As was the case in the Fisher agreement, Taiga funds none of this spending.

Exploration on the property has already begun, with permits being issued in September 2020 for a fieldwork program. Drilling of the property is expected to commence in the near term as well, with an initial 1,500 metre program having been announced.

Solid Cost Controls

For a pre-revenue company, Taiga has controlled its operating and capital spending more effectively than many junior miners. In the first nine months of 2020, the company’s operating loss totaled a modest $570,000. Similarly, its operating cash flow deficit for the first three quarters of the 2020, excluding a one-time payment to Eagle Plains Resources (TSXV: EPL), was around $600,000. Taiga’s capital expenditures over this period were just $84,000, a figure which was more than offset by $135,000 of option agreement payments received in the first nine months of 2020.

| (in thousands of Canadian $, except for shares outstanding) | 3Q 2020 | 2Q 2020 | 1Q 2020 | 4Q 2019 | 3Q 2019 |

| Operating Income | ($149) | ($177) | ($248) | ($152) | ($101) |

| Operating Cash Flow | (42) | (601) | (244) | (187) | (50) |

| Cash Received for Option Payments | 105 | 30 | 0 | 75 | 0 |

| Cash – Period End | 776 | 733 | 1,152 | 32 | 252 |

| Debt – Period End | 0 | 0 | 0 | 0 | 0 |

| Shares Outstanding (Millions) | 81.4 | 80.9 | 79.4 | 63.9 | 63.9 |

Despite positive initial drilling results at Fisher and SSR Mining’s financial strength, which should allow an extensive drilling program to be undertaken, substantial gold resources may not be found at the property. Similarly, Taiga’s Leland and SAM gold projects, which also have option agreements, may not prove to contain gold quantities which are economic to mine.

Taiga is an interesting junior miner for speculation. The company just received a cash payment from SSR Mining equal to nearly 20% of its stock market capitalization. In addition, Taiga has a 20% stake in a JV with the mining giant, as well as an NSR, on a gold property with good potential. Furthermore, two of Taiga’s other properties have option agreements (albeit with less financially strong companies than SSR Mining) structured much like the Fisher project option accord.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.